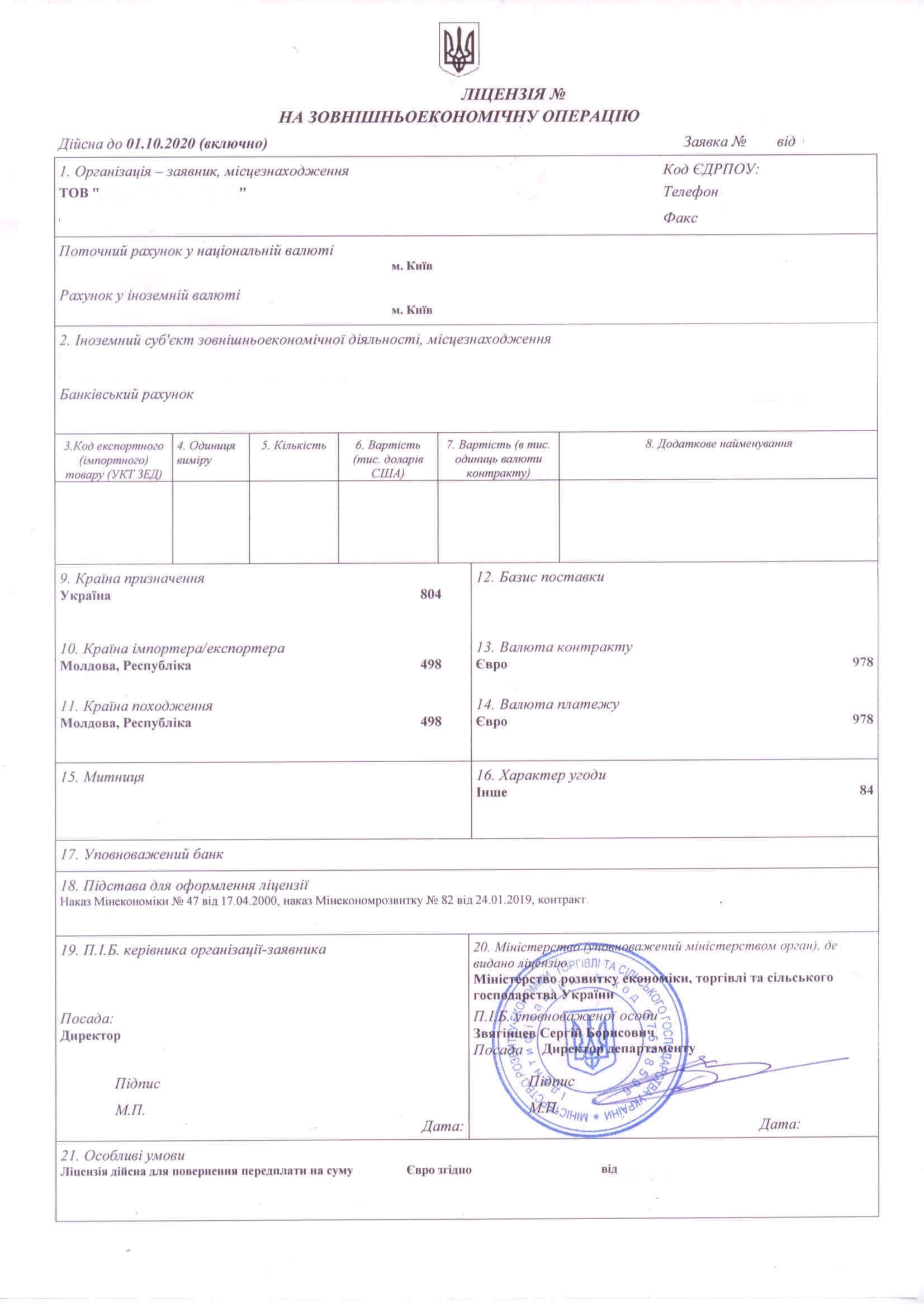

License for import

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

- We provide legal support and assistance in obtaining an International Business License (hereinafter - the License);

- We analyze the documents provided by the Client, including the information on the situation and find the best solutions;

- We represent the Client’s interests in other private and state structures on issues related to obtaining and successful use of the License;

- We help collect and prepare the appropriate set of documents required to obtain the International Business License;

- We assist with the calculation and payment of the state fee;

- We advise the Client throughout the licensing procedure and the collection of documents;

- We help with the development of various foreign economic agreements, letters, conclusions, etc., if necessary;

- We submit a package of documents to the state authority, obtain the License and hand it over to the Client;

-

Assisting with the logistics of importing products containing ozone-depleting substances, including goods with refrigerants (freon);

-

Offering comprehensive assistance with importing goods into Ukraine, including handling declaration procedures, customs clearance, and more.

Documents required for obtaining the International Business License

Documents required for Import License in Ukraine

The list of necessary documents may vary depending on the specific situation and the type of license. However, there are some essential items that our specialists will need for an initial assessment, which will allow them to provide you with a comprehensive understanding of the complete document set and the methods for obtaining them.

Here are some standard items that our lawyers may request from you:

- Contract or agreement (if applicable)

- Detailed description of the situation

For instance, if you are planning to import goods containing refrigerants into Ukraine, we will require not only the international trade contract but also comprehensive information about the model (in the case of equipment), substance formulas, and their quantities (mass).

Service packages offers

- Analysis of the Client's situation by a specialized lawyer

- Providing a list of documents that must be collected to obtain a license

- Providing a step-by-step algorithm for solving the Client's problem to obtain an import license or carry out activities in general

- Providing the best solution to the problem

- Analysis of possible risks and ways to prevent them

- Advising on the necessary documents to obtain a license to import goods

- Advising on the conformity of the product UKTZED

- Advising on a foreign trade agreement (contract)

- Preparation of a complete package of documents for obtaining an import license in Ukraine

- Preparation of details for the license fee

- Support of the case and monitoring of the decision to issue a license

- Advising on the necessary documents to obtain a license to import goods

- Advising on the conformity of the product UKTZED

- Advising on further implementation of activities with imports

- Advising on product quotas

- Preparation of a complete package of documents for obtaining an import license in Ukraine

- Preparation of details for the license fee

- Support of the case and monitoring of the decision to issue a license

- Development of one foreign trade agreement (contract)

- Help with translating documents into English

Licensing for Importing Goods into Ukraine

For entrepreneurs, the licensing of various business activities is an important consideration. Experienced business owners, before exploring a new market segment, often research the need for appropriate permits to legally conduct commercial operations. In terms of licensing, foreign economic activity, especially importing and exporting goods, is a particularly specialized area. This complexity arises because the list of goods requiring import and export licenses changes yearly.

To navigate the licensing requirements for imports, it's crucial to understand which documents govern this area.

The primary regulatory legal documents in this context are the Laws of Ukraine "On Licensing Certain Types of Economic Activities" and "On Foreign Economic Activity."

Analysis of these laws shows that the "On Licensing Certain Types of Economic Activities" law requires licensing for importing items like discs for laser information processing systems, medicinal products, precursors, psychotropic and narcotic substances, as well as holographic security elements. According to this law, trading in alcohol, tobacco, and pesticides necessitates specific licenses. Therefore, importing such goods, including tobacco products and alcoholic beverages, also requires licensing.

However, the aforementioned list is not exhaustive. According to Article 16 of Ukraine's Law "On Foreign Economic Activity," the Cabinet of Ministers of Ukraine annually approves a list of goods requiring import licenses for the upcoming year. For instance, the Resolution by the Cabinet of Ministers of Ukraine, No. 950 dated December 25, 2013, approved the list for 2014. In Appendices 2, 3, 4, 5, and 7 of this resolution, the goods that needed an import license for 2014 are detailed. Particular attention should be paid to Appendices 3 and 4, which enumerate ozone-depleting substances and products containing these substances.

Article 1 of the Law of Ukraine "On Foreign Economic Activity" defines five types of import licenses for goods and materials:

- A special license;

- An open license;

- A general license;

- An import license;

- A one-time license.

Automatic and Manual Licensing of Import

The specifics of import licensing are outlined in Article 16 of the Law of Ukraine "On Foreign Economic Activity." Import licensing is categorized into two forms: automatic and manual.

Automatic licensing consists of a series of administrative actions carried out by the relevant executive body. It involves issuing a permit to a Foreign Economic Activity (FEA) entity for importing certain goods over a specific period, where no quotas are set. In contrast, manual licensing involves administrative measures for the import of goods that are subject to various restrictions.

Import licensing in the automatic mode does not impose restrictive effects on products for which a license is required to be imported. Manual licensing is applied when there are fixed quantitative and other limitations on the import of goods and materials.

The Cabinet of Ministers of Ukraine decides on the specific mode of licensing to be used for importing products.

It's crucial to note that only one type of license is mandated for each product. This license is issued by the central executive authority in charge of economic policy, as well as by the structural division of the regional state administration (in Kyiv, this is handled by the Kyiv City State Administration), within their respective powers.

Apart from the types of licensing, the existing legislation also stipulates the conditions essential for initiating the import licensing procedure, the process of obtaining a license, and the time frames for processing.

If a barter transaction involves goods that require an import license, then such operations are also subject to licensing.

Importantly, goods mentioned in Article 20 of the Law "On Foreign Economic Activity" are exempt from licensing.

Note: As per Article 37 of the Law "On Foreign Economic Activity," conducting import operations without the necessary license, if legally required, results in a penalty of 10 percent of the import operation's value. This is calculated based on the official exchange rate of the hryvnia against foreign currencies set by the National Bank of Ukraine on the day of the operation.

Timeframe for obtaining an Import License (import quota)

The processing time for obtaining an external economic activity license typically ranges around 15 days. However, this duration may vary depending on the type of license (export, import, financial operations, etc.). It is also important to consider the time required for document preparation. If you have up to five items of goods and a standard international trade contract, document preparation can be completed within 1-2 days. However, if you have a larger quantity of goods and a comprehensive contract with attachments and addendums, it may take a week or even longer for a thorough analysis.

An external economic activity license (specifically for the import and export of goods) remains valid until the end of the current year, as the list of goods requiring a license is updated annually.

The government fee for obtaining a license depends on its type. Our team of lawyers can assist you in calculating the applicable cost as part of our service.

Whether you are located in Ukraine or any other country, we can help you obtain an import license or engage in other external economic activities. Our services cover all regions of Ukraine.

Our objective is to streamline the process and make it as fast and simple as possible, prioritizing the comfort of our clients.

Who needs an import license in Ukraine?

An import license is required for anyone planning to import or export goods listed in the resolution of the Cabinet of Ministers for the following year.

The procedure for obtaining an import license is not overly complex and involves a few stages. The key is to ensure that the documents are properly prepared and to effectively communicate with the relevant authorities for license issuance. When working with our clients, we carefully calculate the timeline for document submission and license acquisition to avoid delays at customs for the goods.

Import of controlled substances to Ukraine: chemistry, ozone-depleting substances

Import of chemicals is always one of the most meticulous operations in foreign economic activity. It is necessary to study the composition and purpose of the product very carefully. All further actions on customs clearance of chemicals will depend on the correctness of their classification. And all the requirements for the goods for import are bound primarily to the product code.

For errors in coding the goods are immediately imposed penalties:

-

In the case of a coding error, which led to a decrease in the payment of customs duties - the penalty will be 300% of the underpaid amount;

-

In the case of a significant error in declaration a penalty may be imposed by confiscation of goods with the simultaneous imposition of a fine in the amount of the value of the confiscated goods.

