Non-profit organizations. Types and regulatory framework in Ukraine

Cost of services:

Reviews of our Clients

The Tax Code of Ukraine clearly identifies non-profit enterprises, institutions, and organizations as those exempt from corporate income tax. This status enables these entities to focus their resources on executing socially significant projects and initiatives without incurring additional financial burdens. However, for nonprofits to operate effectively, it’s crucial to understand their types, specific characteristics, and key distinctions from for-profit organizations.

Our article covers all the essential aspects you need to know about non-profit organizations (NPOs) in Ukraine. It's not only important to understand the general requirements but also to consider the specifics of registering and managing NPOs in the current environment, which can be challenging without the necessary experience. We offer comprehensive legal consultations and, if needed, assistance with registering non-profit organizations.

Our team, with over 18 years of experience and a deep understanding of current regulations, ensures a fast, smooth, and hassle-free registration process for NPOs. We provide support with all legal matters, from drafting custom charters to making amendments to existing organizations. Our services also include accounting support, document translation, assistance with opening bank accounts, grant application support, and more. With our help, you can be confident in receiving comprehensive support and professional guidance at every stage of your organization's journey.

According to the Tax Code, non-profitable organizations are institutions, companies, and organizations which are not payers of corporate tax.

In this material, we will consider in detail everything you need to know about non-profitable organizations: their types, features, and differences from profitable organizations.

Related article: Registration features of charity organizations and funds

Types of non-profitable organizations

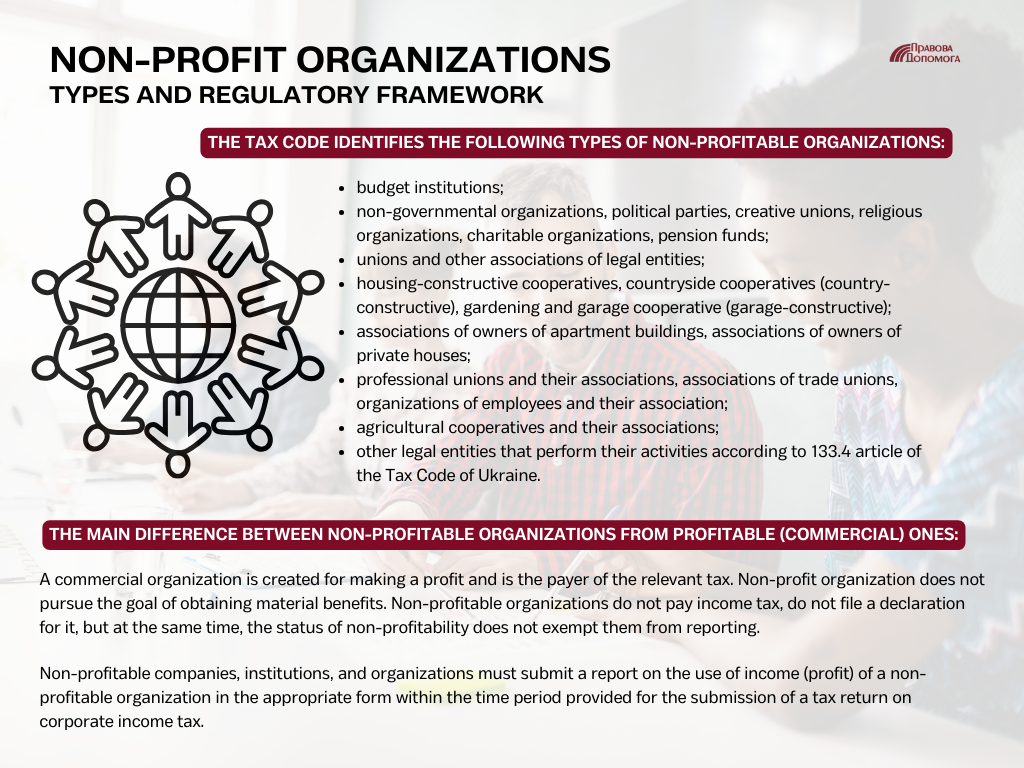

The Tax Code identifies the following types of non-profitable organizations:

- budget institutions;

- non-governmental organizations, political parties, creative unions, religious organizations, charitable organizations, pension funds;

- unions and other associations of legal entities;

- housing-constructive cooperatives, countryside cooperatives (country-constructive), gardening and garage cooperative (garage-constructive);

- associations of owners of apartment buildings, associations of owners of private houses;

- professional unions and their associations, associations of trade unions, organizations of employees and their association;

- agricultural cooperatives and their associations;

The most common types of non-profitable organizations are non-governmental organizations and charitable organizations.

A non-profitable organization is aa association that includes natural persons and/or a private law legal entities, whose goal is to protect rights and freedoms through joint efforts, as well as to ensure the satisfaction of socially necessary interests.

Related article: Classification of forms and types of NGOs in Ukraine

A charitable organization is a private law legal entity created to carry out charitable activities. A charitable organization acts in accordance with the approved program, the purpose of which is to solve problems that correspond to the goals of the organization, specified in the charter. A charitable organization may be founded as a benevolent association, charitable institution, or charitable foundation.

Requirements for non-profitable organizations

The Tax Code of Ukraine regulates requirements for getting non-profitable status:

- such an organization must be established and registered according to laws which regulate activity of non-profitable organizations;

- organization’s incorporate documents must have prohibition of distribution of profits or their parts among establishers, members, members of management, workers (except their salaries and Social Security Tax) and other persons;

Related article: Charter of an NGO in Ukraine. Comments of a lawyer

- organization’s incorporate documents must have clauses about transferring NGO’s property to one or more similar non-profitable organizations or transferring property to a state budget in a case of liquidation of a legal entity;

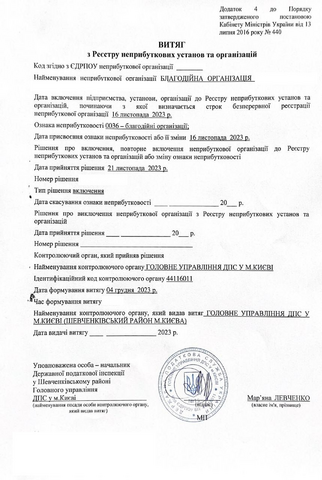

- such an organization must be included in the Register of non-profitable organizations.

Related article: We registered an NGO in newly formed Ukrainian non-profit register

- income (profit) of a non-profitable organization must be used exclusively to finance the costs of maintaining such a non-profitable organization, the implementation of the purpose (goals, objectives) and activities identified by its constituent documents.

The main difference between non-profitable organizations from profitable (commercial) ones

A commercial organization is created for making a profit and is the payer of the relevant tax.

Non-profit organization does not pursue the goal of obtaining material benefits.

Non-profitable organizations do not pay income tax, do not file a declaration for it, but at the same time, the status of non-profitability does not exempt them from reporting.

Non-profitable companies, institutions, and organizations must submit a report on the use of income (profit) of a non-profitable organization in the appropriate form within the time period provided for the submission of a tax return on corporate income tax. The report is intended to control the expenses of income (profit) because if you violate the purpose of use you will have to pay tax and become a payer of income tax on a common basis.

Related article: Expenditures and income in tax returns of charities in Ukraine

On our site, you can find more information on all issues regarding the registration and operation of non-profitable organizations.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form: