Corporate tax in the UAE 2023: what can entrepreneurs expect?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

As of June 1, 2023, the UAE has implemented a 9% profit tax. This tax will be applicable as a standard rule if a company's profits surpass the threshold of 375,000 dirhams (≈ 0,000). The focus will specifically be on the company's profit, which is calculated as income minus expenses. If a company's profit remains below 375,000 dirhams, the company will still retain the option to be subject to a 0% tax rate.

For multinational companies generating profits exceeding 750 million euros, the tax rate will be set at 15%.

According to the overall approach stipulated in the UAE's profit tax law, companies within free zones can continue to be exempt from profit tax provided they can verify the following:

- The presence of a satisfactory level of substance within the UAE.

- Receipt of Qualifying Income.

- No voluntary application has been submitted to transition to the 9% profit tax rate system.

- The company's transactions adhere to the "arm's length" principle (meaning they are conducted under economically beneficial conditions, particularly with related parties), and transfer pricing reports are submitted.

In the event that a free zone company fails to meet these requirements at any given time, it must adopt the general tax framework (9%) starting from the beginning of the year in which the violation occurred (failure to meet exemption conditions).

If a company does not meet the conditions mentioned above, it is obligated to pay a 9% tax.

Many entrepreneurs, including our clients for whom we facilitate company registration in the UAE, are troubled by such a scenario. The most intriguing question, in this context, is what will fall under the category of Qualifying Income.

Addressing these concerns, on June 1, 2023, the Ministry of Finance of the UAE issued clarifications through its Decision No. 139. As per these clarifications, it was further elucidated that for companies operating within free zones:

- The 0% tax rate will be applicable to Qualifying Income.

- The 9% tax rate will be applied to income that does not meet the criteria for Qualifying Income.

We will now elucidate the significance of these clarifications for entrepreneurs who possess companies in the UAE.

You may also like: Company Registration in the UAE for Ukrainian Entrepreneurs

What does Qualifying Income refer to?

- Earnings derived from transactions with other companies within free zones, excluding those falling into the category of Excluded Activities.

- Income generated from dealings with non-residents of the UAE and mainland companies, falling within the scope of Qualifying Activities (provided these operations are not categorized as Excluded Activities).

- Any other income that meets the de minimis requirements.

Which operations are considered Excluded Activities?

- Transactions involving individuals (with specific exceptions, notably in the context of maritime and air transportation services, as well as wealth management activities such as the establishment of funds and investments, among others).

- Banking, financial, leasing, and insurance activities subject to regulatory oversight.

- Ownership and utilization of intellectual property rights.

- Ownership and use of movable assets (excluding transactions involving free zone companies related to commercial real estate located within the free zone area).

You may also like: Taxation System in the UAE

What does Qualifying Activity mean?

- Manufacturing and processing of goods and materials.

- Ownership of stocks and other valuable securities.

- Control and operation of ships.

- Reinsurance (a regulated activity) and wealth management.

- Financing provided to related parties.

- Aircraft leasing, logistics, and financing.

- Distribution of goods to or from the free zone.

What are de minimis requirements?

Under the de minimis requirements, any company will have the opportunity to earn income that doesn't fall under the category of Qualifying Income (thus exempt from profit tax) within the following limits: 5% of total revenue or 5 million dirhams (whichever amount is lower). The lower amount will be applied, ensuring the maximum tax exemption.

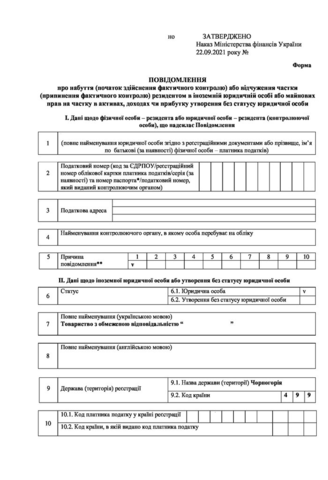

You may also like: How to Submit CFC Reporting Notification in Ukraine?

What level of substance will be necessary?

The substance required should enable the seamless operation of the stated business and the attainment of corresponding profits. It will involve the following:

- Ownership of substantial assets within the UAE.

- Maintaining an appropriate number of personnel.

- Incurring expenses that align with the company's activities and are proportional to the nature of the business, among other factors.

This is an ideal juncture to reassess existing structures (businesses) in the UAE from two crucial angles:

- Scrutinizing the operations they undertake (analyzing transactions with UAE residents and non-residents) to ascertain the category into which these activities fall and whether they meet the criteria for Qualifying Income.

- Evaluating the substance retained by these companies.

Henceforth, the activities of free zone companies will be under stricter scrutiny. To continue benefiting from profit tax exemptions, a series of well-defined measures will be indispensable.

For instance:

- Establishing companies with the appropriate substance (note that previously utilized lease agreements, especially those catering to banking purposes, might not suffice in this context; vigilance over the company's "expenses" is essential).

- Carefully examining operations and potentially restructuring financial flows, among other strategic actions.

Our company's specialists are at your service to develop a tailored action plan and assist with its implementation. Don't hesitate to get in touch today for answers to your queries.

Moreover, we can offer you:

Tax optimization strategies for your business

Filing notifications and reports for CFC reporting

Support in initiating and restructuring your overseas business endeavors