Thus, determining the code is the key point where it is very important not to make a mistake.

How to determine the code, and how the ozone-depleting substances in the composition of the goods affect customs clearance?

It is very convenient when the sender reports CAS numbers on the products - this facilitates the process of classifying the goods. Also, when CAS numbers are available, the probability of the customs authorities changing the product code is very low. However, this information is not always provided by shippers.

When determining the code of goods you need to know:

-

the full chemical composition;

-

or the composition indicated on the product label;

-

the physical form of the product;

-

the function it performs;

-

its packaging.

For example, the soap code will depend on whether it is in bars or in powder, granules or other forms. Or fabric softener might be under the code for textile excipients or under the code for silicones, if there are any in the composition.

This affects the rate of duty on the product.

For textile excipients, an import license for ozone-depleting substances is required. But only if the goods are in aerosol packaging. And only if the goods contain ozone-depleting substances.

Please note! The list of goods and substances controlled in Ukraine is determined by the Decree of Cabinet of Ministers No. 1329 of 28.12.2020, and is not valid from 01.01.2022. Therefore, you should know exactly what is contained in the goods in order to verify whether the planned imported substances are controlled or not.

For example, if you are engaged in the textile industry, unfortunately, this does not mean that all the chemicals you import shall automatically be classified as textile-auxiliary substances. Especially if, according to the Ukrainian classifier of goods for FEA, there is a specific code for these products, such as adhesives, paints, silicones, surfactants, detergents. So, if your product is not a pure substance, but a mixture of different substances, and its function is to glue – the product code will be in group 35. However, in most cases, the adhesive code does not require an import license for ozone-depleting substances.

Paints are also a prime example. Paints come in a variety of colors: for drawing, for screen printing, inks for printing, paints for fabric, and paints for shoes. All of these products have completely different codes. Without a properly defined code it is impossible to tell whether a client needs a license to import ozone-depleting substances.

With the right approach to determining the needs of the entrepreneur, one should first consult, study all the shipping documents, and then determine whether the goods require additional import licenses or permits.

One must have an invoice or proforma, appendix or specification, safety data sheet, and information on the chemical composition of the goods. Such information can be found in the manufacturer’s letter or on the label of the goods.

It is better to ask for advice at the stage of planning the import, not when the goods are already in the customs control zone. Since if you need to obtain a preliminary license, you need time to prepare the documents (consideration period is 30 business days), and the state body has legal terms for the issuance of such a license.But if a license is needed, the goods are already in Ukraine, and there is no license, then the goods either wait in the area, for which the daily fee increases, or go to the warehouse, which also entails payment for unloading work and place / time of storage of the product.

Why is the Import License waiting period so long chemicals and ozone-depleting substances?

The deadline of 30 business days is set for a reason, because there are two ministries involved: the Ministry of Environmental Protection and the Ministry of Economy. And the entire package, which must have two copies of applications, shall be submitted to the Ministry of Economy, where the entire case goes through the clerk’s office, where it is signed by the relevant licensing department and transferred to a certain executor, who sends one copy of the application to the Ministry of Environmental Protection, where, in turn, this application also finds its executor.

The Ministry of Environmental Protection has three business days to report on the grounds for refusal to approve the issuance of a license, and if such grounds are not found, they must issue a consent to issue a license within 10 days.

So when the procedure involves several government agencies and many people, you should expect that at least one of them will have some comments. However, you can avoid problems if the entire package of documents will be properly prepared.

And what if there are some drawbacks? Then you will either be rejected (if the comments are incompatible with obtaining a license and they concern mostly the substances), or you will be given a recommendation to correct the mistakes, and to add only the corrected documents followed by a certain cover letter.

But what happens to the deadlines in that case? That’s right, they start all over again from the time the corrected documents are submitted.

