How to Obtain and Maintain Your Nonprofit Status

Cost of services:

Reviews of our Clients

The general principle is that non-governmental organizations (NGOs) in Ukraine are formed as non-commercial entities. According to Ukraine's Tax Legislation, non-profit status for an NGO implies exemption from accruing and paying corporate income tax. A key consideration here is identifying which organizations in Ukraine qualify as non-profit and understanding how to obtain and retain this status.

With years of experience in establishing NGOs in Ukraine, our team is adept at providing comprehensive legal support during registration and ongoing human resources and accounting assistance. In this article, we aim to offer exhaustive insights into the crucial questions surrounding the non-profit status of NGOs and detail how we can aid in the effective management of your NGO's activities.

You may also like: Non-Governmental Organizations in Ukraine: Types and Regulatory Framework

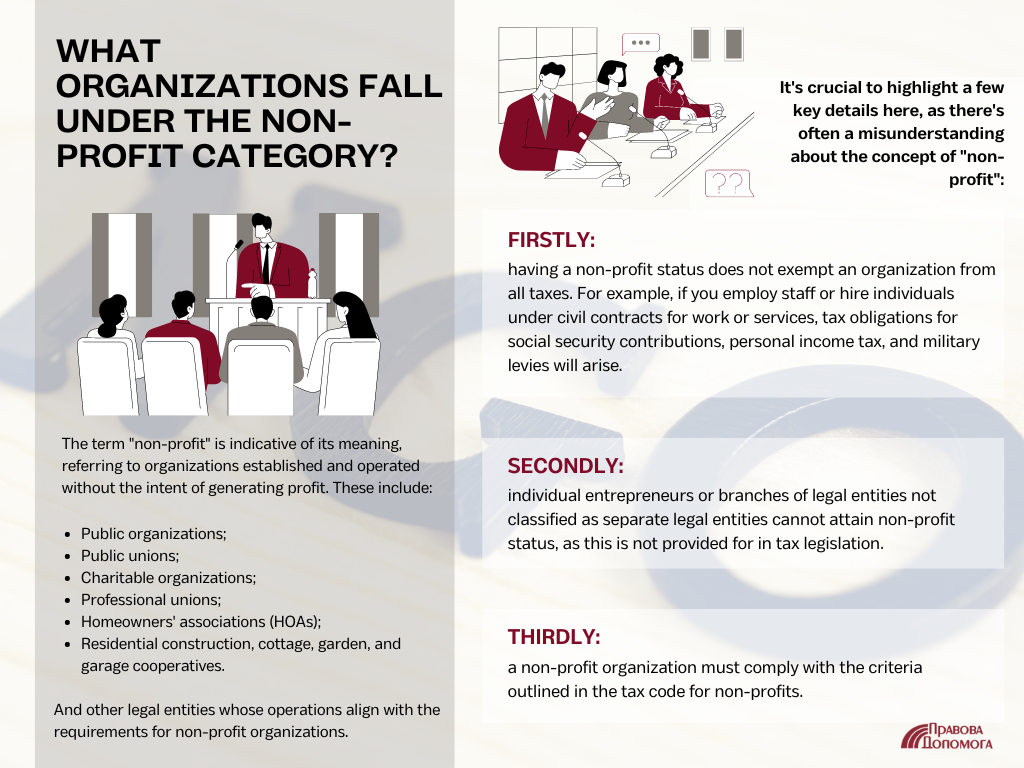

What Organizations Fall Under the Non-Profit Category?

The term "non-profit" is indicative of its meaning, referring to organizations established and operated without the intent of generating profit. These include:

- Public organizations;

- Public unions;

- Charitable organizations;

- Professional unions;

- Homeowners' associations (HOAs);

- Residential construction, cottage, garden, and garage cooperatives.

And other legal entities whose operations align with the requirements for non-profit organizations.

It's crucial to highlight a few key details here, as there's often a misunderstanding about the concept of "non-profit":

- Firstly, having a non-profit status does not exempt an organization from all taxes. For example, if you employ staff or hire individuals under civil contracts for work or services, tax obligations for social security contributions, personal income tax, and military levies will arise.

