How to quickly liquidate the company in Ukraine? Legal advice

At the end of April 2020, a Client contacted us with a request on how to liquidate the company. According to him, he had recently started his own company, but due to quarantine, activity had to be stopped and in general the business did not go, as did many. Therefore, at present, there is nothing left but to close the enterprise.

Unfortunately, this is not the only such request and we understand that the issue of quick and safe business liquidation may be of interest to many entrepreneurs now. Therefore, we decided to share an example from our practice to help those who are thinking about terminating their business activity to make head of the situation.

You may also like: How To Liquidate The LLC With Debts?

Things to consider when liquidating the LLC

During the consultation, our specialists elaborated with the Client on the following issues:

- What it takes to liquidate the LLC;

- How to terminate the company’s activity quickly;

- Ways of liquidating the company.

So, what do you need to liquidate the company?

First, decide which way and how quickly you need to liquidate the company. If we are talking about the standard liquidation procedure, it involves the following steps:

- The general meeting shall be held;

- A decision on the company’s liquidation shall be made;

- The liquidator / liquidation commission shall be appointed;

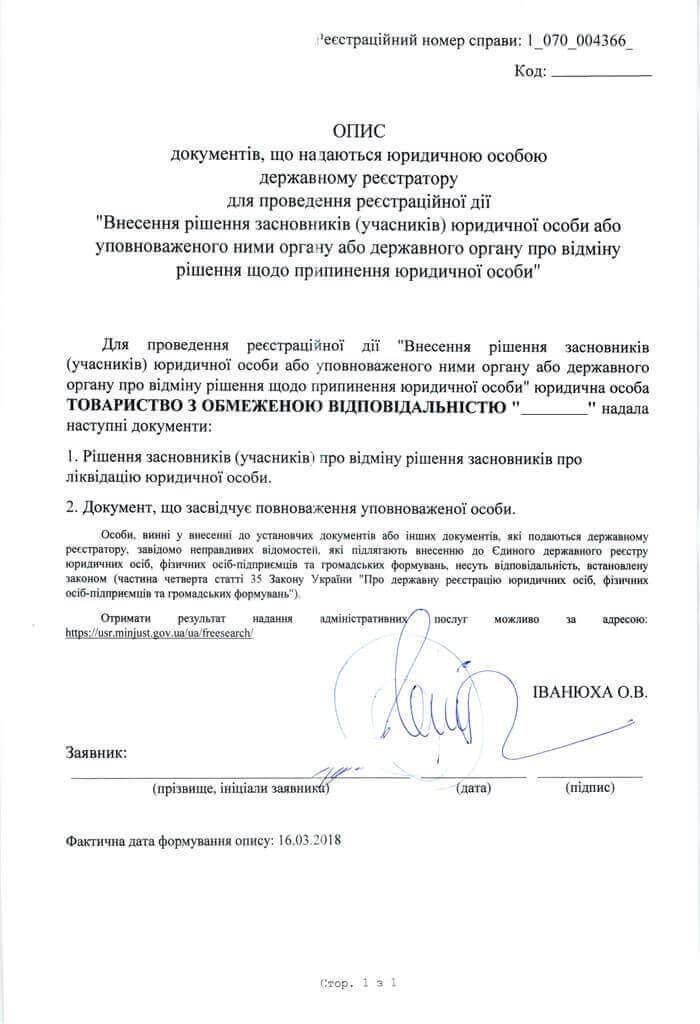

- All these decisions shall be documented in the minutes (if the shareholder is alone, it will be just a decision of the shareholder) and filed with the state registrar;

- The registrar records the liquidation of the company in the Unified State Register, and the company begins to pay off the creditors and wait for the tax audit.

Back in the “pre-quarantine” times, you could wait for the appointment of the tax audit for months. Currently, there is a moratorium on tax audits, which will last until 01.06.2020. However, considering the number of companies that are forced to terminate their business activity, it is obvious that the queue for liquidation audits is growing.

If you don’t need to liquidate the company within the shortest possible time, at this stage you can start all the preparatory work and just wait for a tax audit.

How to quickly liquidate a company?

What to do if you want to terminate business activity within the shortest possible time?

Firstly, it won’t take less than two months anyway, as this is the period given to creditors to claim. Secondly, as mentioned above, there is a moratorium on tax audits until June 1. During this period, the queue of those who have to be checked is not moving.

So, it is almost impossible to liquidate the company in a few months. By the boldest estimates, the liquidation procedure will take eight months and more.

However, you can at least eliminate the extension of this period, if you contact qualified lawyers who will promptly prepare for you all the documents and provide you with legal support during the tax audit.

You may also like: How To Withdraw From Members Of The Problem LLC

Other ways to terminate business activity

In addition to the abovementioned procedure for termination business activity through liquidation, there is also bankruptcy and so-called alternative liquidation.

Bankruptcy also has its own procedural features and never goes quickly.

Therefore, when for some reason it is really urgent to “get out of the game”, the only way is to transfer management and corporate rights to the person who will continue to deal with the termination of this company.

The Client liked the idea to transfer the company to other hands as soon as possible, so after consultation we discussed the details of further cooperation. A few days later, the Client completely ceased its participation in this company.

If you’re thinking about terminating your existing business, don’t hesitate to call us. We can help you choose the best option.

Our clients