How to pas planned tax preparation for Ukrainian business?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The most intricate and comprehensive form of tax inspection for a taxpayer is a scheduled audit. Its complexity stems from the fact that, firstly, it focuses on the accuracy, completeness, and punctuality of tax and fee calculations and payments, which include the Unified Social Contribution (ESC). Secondly, the audit period typically encompasses the last three years.

This implies that, before a scheduled audit, it is essential to align all the necessary documentation with the legal requirements, covering at least the preceding three years.

Following a scheduled tax audit, you, as a taxpayer, may face penalties and additional tax liabilities. Such audits commonly reveal underreporting of tax obligations, particularly concerning corporate income tax and value-added tax.

These audits often involve scrutinizing commercial transactions with business partners. After such an analysis, the tax authority may dispute the authenticity and actual occurrence of these commercial transactions. Consequently, expenses associated with such transactions are disallowed, and any accrued tax credits are revoked by the tax authority. This can lead to increased tax liabilities.

Based on our experience in assisting clients with tax audits, we will share insights on how to prepare and what aspects to focus on to successfully navigate a scheduled tax audit.

You may also like: Tax Audits Making a Return in 2023

Can you predict a scheduled tax audit and how can you prepare in advance?

Yes, indeed. Among the various types of tax audits conducted by tax authorities, a scheduled tax audit is the most foreseeable due to the following reasons:

- As a taxpayer, you should be part of the plan schedule for scheduled audits.

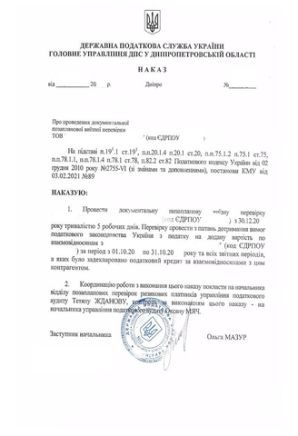

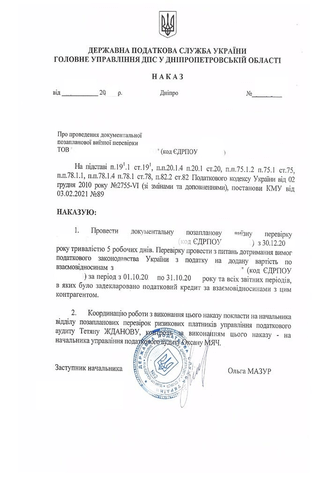

- The tax authority is obligated to send you a copy of the order and a written notification of the scheduled audit, including the start date, at least 10 calendar days before the audit.

Upon receiving the order for a scheduled audit, you will be informed of the audit's commencement and the audit duration.

You should engage a tax attorney in the preparation for such an audit, whether it is at the stage of your inclusion in the audit schedule or when you receive the actual order for a scheduled audit.

Due to the typical audit period for a company's activities spanning 3 years, both the enterprise and the attorney need to allocate a sufficient amount of time for the following:

- Effective preparation for such an audit.

- Organizing the primary documentation for the relevant period.

- Recovering certain documents through collaboration with business partners, if needed.

Additional audit work is typically conducted when the client already has an order for a scheduled audit. This is because the audit order guides the audit's start date and duration.

The additional audit work consists of the following conditional stages and components:

- Requesting and analyzing the company's accounting and tax reports for the audited period.

- Checking business partners in various state registries and exchanging information with them.

- Analyzing primary documentation related to business transactions during the audited period, especially transactions that impact expenses and tax credits.

- Providing a final report on the additional audit work, identifying potential risks, and outlining methods to mitigate them.

Certainly, for instance, in our work with one of our clients, our team's supplementary audit revealed a series of high-risk transactions. The primary documentation related to these transactions required refinement to ensure its alignment with both the primary documentation and the accounting records.

The primary documentation was adjusted accordingly, resulting in no violations of tax legislation found in the respective business transactions during the audit. Since the total expenses and the accrued tax credit amounted to over 3 million UAH, the supplementary audit proved to be effective, and the client avoided the repercussions of a tax notice exceeding 3 million UAH.

The planned tax audit procedure

The procedure for conducting a planned tax audit typically follows these steps:

- Meeting with representatives from the tax authority and receiving the audit directive.

- Identifying the individuals participating in the audit and verifying their correspondence with those listed in the audit directive.

- Receiving and reviewing requests regarding the submission of primary documents and explanations, considering the relevance of the requested documents and the volume of documentation needed.

- Preparing responses to the requests.

- Obtaining the audit report.

- Preparing objections to the audit report.

- Ensuring participation in the review of objections to the audit report by the tax authority's commission.

When should you involve a tax attorney in the audit process?

Ideally, it's best to engage a tax attorney when you receive the audit notification. This early involvement provides greater assurance of successfully navigating the audit with minimal risks.

There are situations where a company's documents related to transactions with business partners are either missing or require significant adjustments or restoration. This can be a critical issue during the audit because auditors may not acknowledge these transactions, leading to disallowed expenses and tax credits associated with these transactions. Our team has a positive track record in resolving such issues, as briefly discussed in previous sections.

Please note! Failing to provide documents during the audit can result in the imposition of separate penalty sanctions, which will be detailed in a separate tax notice-decision.

In the context of the audit, as a taxpayer, you will invariably receive requests for explanations regarding the identified violations during the audit and the submission of documents mentioned in such requests. Typically, tax authorities request more documents than necessary, so analyzing and addressing these requests with an attorney during the audit process can help minimize the risks of imposing penalty sanctions and additional tax liabilities related to various taxes.

An attorney plays a crucial role in the process of submitting objections to the findings presented in the audit report. Additionally, during administrative and judicial appeals of tax notifications based on the conclusions of the audit report, an attorney can provide invaluable assistance.

Of course, it's possible to involve an attorney after failing the audit and seeking damage control, but it is more rational to allow an attorney to protect your interests with maximum effectiveness from the beginning of the audit.

Certainly, in our practice, there was a case where a taxpayer allowed a tax audit to take place, and the audit was completed, resulting in the issuance of tax notifications totaling more than 12 million UAH. The client approached us to challenge the consequences of the audit, which formed the basis of these tax notifications.

After analyzing the process of appointing and conducting the audit and identifying violations outlined in the audit report, we decided to challenge the tax notifications in court. We demanded to have them recognized as unlawful and to cancel these tax notifications. This was because the tax authority had violated the proper procedure for conducting the tax audit.

Although the tax authority insisted that the audit had been conducted properly and the taxpayer did not deny its occurrence during the audit, recent legal positions of the Supreme Court favored our case. As a result, our lawsuit was successful, and the tax notifications were overturned.

Our company offers support for various types of tax audits.

Our clients