- Secondly, individual entrepreneurs or branches of legal entities not classified as separate legal entities cannot attain non-profit status, as this is not provided for in tax legislation.

- Thirdly, a non-profit organization must comply with the criteria outlined in the tax code for non-profits.

These points are essential to consider if you're navigating the realm of non-profit status and seeking to obtain it. With our experience, we can guide you through this process, ensuring all legislative requirements are met in the most beneficial manner for you.

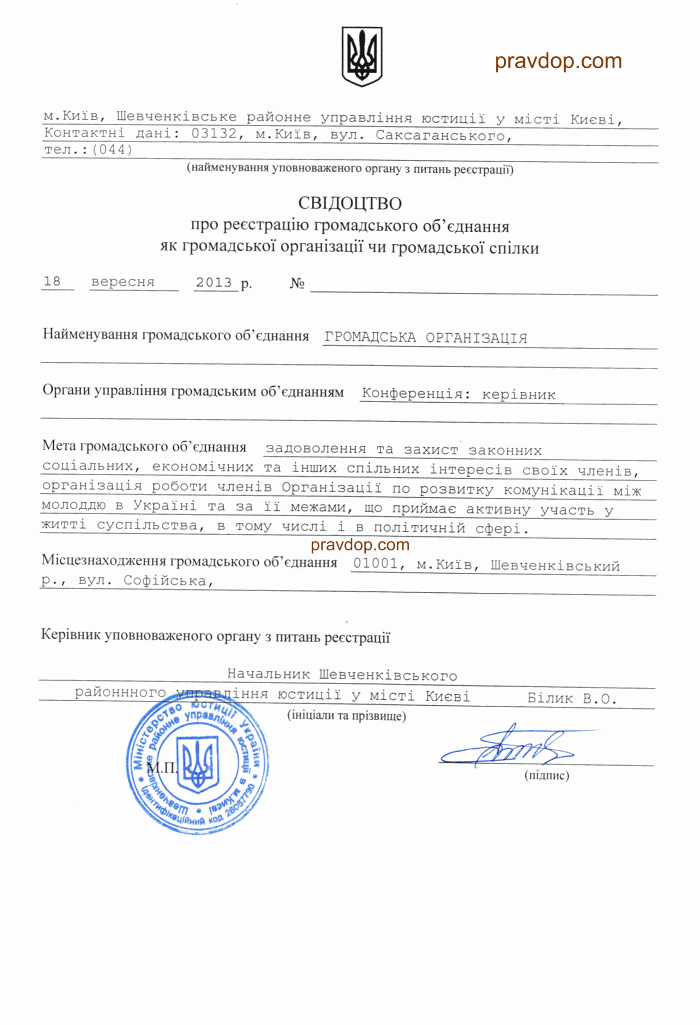

Updating a Charter and Providing Legal Assistance for Non-Profit Status: Successful Cases

In our legal practice, we often encounter queries about non-profit status, its acquisition, and maintenance. For instance, public and charitable organizations formed before 2017, which have not aligned their bylaws with current legislation or are not listed in the non-profit organizations registry, frequently seek our assistance. This is because to operate effectively and acquire non-profit status, it's essential to update the organization's bylaws in accordance with the prevailing laws.

Clients typically rely on lawyers for this task, as they lack the specific expertise to properly draft bylaws. We are ready to offer our expertise in updating bylaws and other documents, and also assist with registering changes in the non-profit organizations registry, ensuring that your operations comply with current legislation and function efficiently.

In our experience, some clients failed to acquire non-profit status after their organization's registration due to non-compliance of their bylaws with the legislative requirements, particularly in terms of non-profit provisions. For example, a bylaw might lack stipulations about transferring assets to other non-profits upon dissolution or prohibit distributing funds among members of a public organization. In such situations, it's necessary to amend the bylaws and reapply for inclusion in the non-profit organizations registry.

