How to open a bank account in Ukraine for business and obtain an electronic signature?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

A foreign client approached us with plans to start a business in Ukraine and import specific goods. The entrepreneur had already identified potential business partners and made agreements, but they lacked a business entity and the necessary infrastructure to carry out their activities.

After a meeting with the client, it was decided to establish a Limited Liability Company (LLC) in Ukraine, with the client as the sole participant and director. The goal was also to obtain Value Added Tax (VAT) registration and set up the company's operations. Following the registration of the LLC, obtaining work permits for the foreign client, and changing the directorship, the next crucial step for full operation was to open a corporate bank account.

Ukrainian legislation does not impose specific requirements or deadlines for opening a bank account. However, given the necessity of conducting active business operations, having a bank account is crucial for the following reasons:

- Transactions between business entities are typically conducted in a non-cash manner using Ukraine's national currency, the hryvnia. Therefore, if your company does not have an account, clients or buyers will be unable to make payments to you through legal means.

- Payment of taxes and fees for legal entities is carried out through non-cash methods to designated bank accounts. Without such an account, meeting your tax obligations can be challenging.

- Employee salaries are paid in hryvnias and often deposited into hryvnia-denominated bank cards.

Thus, there are at least three compelling reasons that can significantly impact your business's ability to operate effectively. These reasons underscore the importance of opening a bank account for a company in Ukraine. We can guide how to achieve this if the founder and director of the company in Ukraine is a foreigner.

You may also like: Alternative Payment Methods for Businesses in Ukraine

What is the procedure for opening a bank account for a company?

The first step in opening a bank account for a company is to select a banking institution that operates in Ukraine. The choice of the bank can be influenced by various factors, including convenience, the availability of online banking, fee structures, a straightforward compliance and currency control process, or the preference for a bank with a European parent company.

The client is responsible for selecting the banking institution. Drawing from our experience, we recommend choosing a bank that suits the client's needs and has a solid reputation. Additionally, we can provide suggestions for institutions with which we have prior experience and that we know will align well with the client's interests.

What is the procedure for opening a bank account for an LLC?

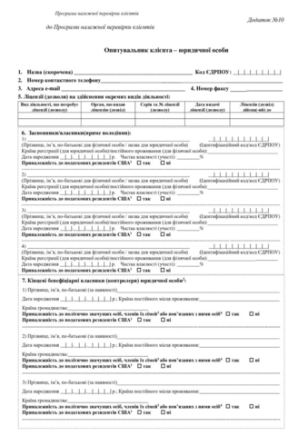

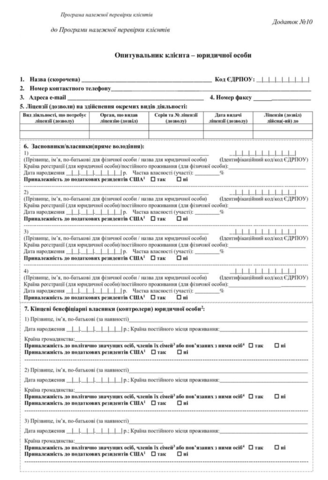

The director of the Limited Liability Company (LLC) should visit a bank branch, complete the necessary forms, applications, and questionnaires, and provide the required documents. Some banks, such as PrivatBank, have already streamlined their processes, offering clients the option to independently fill out applications and only bring the necessary documents to the bank.

In most cases, when a client selects PrivatBank, we follow the following procedure:

- We assist in completing the application and accompany the client for verification and document submission.

- We oversee the process and stay in communication with the bank's managers.

The verification of information and documents may take up to three days. Following this, the bank may either provide feedback and request additional documents or open the account.

We had one client who faced a unique challenge. They had submitted documents to open a bank account and then left Ukraine. When the bank provided further requirements, the client couldn't address them in person for understandable reasons. We liaised with the bank, helped collect all the necessary documents, prepared a description of the business activities, and remotely submitted the complete package to the bank. Through this collaborative effort, the client successfully opened the account.

When the director of a Limited Liability Company (LLC) is a foreign national with a valid work permit, the bank will subject this foreign director to the same verification process as Ukrainian citizens. In such cases, the foreign director will need to open a personal bank account to receive their salary, and the bank will request the following documents:

- Certificate of the assigned identification number.