What are the most common comments to the documents for an Import License? The documents that fall under the strictest scrutiny of the regulatory authorities include the foreign trade contract, specifications, invoice/proforma invoice.

The documents, which are filed for a license, must be bilingual or with a translation into the Ukrainian language. The names of goods, the price per piece, their codes - everything must be clearly written. Extract from the Unified State Register must be up-to-date - it must be obtained one month before the date of filing at the earliest.

If you do not have so much time to study all the nuances and re-submit the documents, you should immediately contact the experts. We will get an Import License at the first try and without refusal.

How to Obtain an Export License for Ozone-Depleting Substances?

Activities involving the use, production, and placing on the market of products containing ozone-depleting substances are regulated by the state at certain stages and require a licensing basis for operation.

The complexity lies in the fact that obtaining a license is not the only step you'll need to take to export or import ozone-depleting substances from Ukraine.

What are the primary actions needed to ensure the export of goods containing ozone-depleting substances?

1. Identify if the substance in the product is ozone-depleting.

Before exporting a product abroad, you must understand its classification and whether it falls under the category of goods requiring an export license.

Our lawyer can ascertain whether your product requires licensing and if quotas apply. Moreover, you'll need to obtain a clarification letter from the Ministry of Ecology, confirming the necessity of obtaining an export license for such goods.

2. Registration with a customs body.

For this, you should apply for registration at any customs office in Ukraine. The application can be in written or electronic form. Customs may refuse registration if the application violates legislative requirements or provides information inconsistent with the State Register of Individual Entrepreneurs or the Unified Bank of Data on Legal Entities.

Our lawyers will take care of drafting the application according to all legal requirements and handle the communication with the customs service.

Registration is usually completed no later than the next business day following the application submission. You don’t need to re-register for subsequent exports of the same goods.

3. Conclude a foreign economic contract.

This contract is established between entities of international economic activity and foreign counterparts.

The process of concluding an international economic contract has certain nuances, which our lawyer can handle, including analyzing the contract terms or drafting it from scratch. Keep in mind:

- The choice of applicable law plays a significant role.

- If at least one party is a Ukrainian citizen or a legal entity registered in Ukraine, the contract must be written as legally required, regardless of the place of its conclusion.

We can help you:

- Develop a contract tailored to your needs;

- Correctly select the applicable law for the international economic contract;

- Address nuances such as force majeure and who will bear banking fees;

- Facilitate effective communication with the foreign counterpart, leading to a swift and straightforward contract conclusion.

4. Prepare transport documents for the export of ozone-depleting substances.

There are several nuances here, for example, the documents differ depending on the type of transport vehicle used for shipment:

- Bill of Lading;

- Transport Invoice;

- CMR Consignment Note;

- Carnet TIR;

- Air Waybill (AWB).

Some of these, like the Transport Invoice and Carnet TIR, can be prepared by our lawyers.

For others, such as the Bill of Lading, AWB, and CMR Consignment Note, our lawyers will check if they are correctly filled out by the carrier or freight forwarding company, helping to avoid unnecessary questions at customs.

5. Prepare documents that confirm the value of the goods.

These could be:

- Invoice;

- Proforma invoice;

- Proforma bill;

- Commercial invoice.

While these documents are prepared by the business entity, our lawyers will ensure their correctness to prevent delays and inquiries at customs.

6. Obtain the necessary permits for exporting ozone-depleting substances.

Having completed the preparatory steps, you can proceed to obtain permits for the export of goods containing ozone-depleting substances.

The activity may require more than one license, depending on your specific operations and how you plan to organize the export: whether you transport the substances yourself, if the substances are classified as hazardous waste or particularly hazardous chemicals, etc.

Our lawyers will clarify all details of your operation and assist in obtaining the precise set of required permits.

What permits are needed for exporting ozone-depleting substances?

