How to submit a declaration on the income of a representative office in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

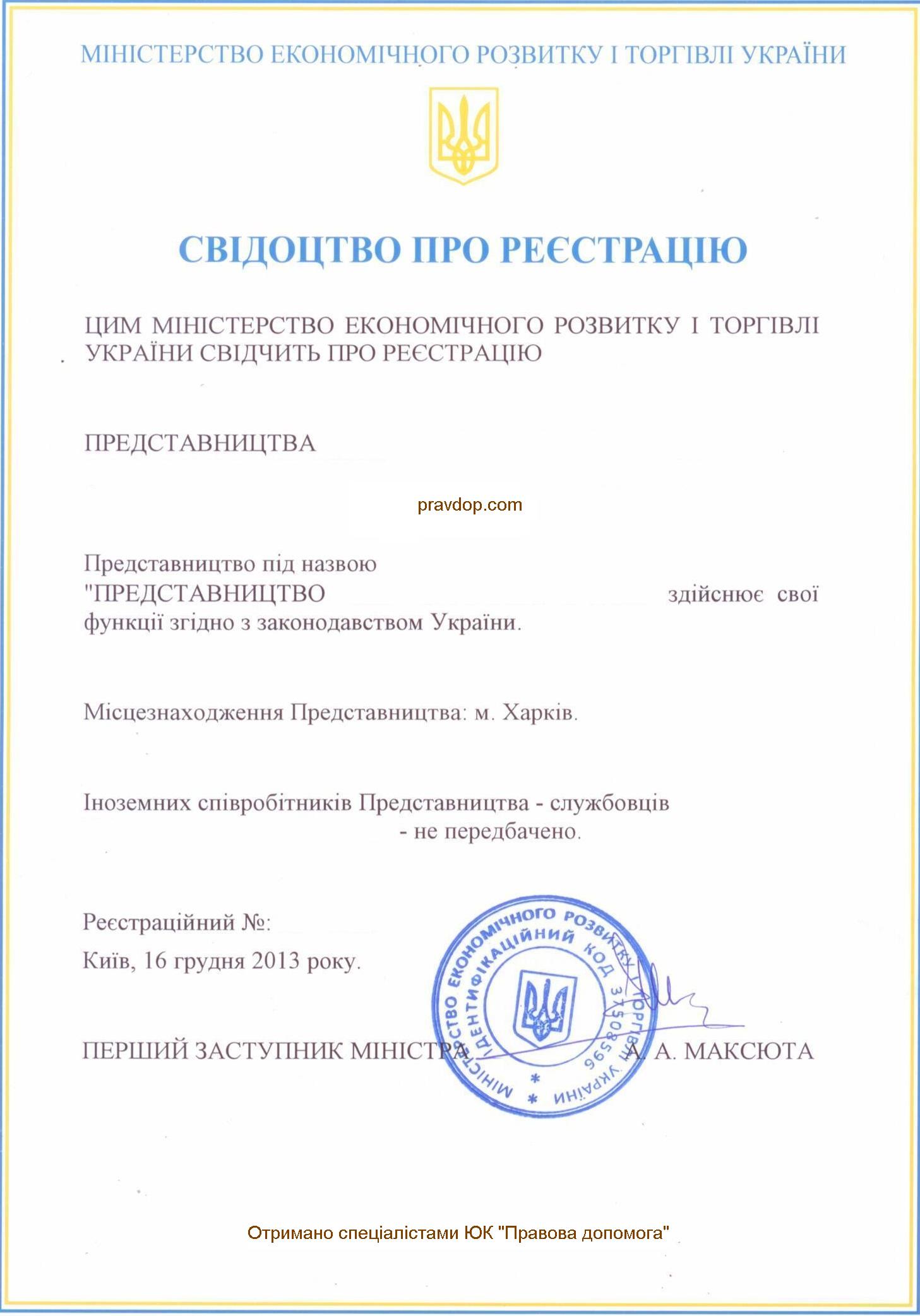

Representative offices of foreign companies present a distinctive organizational and legal way to conduct business in Ukraine. While not extremely popular today, they still maintain their relevance and are used within the country. It's interesting to note that about 10-15 years ago, it was more common for foreign businesses to open representative offices in Ukraine for their entrepreneurial activities. According to Ukrainian legislation, a representative office is not a legal entity. Consequently, it's perceived that a foreign company conducts its activities in Ukraine through this representative office.

