How to open an account for a foreign legal entity in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Not only individuals but also legal entities can open an account in a Ukrainian bank. This norm was introduced into the Ukrainian legislation only a couple of years ago, with the aim of free movement of capital. Now foreign legal entities can open both investment and business accounts in Ukraine.

But while giving freedom to foreign companies, Ukraine needed to take care of minimizing the risk of “front” foreign companies established to launder money. Thus, Ukraine introduced changes to the financial monitoring system of the country and the procedure for identifying such companies and checking accounts of foreign legal entities.

Today, we will tell you what is required to open a bank account in Ukraine for a foreign company. If you do not want to deal with this procedure on your own, please contact our specialists, and we will take care of the entire procedure.

You may also like: How to Register a Foreign Business in Ukraine?

What are the documents required to open an account in a Ukrainian bank for a foreign legal entity?

In order to open a bank account, you need to prepare a package of documents. Banks may require additional documents, but the standard package includes the following:

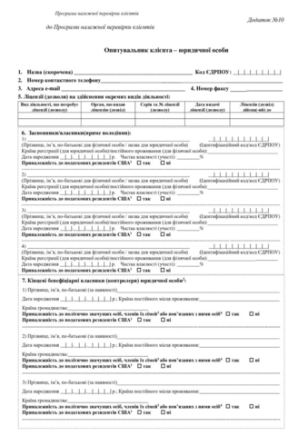

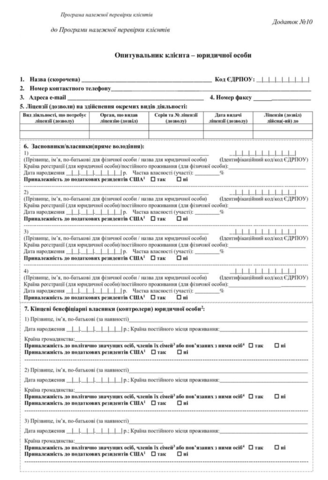

- Application for opening a bank account - you can take the form at the desired bank. You must specify the purpose of the account, such as making investments or conducting business activities, etc. The application must be signed by the head of the foreign company or an authorized person.

- Copy of power of attorney for opening a bank account issued to the authorized person - this power of attorney must be apostilled or legalized in other legal ways and certified by a notary. If the power of attorney is not issued in the Ukrainian language - it will need to be translated and its translation must be certified by a notary.

- Copy of the document on registration of the foreign legal entity - it can be an extract from a commercial, bank or court register or a registration certificate of the local authority of the foreign state. The copy must be notarized, the document must be translated, and the translation must also be certified by a notary.

- Statements on the ownership structure of the foreign legal entity - statements may be prepared in any form, our lawyers prepare such documents themselves, based on the information provided to them. The document must be signed by the head or an authorized person, and the translation must be certified by a notary.

- Copy of the document confirming the registration of the non-resident legal entity with the controlling body, i.e. the Ukrainian Tax Service. Before opening an account we will help with the registration, or consider other options, if possible.

To open a bank account, the authorized person must go to the bank in person with an identity document.

With the right, timely organization of the process, opening a bank account will take only a couple of hours. In our practice, there was a case where the director of a foreign company came to Kyiv for just 1 day to open an account.

You may also like: How to Settle Relationships Between Business Owners in Ukraine?

Can I have any problems at the bank?

There are several main aspects to keep in mind when opening an account in a Ukrainian bank.

Firstly, unfortunately, not every bank is suitable, as not all of them have sufficient experience in working with foreign corporate clients. Our company has been providing services for foreign legal and individuals for many years, during which we have worked extensively with Ukrainian banks. We worked out our top Ukrainian banks which not only know how to work with foreign clients, but also are ready to make advances and provide the best service for their clients.

Secondly, the procedure of opening a bank account requires preliminary registration of the legal entity with a tax authority. During this procedure, the foreign company receives a registration number and certificate of taxpayer registration. This certificate, after the line “(name and code of the controlling authority)” specifies “ the way a foreign company plans to open a bank account”.

After opening an account, the bank will send a notification to the tax authority that the account is open and ready to use.

Thirdly, it is important to properly provide the bank with all the required information. The very process of verifying “front” companies, authorizes the banks to conduct enhanced scrutiny or refuse to open an account if a Client fails to provide complete information or information provided is unreliable.

We offer you full support of opening a bank account for your company in Ukraine and legal consulting regarding your goals and business activity in Ukraine.

Do not risk your time and money, turn to the specialists for solving your legal issues in Ukraine. Our task is to make solving your problems simple and safe.

Didn’t find an answer to your question?

Our clients