The export of goods that are ozone-depleting or contain such substances requires licensing in Ukraine, as mandated by the Cabinet of Ministers' Resolution "On Approval of the Lists of Goods, the Export and Import of which are subject to Licensing and Quotas," issued annually for the upcoming year. These goods must also comply with the Montreal Protocol and Ukrainian laws such as "On Environmental Protection," "On Waste," and "On Protection of Atmospheric Air," among other legal regulations.

For exporting or importing ozone-depleting substances, various permits may be necessary, depending on the nature of the activities:

- Import/Export License: This essential document is required regardless of the situation. Issued by the Ministry of Economy, acquiring this license necessitates completing all previously mentioned steps.

- License for Transporting Hazardous Goods and Wastes: Needed if you plan to transport goods using your own vehicles. This license requires that the personnel involved in transportation have specific experience in handling hazardous goods and wastes. There are also minimum age requirements for the carrier. It's essential to ensure that the driver meets these criteria.

Obtaining this license can take up to three weeks and can be processed concurrently with other required licenses, saving time as all your documents are handled simultaneously.

- License for Handling Hazardous Waste: Required if the substances are classified as hazardous waste and the associated activities involve storing them for over a year.

- Precursor License: Needed when chemical substances are intermediates in synthesizing ozone-depleting substances, requiring a distinct procedure to obtain.

By engaging our services, you won't have to wait for multiple contractors to complete tasks – you can acquire all necessary licenses from a single, comprehensive source. This approach saves time and money and ensures the achievement of your desired goals.

Our legal team has extensive experience cooperating with the Ministry of Economy, acquiring import or export licenses, and registering foreign company representative offices. With us, you won't need to seek another partner to kickstart your export business.

Why us

Our clients

Our successful projects

Key points to know about foreign economic activity licensing

Licensing for foreign economic activity is regulated by Article 16 of the Ukrainian Law on Foreign Economic Activity. The specific list and quotas of goods subject to export or import restrictions imposed by the government are established annually through relevant resolutions of the Cabinet of Ministers of Ukraine.

It's important not to confuse this licensing process with the licensing of pharmaceutical imports or the licensing of alcoholic beverages and tobacco products. The import and sale of pharmaceuticals, alcohol, and tobacco are governed by separate legislative acts. Information on obtaining these specific licenses can be found on our website.

However, the import and export of goods containing ozone-depleting substances are fully regulated by the Ukrainian Law on Foreign Economic Activity, as well as the Cabinet of Ministers Resolution on the list of goods subject to licensing (updated annually). An essential element in this process is the international trade contract.

Answers to frequently asked questions

What to do in case of facing problems during the economic transaction (sanctions imposed, export/import prohibited)?

In this case, you can apply for a one-time (individual) International Business License, which will allow you to either return the money or finish the transaction.

We have contacted the Bank/Ministry (another authority) and they require us to develop additional agreements, but we don’t know how to do this properly. What to do in this case?

In this case, our lawyers can contact your bank/executor or other responsible person, and we will help you to resolve this issue.

Legal services for obtaining the International Business License (Import License)

Upon reaching an agreement on the terms and cost of the Import License, we sign a Legal Services Agreement with the Client.After signing the agreement and making the calculations (import quota and import license provide for a certain calculation procedure), the lawyers of our company carefully review the documents provided by the Client and give recommendations on additions to the package of documents. At the same time, we develop the documents necessary to obtain the Import License (application, etc.).

After the complete package of documents is prepared and signed by the Client, our specialists submit them to the appropriate state authorities.

During the consideration of the case by the Ministry of Economic Development and Trade of Ukraine, our company’s lawyers communicate with an appointed employee of the Ministry, promptly address all the deficiencies and monitor the progress of the case.

If necessary, our company’s specialists can pay the license fee on behalf of the Client. In this case, the Client shall provide us only with details and the necessary amount of money.

At your request, we can change the standard procedure for obtaining the Import License to a more convenient option for you.

If you want to get the Import License quickly and without problems, don’t hesitate to call us!