Return of tax audits: how to prepare?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Commencing July 1st of this year, there are plans to resume documentary tax audits. This is one of the prerequisites that Ukraine has agreed upon with the International Monetary Fund.

Even though the required changes to the Tax Code have not yet been approved, the bill has already been registered in the Ukrainian Parliament.

The State Tax Service of Ukraine has disclosed the schedules for the anticipated documentary audits of taxpayers for the year 2023. The majority of these audits will commence at the end of this year's summer.

What occurs with tax inspections during a state of war?

After the imposition of a state of war on February 24, 2022, all tax inspections in Ukraine were brought to a halt, even those that were already underway. This decision was taken due to exceptional circumstances. On March 3, 2022, the Verkhovna Rada ratified Law No. 2118-IX, which legislatively prohibited the carrying out of tax inspections.

Nevertheless, as early as May 2022, the Verkhovna Rada passed Law No. 2120-IX, which partially reinstated tax inspections starting from late July. According to this law, regulatory bodies were granted the authority to conduct ad-hoc desk, field, and documentary inspections. However, the range of reasons permitting a tax inspection was restricted, including:

- The taxpayer's application;

- Company reorganization;

- Company dissolution or bankruptcy;

- Application for VAT reimbursement.

You may also like: How Will Automatic Exchange of Tax Information Work?

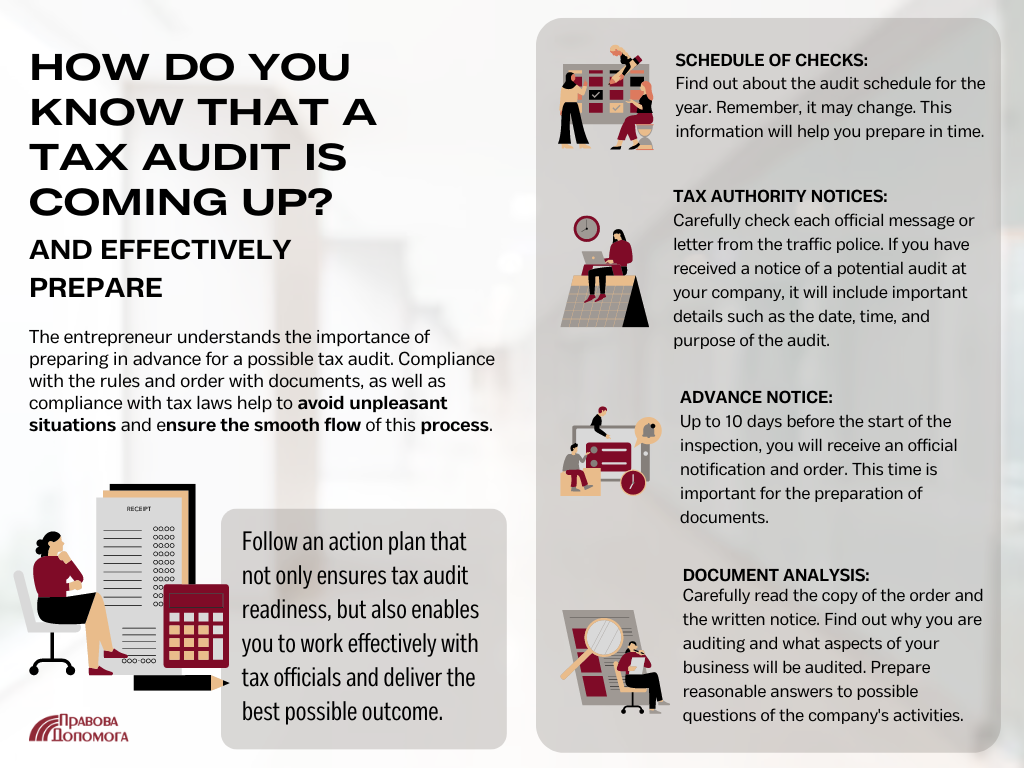

How can you determine if tax officials will be visiting you soon?

To find out whether a tax audit is in the cards for your enterprise, follow these steps:

- Review the tax audit schedule: It's advisable to check the schedule for planned tax audits at the beginning of the first and second quarters of the year. These schedules are typically released towards the end of the preceding year. The schedule may include proposed dates and the businesses earmarked for scrutiny. Keep in mind that this plan could evolve throughout the year, so periodic updates are worth looking out for.