This model has its advantages, primarily because the non-resident parent company exercises complete control over the representative office. However, there are downsides, notably the lack of legal entity status, which can complicate certain aspects of the operation. Nevertheless, a significant number of representative offices remain in Ukraine, actively conducting their business.

It's worth mentioning that the registration of new representative offices has been declining year by year. For foreign companies today, establishing a Limited Liability Company (LLC) is often a better route, allowing them to conduct their activities through the LLC. However, if you're unsure which organizational and legal form is best for your situation, our legal experts can provide consultation. We are always prepared to assist in choosing the most suitable organizational and legal form for your business's efficient operation.

If you opt for a representative office, the following step would be to set up the appropriate reporting system for this type of entity. More details below.

You may also like: Business Registration in Ukraine: Personal Ownership vs. Foreign Company Registration

Tax Registration and Compliance for Foreign Company Representative Offices

Representative offices of foreign companies, much like other legal entities in Ukraine, are required to maintain financial records, pay taxes, and comply with Ukrainian law. When such an office is registered in Ukraine, it must be included in the national taxpayer registry. However, following amendments to the Ukrainian Tax Code a few years back, non-residents operating through permanent representative offices also became obligated to register as taxpayers.

After these changes to the Tax Code, our law firm assisted several representative offices with their tax registration. This process involved gathering a set of necessary documents, submitting them to the State Fiscal Service, and obtaining 1-ОПН and 34-ОПП certificates.

The definition of a permanent representative office is determined according to the Ukrainian Tax Code, which enumerates specific criteria for such entities. The State Tax Service of Ukraine has also provided additional clarifications regarding representative offices in Information Letter №20.

One common question among many representative offices was whether there was a requirement for non-resident registration for tax purposes. It's advisable to seek advice from legal professionals or directly from the Tax Authority, possibly through a request for individual tax consultation. This matter invariably requires a detailed analysis and legal expertise.

In 2021, our practice encountered several instances of non-resident entities, operating through representative offices in Ukraine, needing to register for tax purposes. In these cases, the companies were actively functioning and met the criteria for being considered "permanent representative offices". Complying with the guidelines outlined in the Ministry of Finance Order №1588 dated 09.12.2012, we filed the necessary 1-ОПН application and subsequently obtained the required certification.

We also faced inquiries about the tax registration necessity for separate units of foreign non-governmental organizations acting as representative offices. After handling numerous cases, we concluded that such entities are not deemed "permanent" under the Ukrainian Tax Code, a viewpoint later confirmed by the tax authorities in several Individual Tax Consultations and Letter №20.

You may also like: Choosing the Right Taxation Form for Business Operations: The Unified Tax

Tax Reporting: A Case Study from Our Practice

We encountered a scenario where a client required assistance in submitting tax reports for both their representative office and a non-resident entity registered with Ukrainian tax authorities. To guide the client effectively, we brought in our auditor who provided detailed advice on preparing and submitting these reports. The client also had a query regarding who is responsible for filing reports for the non-resident entity.

Upon examining the documents, it was evident that the mandate given to the head of the representative office did not include the authority to submit tax reports or make tax payments on behalf of the non-resident. We advised the client to revise the power of attorney for the head of the representative office, incorporating these duties, and to issue a separate mandate for the individuals representing the non-resident's interests in Ukraine. This would enable the client to fulfill their reporting and tax obligations effectively.

Responsibility for Conducting Business Without Registering the Non-Resident

According to Ukrainian tax law, from the moment a non-resident is registered as a corporate income taxpayer, it is independently responsible for calculating, declaring, and paying taxes. Article 117.4 of the Ukrainian Tax Code stipulates that a non-resident (a foreign legal entity or organization) conducting activities through a separate subdivision, including a permanent establishment, without proper tax registration, faces a fine of 100,000 UAH.

To mitigate risks and potential penalties, we advise non-resident parent companies operating through a representative office in Ukraine to ensure proper tax registration and compliance.

If you require assistance with the registration, modification, or liquidation of Representative Offices, or need consultations on their operations, our team of lawyers, financial advisors, and auditors is prepared to support your business.

Our range of services includes:

Assistance with the operation of foreign representative offices in Ukraine

Our clients