Clients who attempt to resolve this issue independently often face time-consuming processes and repeated rejections from various institutions, forcing them to start over. Our lawyers are prepared to take over these cases, saving time and accelerating the achievement of obtaining non-profit status. We will update your organization's bylaws, make any other necessary amendments, and register them with the Ministry of Justice.

Legal Issues and Challenges Faced by Non-Profit Organizations in Their Operations

After attaining non-profit status, the primary goal for an organization is to maintain this status throughout its operation. Common causes for losing non-profit status often involve a few key issues.

Conducting Activities Not Stipulated in the Charter

The Tax Code mandates that the income of non-profit organizations must be spent on their objectives and goals. Therefore, when collaborating with clients, our firm pays special attention to drafting the charters of non-profit organizations. This includes developing an individualized strategy considering potential future activities. This approach minimizes the need for future charter amendments and reduces the risk of losing non-profit status.

A client once approached us to establish a charitable organization in Ukraine. They provided a list of intended activities, but our lawyers questioned their understanding of the charter's provisions. After a detailed consultation, it became clear that the client's activities and prospects were broader than initially described. Consequently, we decided to draft a charter version that accurately reflected this broader scope, enabling the client to successfully implement their planned projects.

Distribution of Income Among Founders

A common misconception among founders or members of non-profit organizations is that they can distribute received funds among themselves or to their sole proprietorships. Such actions contravene the requirements for maintaining non-profit status. However, paying salaries to employees of the non-profit, even if they are members, is an exception.

Therefore, these factors should be taken into consideration when conducting activities. If your project does not fit the non-profit model, it might be more suited to a business venture. However, it's important to note that non-profit organizations can engage in economic activities and generate income. The key factor is how such income is used, which is crucial in maintaining non-profit status. Our advice is to closely monitor your non-profit status and avoid actions that could lead to its revocation.

Please note! Loss of non-profit status entails the application of corporate income tax on revenues, the requirement to file quarterly reports, and tax liabilities.

You may also like: How to Ensure Compliance with the 80/20 Rule in a Non-Profit Organization?

How to Properly Organize Internal Relations and Membership Fee Payments

When it comes to nonprofit organizations, it's important to understand that their internal relationships between members are governed by their charter. However, it's not uncommon for organizations to have additional internal documents that further define specific procedures or protocols. These can include:

- guidelines;

- regulations, or policies.

However, they should be consistent with the laws and the charter's provisions. For instance, the issue of collecting membership fees is typically addressed in most organizations through a separate document, often referred to as "Regulations," rather than directly within the Charter. This flexibility allows organizations to adapt the collection of membership fees based on varying circumstances, including the amount and frequency.

If an organization decides to implement mandatory membership fees, this should be mentioned in the charter or the relevant internal documents. In most cases, a non-profit's charter allows for the introduction of membership fees, but the details of their payment are defined in internal documents.

As an example, one of our clients needed to establish a system of membership fees to support the financial aspects of their nonprofit organization's activities. In this case, we developed appropriate "Regulations" that detailed the procedure, fee amounts, and other relevant aspects. We then convened a conference to adopt these "Regulations" and ensured their implementation. As a result, members of the nonprofit organization now contribute membership fees on a quarterly basis.

Therefore, using membership fees as an alternative means of funding a nonprofit organization is not only acceptable but also common. Importantly, the legislation does not specify the exact amount or frequency of these fees, allowing the organization to determine these aspects independently. It's worth noting that membership fees are a straightforward way to finance a nonprofit organization and do not impact the risk of losing its nonprofit status.

If you're considering introducing membership fees, it's crucial to properly organize the process of collection, monitoring, and utilization of these funds. We are prepared to assist you in this regard, offering the following services:

- Legal and accounting support for non-profit organizations

- Audit and compliance in charitable or public organizations

- Development of accounting systems for non-profits

- Crisis management and other services related to non-profit organizations

For comprehensive support in establishing or managing a non-profit organization, feel free to contact us.

You can find additional information for non-profit organizations and details about our service fees here.