- Stay attentive to official notifications: Keep a vigilant eye on any official communications or letters sent by the State Tax Service. If you receive an official notice indicating an impending audit of your business, it will furnish all necessary particulars concerning the date, time, and objectives of the audit. It's of paramount importance to always be prepared for the potential of a tax audit. Maintain meticulous documentation and adhere to tax regulations to avert any potential complications.

- As per tax regulations, tax authorities are obligated to furnish you with a copy of the directive and a written notification that includes the commencement date of the tax audit. This notification must be provided no later than 10 calendar days before the audit begins. This affords you ample time to brace for the audit and ensure that your documentation is in order.

Upon receipt of the directive and written notification, scrutinize the audit's start date and other essential details contained therein.

Meeting deadlines and carefully absorbing all the information provided are crucial steps. These measures will empower you to prepare for the audit and guarantee that you're in full compliance with the demands of tax legislation.

You may also like: Financial and Tax Asset Audit for Companies in Kyiv

How can you confirm the legitimacy of the inspectors' right to conduct an audit?

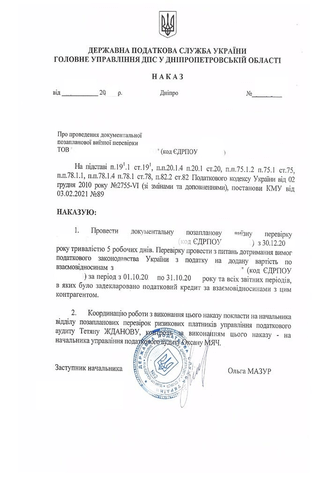

Firstly, you should request the following documents:

- Copy of the Official Order: Make sure to obtain a copy of the official order that approves the audit. This order will provide essential details about the audit, such as its start date, duration, purpose, and the legal basis for conducting it. The order should be signed by the head of the tax authority and stamped with an official seal.

- Written Notification: You should also receive a written notification containing information about the inspecting authority, particulars of the audit order, your business's name and details, as well as the name and position of the individual responsible for carrying out the audit. The notification will also include the date it was issued.

- Official Identification: The tax inspectors who arrive for the audit must present official identification that confirms their role and authority.

You'll have the opportunity to scrutinize these documents, ensuring their accuracy and compliance with the required standards. The written notification must clearly encompass all the necessary information mentioned above.

Keep in mind that if you are hesitant to sign the notification, the tax inspectors might create an official record that serves as the foundation for initiating the audit.

You may also like: What to Do When Your Company Faces a Significant Corporate Income Tax Payment?

Which documents should you furnish during an audit?

When facing a tax audit, it's essential to provide tax authorities with documents directly linked to or associated with the subject under review. Among the key documents that might be necessary during an audit are as follows, though this is not an exhaustive list:

- Financial Reports: Reports detailing financial outcomes, balance sheets, cash flow statements, and any other financial reports prepared in alignment with prevailing laws.

- Contracts and Agreements: Copies of contracts involving clients, suppliers, partners, and any other relevant parties with whom your company maintains agreements.

- Transaction Records: Invoices, cash orders, payment instructions, certificates indicating completed work, receipts for the transfer of goods and services, shipping documentation, and any additional records verifying transactions.

- Personnel Papers: Employee employment records, copies of employment contracts, official appointment orders, extracts from individual employee files, payroll summaries, and any other paperwork connected to staff management.

- Tax Returns and Reports: Copies of filed tax returns, reports on tax remittances, payment instructions, and any further documents pertinent to tax obligations.

- Other Documents: Depending on the nature of your business, you might need documents corroborating the legality of operations, documented expenses, salary computations, records of investment endeavors, and more.

Keep in mind that you should share documentation only after the audit has formally commenced, and specifically, those documents directly linked to the focus of the audit.

Always conduct a thorough review of the documents you're submitting and maintain copies for your own records.

How does a tax audit conclude?

Following the conclusion of the tax audit, tax authorities draft a report or a certificate based on the findings. The potential outcomes of the audit typically fall into these categories:

- Report on Discovering Violations: If violations of tax legislation requirements are identified during the audit, tax officials create a report documenting these breaches. This report includes details about the violations, observations, requirements for rectifying the violations, and potential consequences. These consequences might involve penalties or other measures.

- Certificate of Absence of Violations: If the audit reveals no breaches of legal requisites, tax authorities issue a certificate affirming that your operations align with the specified regulations.

Once the report or certificate is generated, you are furnished with a copy. Should any violations be unearthed, you are granted a window within which you can submit objections to the conclusions drawn in the audit report.

Subsequently, predicated on the audit report, should your objections not be upheld, tax authorities might proceed to issue tax assessment notices.

How to get ready for a tax audit during a state of war?

Once an audit is underway, the room for responsive actions becomes quite limited, making it challenging to effectively address tax authorities' requests within the ongoing audit. This includes providing necessary explanations and documents promptly.

Having advance notice about a potential audit offers taxpayers the chance to prepare more comprehensively, anticipating a range of adverse consequences that could emerge during the audit. This is especially significant regarding potential additional tax assessments.

To accomplish this, consider these steps:

- Stay informed about the tax audit schedule: Tax authorities periodically adjust the annual tax audit schedule. If you discover that your business is listed in the schedule, it's a clear signal to start preparing for the audit. In such cases, the audit will likely cover the preceding three years.

- Respond swiftly to tax authority requests: If you receive a request from tax authorities, ensure it doesn't slip through the cracks. Your response should address specific transactions, counterparties, and a defined timeframe. Frequently, the receipt of such a request precedes an unscheduled documentary audit.

However, knowing when an audit is on the horizon is just the starting point. Being prepared for it with proper documentation is paramount.

No matter how a taxpayer positions themselves regarding the authenticity of primary documentation, the alignment of accounting and tax records with the norms of tax legislation, and the integrity in tax collection, there's a significant likelihood that the tax authority, during the audit, will recalibrate tax obligations or apply penalty sanctions based on the findings of the audit. This occurs because, during an audit, the tax authority tends to interpret the provisions of the Tax Code in a manner that maximizes fiscal considerations.

Based on practical experience, it can be asserted that conducting an audit of primary documentation before the audit itself is highly recommended, especially if the company has substantial expenses, sizable tax credits, transactions with high-risk counterparties, or operations that the tax authority might perceive as suspicious.

At times, the relevant transaction that serves as the foundation for recorded expenses and tax credits might lack all the requisite documentation (for instance, the absence of shipping documents, reports for marketing services, supplementary agreements to contracts, and so forth).

Conducting an audit of primary documentation and involving a legal advocate/lawyer doesn't cast doubt on the competence of accountants or directors. Instead, it allows for an evaluation of business operations from a legal perspective, taking into consideration potential claims from regulatory bodies and the current judicial practices.

Our company undertakes such audits, providing recommendations to minimize risks for you when undergoing a tax audit.

Streamlining Work Processes to Approach Audits with Confidence

In addition to audits and document preparation, you can establish effective work processes within your company that will bolster your confidence when facing future audits.

- Analyze and Scrutinize Counterparties. Keep in mind that if your business partners are linked to criminal cases, are classified as high-risk, or lack proper material and technical resources (such as staff, warehouses, and transportation), these factors might raise doubts about the legitimacy of your transactions with them, irrespective of the actual execution of such transactions.

- Employee Training and Guidance. We collaborate with your company's employees and provide concise guidelines on how to conduct themselves during an audit. This is especially pertinent for accountants and directors. The arrival of auditors often induces stress among the company's staff. Employees should have a clear understanding of the steps to take and who holds responsibility for facilitating the tax audit process. It's essential to communicate that communication with auditors should be led by the director and/or legal counsel, as well as the chief accountant. Other team members should abstain from signing documents or engaging in discussions with inspectors.

Our company specializes in establishing such processes and crafting essential instructions for both you and your staff.

Preparing for a tax audit serves as the most effective defense strategy. Identifying risks ahead of time enables the elimination or reduction of their impact.

Even if violations are eventually uncovered as a result of such an audit, and subsequently tax notifications or decisions are issued, the actions taken by your legal representative and director/accountant will offer significant advantages during the legal challenge of the audit's outcomes.

Preparation for tax audits encompasses not only the compilation of requisite documents but also a thorough understanding of legal requirements, the implementation of internal process controls within your company, and the provision of relevant guidelines to your employees.

This approach will aid in mitigating the risk of violations and securing a successful audit outcome.

Our company offers comprehensive support throughout the process, from the initial audit to the involvement of our specialists during the audit itself.