- Passport (scanned copy) with a Ukrainian translation.

- Proof of address (in some instances, the bank may request this).

Concerning the opening of the LLC's account with a foreign director, there are two approaches:

- An individual who temporarily assumes the responsibilities of the LLC's director while the foreign national secures a work permit can open the account. After the directorship is officially transferred to the foreign national, they can update their information with the bank.

- If the foreign national already possesses a work permit and holds the position of the LLC's director, we facilitate the process of opening a bank account for them. Our team manages the bank meeting and all necessary preparations, minimizing the client's involvement in the process.

Both of these procedures are legal and widely employed. We select the option that is most convenient for our client.

Benefits of using an Electronic Digital Signature (EDS)

The EDS holds significant importance in the modern context as it offers several advantages:

- Signing documents, including contracts, with the same legal weight as traditional paper documents.

- Access to government registries. Presently, nearly all publicly accessible registries necessitate the use of EDS for user verification. This makes accessing information from the majority of registries impossible without an EDS.

- Access to online platforms, including the taxpayer's portal, for report submission and signing. This eliminates the need for physical visits to tax offices, waiting in queues, and worrying about report acceptance. Instead, reports can be electronically submitted and monitored through online portals.

Considering the aforementioned benefits, we consistently advise our clients to acquire an EDS for their business operations. Typically, such a signature can be obtained from certified electronic service providers, which often involves a fee. However, it is possible to obtain a free EDS from the State Tax Service. The easiest option is to open an account with a bank that offers electronic signatures and obtain the EDS from the same institution. For the majority of our clients, we facilitate the acquisition of an EDS through the bank where we assist in opening their accounts.

You may also like: Planning and Developing a Market Strategy in Ukraine

What challenges may arise when opening an LLC bank account?

Opening a bank account for your Limited Liability Company (LLC) might seem straightforward if you're not subject to sanctions or restrictions. However, practical experience shows that this process can sometimes become complex and time-consuming due to a mix of objective and subjective factors.

For instance, one of our clients encountered difficulties when an inexperienced bank manager mishandled the documents required for opening the account. This led to inaccuracies in the application and the omission of essential documents. As a result, the bank requested further information, including documentation to prove the availability of adequate funding for the intended business activities and the requisite skills and personnel. Understandably, this left the client feeling uncertain. Nevertheless, we found a solution by providing the required documents, drafting explanations, and successfully facilitating the account's opening. Our client was pleased with the outcome of our collaboration.

Hence, if you want to conserve your resources, efforts, and time, entrust the task of opening your company's bank account to our experienced legal professionals. Why should you consider our company? Our specialists will:

- Help you compile the necessary documents and either accompany you to the bank for the account opening process or facilitate electronic application submission.

- Engage with the bank's managers if any inquiries or issues arise.

- Assist in providing the essential documents and information to the bank.

- Guide you through the entire procedure until the account is successfully established.

- Aid in obtaining an Electronic Digital Signature (EDS).

If you are seeking not only a highly qualified lawyer but also a reliable partner, do not hesitate to reach out to us right away!

Check out the cost of business and tax consultation in Ukraine here

Our clients

Service packages offers

-

Analysis of the client's requirements and selection of a bank for account opening.

-

Provision of a draft power of attorney for account opening.

-

Review and preparation of the required document package.

-

Purchase of a Ukrainian SIM card.

-

Submission of documents to the bank and completion of bank forms.

-

Legal oversight of the compliance process and communication with the bank manager*.

-

Assistance with obtaining and providing any additional documents required by the bank after reviewing the application.

-

Support in setting up online banking for the client.

*This package includes 2 hours of legal work with the bank. If complications arise, additional hours are charged at 4,000 UAH per hour.

**Document translations are not included

-

Analysis of the client's requirements and selection of a bank for account opening.

-

Review and preparation of the required document package.

-

Purchase of a Ukrainian SIM card.

-

Submission of documents to the bank and completion of bank forms (requires the director’s personal presence).

-

Legal oversight of the compliance process and communication with the bank manager*.

-

Assistance with providing additional documents required by the bank after reviewing the application.

-

Support in setting up online banking for the client.

*This package includes 2 hours of legal work with the bank. If complications arise, additional hours are charged at 4,000 UAH per hour.

**Document translations are not included