Corporate income tax: who and how much should pay?

Cost of services:

Reviews of our Clients

If you intend to register a business, our company can help you to choose the most advantageous tax scheme.

The corporate income tax rate varies by country and is determined by the government's fiscal policy. As of today, the most popular and favorable option for many companies is the simplified taxation system, a single tax.

However, single tax can’t be applied to certain types of economic activities and such companies should operate under the general taxation system.

In this article we will elaborate on the peculiarities of corporate income tax: who is the corporate income tax payer and how is it calculated?

Related article: What Form Of Taxation It Is Better To Choose For Doing Business: Single Tax

Who is the corporate income tax payer?

The first thing our Clients ask us is when their company shall qualify as a corporate income tax payer.

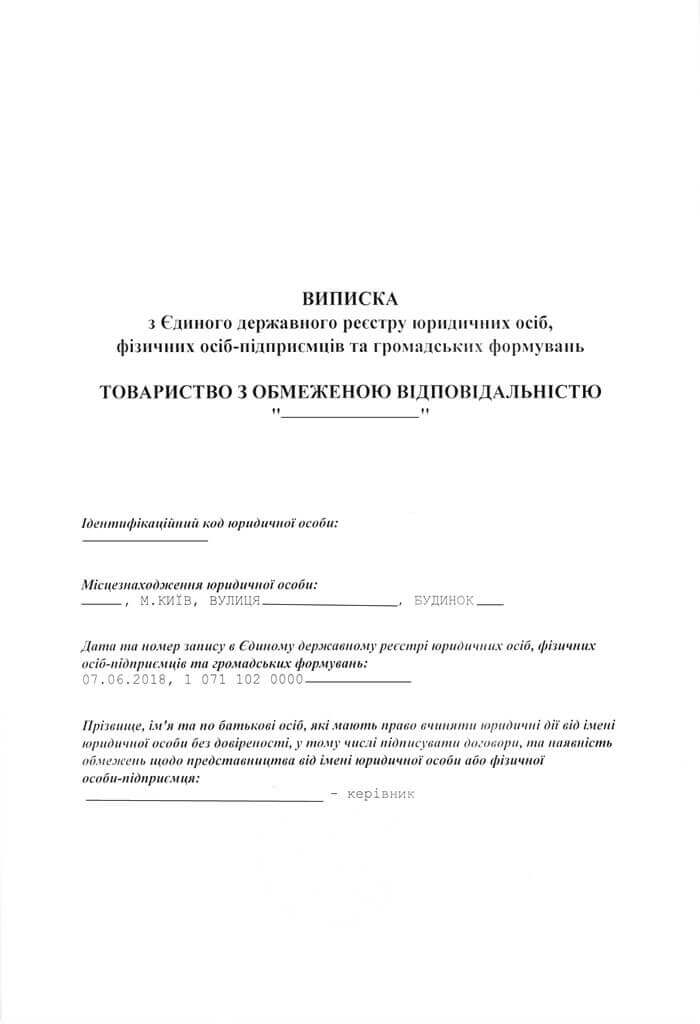

Payers of this type of tax are only those legal entities that operate under the general system of taxation (do not pay single tax), namely:

- Legal entities - residents, that is, those that are officially registered in Ukraine and carry out their business activities, both in Ukraine and abroad;

- Legal entities - non-residents, that is, those that are officially registered outside Ukraine, but receive income with origin from the territory of Ukraine. This subgroup also includes permanent representative offices of the companies, which are registered and make profit in Ukraine.

Note! In this situation, there is an exception - a non-profit legal entity.

Companies with higher profits are typically subject to a higher corporate income tax rate. It should also be remembered that individual entrepreneurs shall not qualify as corporate income tax payers. If you are an individual entrepreneur using the general taxation system, you shall pay 41.5% (18% personal income tax + 1.5% military fee + 22% unified social contribution) of your “net income”.

What is the object of taxation and how to calculate the tax base?

Object: Income of a taxpayer received from sources either inside, or outside Ukraine.

Tax base: “Net profit”, i.e. gross business income minus business expenses. This is the amount of money from which the corporate income tax shall be deducted.

As for the tax rate, it usually stands at 18% of the “net profit”.

Related article: Our Lawyers Provided Legal Advice On Double Taxation And Obtained A Tax Residency Certificate

For example, you have a company registered in Ukraine, which received money from customers for services provided or from the parent company. Let’s take, for example, USD 11,000. And you need to pay salary for the company’s employees - for example, ,000. The tax rate is charged on the difference between these two amounts.

So, 11,000-10,000 = 1,000, then 1,000 * 18% = USD 180. You need to pay 0 of income tax.

Note! Net profit received from certain types of business activity insurance, gambling) is subject to special tax rates. If this is your case, we can help you determine the tax rates and optimal taxation system.

When do the tax liabilities arise?

Tax liability arises after the submission of the relevant tax returns. All businesses are required to file corporate income tax annually, reporting their earnings and expenses.

For example, if your company’s calendar year is considered to be a tax reporting period, you should file the tax return before March 11 of the year following the tax year. And you shall settle your tax liability within 10 business days after the submission of tax returns.

Remember, each business is unique and requires its own approach to finding the optimal scheme of taxation. We are always ready to help you with this issue. If a company fails to file corporate income tax on time, it may face penalties and interest charges.

If you want to learn more about the procedure for paying your business taxes, please don’t hesitate to contact our company’s lawyers in any way most convenient for you.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form: