Buy a financial institution

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

- find out from the Client the basic information about characteristics, which a financial institution that is to be purchased must have (name, address, accounting system, list of types of financial services to be provided etc.);

- provide a list of financial institutions for selection in accordance with the Client’s requirements after an advance payment is made;

- after selecting the suitable financial institution, the Client can check its license, constitutional documents and get acquainted with an accounting system;

- arrange a meeting with the notary to sign sale contract;

- if necessary, support the procedure of re-registration of an institution "on a turn-key basis", as well as notify the licensing body about changes and include them in the register of financial institutions.

Documents for the purchase of the company

To purchase a financial institution with a license, you must submit documents of a new owner (owners) of the financial institution and documents to confirm the compliance of director and chief accountant with professional requirements.

A Client may change the name and address by purchasing a financial institution. Therefore, to re-register and notify the licensing authority about the changes, it is necessary to provide information on new features of the institution.

Legal advice on the purchase of a financial institution

If you want to buy a ready financial institution in Ukraine and you are interested in how the procedure of transferring it to a new owner is carried out, please contact our lawyers for an introductory consultation.

Within its framework the expert will answer the following questions:

-

How long will it take to register a financial institution?

-

How are institutions searched and vetted?

-

What documents will be needed in order to carry out the procedure?

-

Which would be more beneficial in your situation: buying a pre-existing institution or registering from scratch?

If you decide to buy a financial institution with us, the cost of the introductory consultation will be included in the price of the main service.

A procedure of re-registration of the institution and notification to the licensing authority about changes are not included in the cost of the service. If we provide you with a service of purchase and sale of the financial institution “on a turn-key basis”, you will receive additional services at a discount.

Why us

Our clients

Before providing a list of financial institutions, we find out the necessary information about the characteristics which must be in such a company (name, address, types of financial services etc.).

To check a license, get acquainted with the constitutional documents and discuss other issues, we suggest to hold a meeting in our office if you are in Kyiv. Even if you are in another region of Ukraine - it is not a problem.

Answers to frequently asked questions

Is it possible to change a name of a financial institution when purchasing it?

When purchasing a financial institution you can change information on the name as well as on the address at which its activities will be carried out.

What experience must have a person to become a director of a financial institution?

A director of a financial institution (except a pawnshop) must have a total work experience of at least 5 years, of which at least 2 years are in management positions, in particular at least 1 year is in the financial services markets.

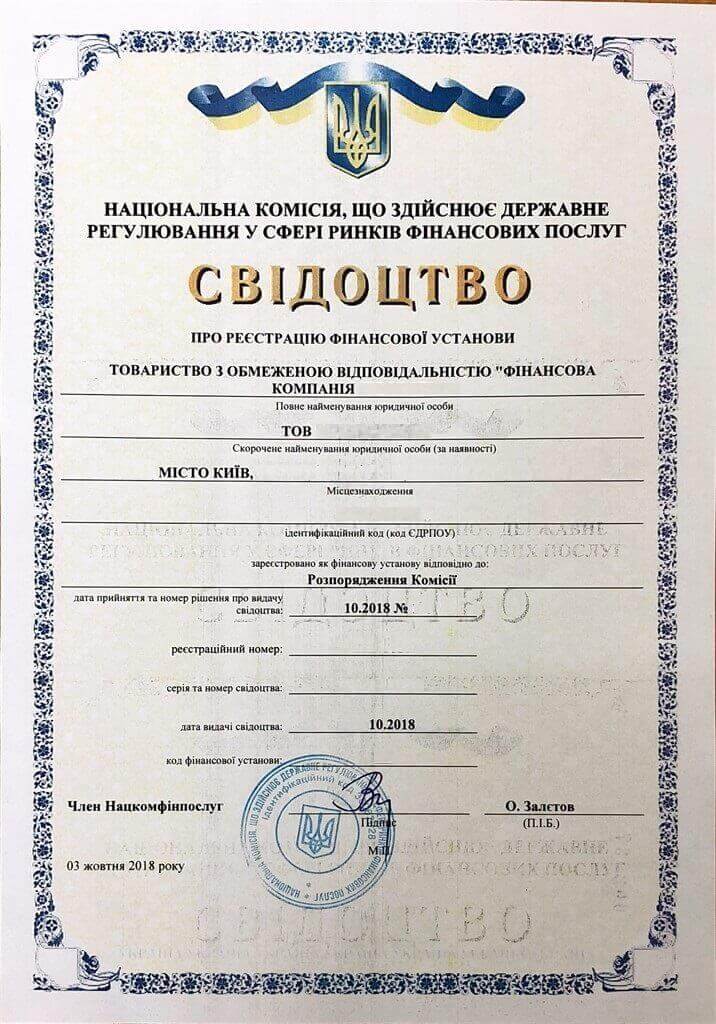

The first set of documents intended for a re-registration of a financial institution includes a registration card of the financial institution, an original of a Certificate of registration of the financial institution, extract from the Unified State register of Enterprises and Organizations. The set of documents is submitted in case of changing a legal address of the financial institution.

The second set of documents is a registration card, information on changes and documents, including various certificates and orders confirming the changes. The set of documents is intended to inform the Commission about other changes.

The third set of documents is intended to be submitted for obtaining an Approval on acquisition of significant share. The state regulator issues an Order on the Approval, which is in the form of an administrative document. It should be noted that in order to obtain such a document, it is necessary to submit a document on the source of cash inflow for which the financial institution was purchased. This can be a salary certificate, a certificate of income of an sole trader, an extract from a bank on availability of funds on the account and/or other documents.

If you want to buy a ready-made financial institution simply and safely - call us!