Cyprus tax residency: do you have to pay taxes if your business is located in Ukraine and you are in Cyprus?

Cost of services:

from 1000 USD

Start

from 1500 USD

Audit + Solution

from 800 USD

For foreigners

Reviews of our Clients

Director V. Ryabko, PJSC "Rodos"

It should be mentioned that cooperation with Law firm "Pravova Dopomoga" means the guarantee of timely and high quality legal support of business activities

Director S. Astashev, LLC "Company "Biznes proekt"

Our experience of work with you in the field of litigation, tax consultations, registration of legal entities and others showed that you can be entrusted not only with ordinary projects but also with those that require creativeness in protection of interests

Director A. Sorokin, LLC "ADREM"

Our experience of work with Law firm "Pravova Dopomoga" allows to assert that lawyers of the firm do not only possess professional qualities but also are ready to listen and understand Client needs

Earlier, we have already talked about what happens if a Ukrainian FLP, being a refugee, lives in Poland. Today we will consider a variant of the same situation, but if you are or plan to stay in Cyprus for a long time, while continuing your activities in Ukraine.

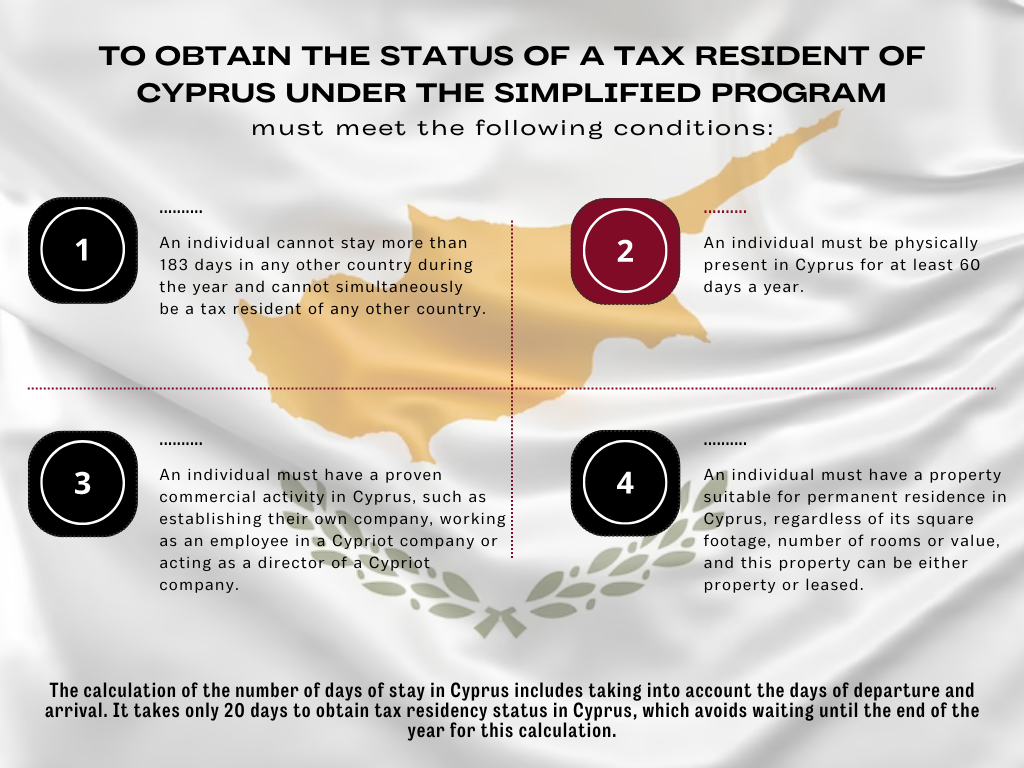

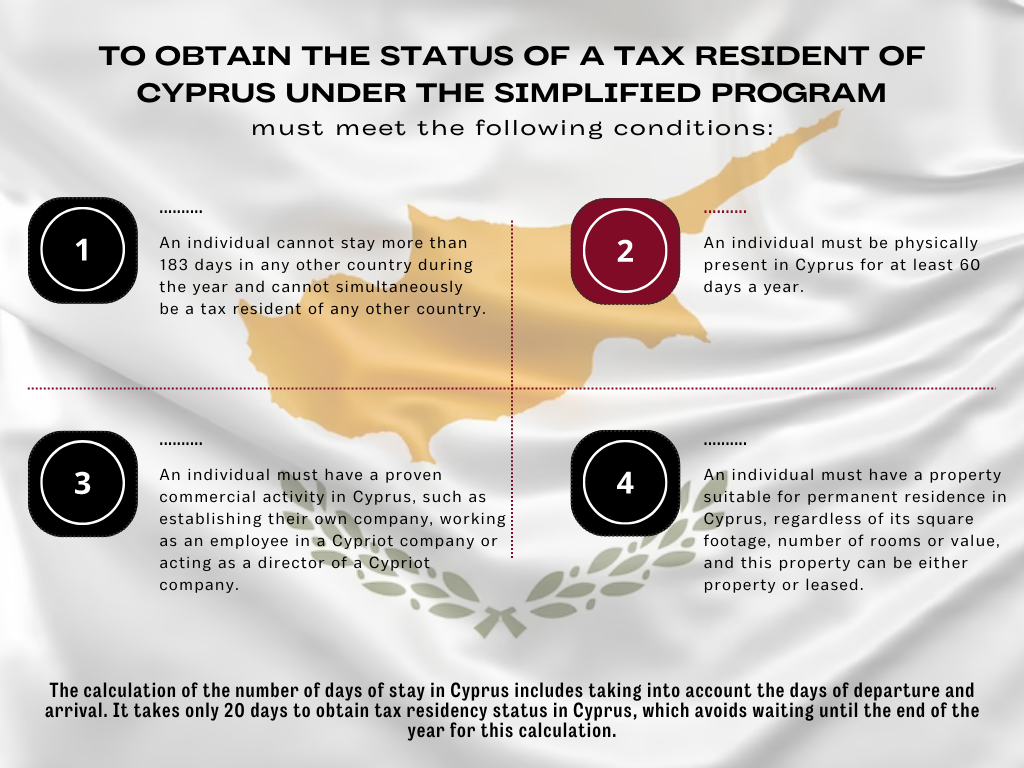

Cyprus is interesting in that, in addition to standard approaches to determining tax residency (in particular, a test for 183 days a year), since 2017 there has been a program that allows you to acquire tax resident status on a preferential basis, staying only 60 days a year in Cyprus. At the same time, tax residents of Cyprus enjoy a number of tax advantages, which will be discussed below.

Dear visitor, the full text of this article is available only in Ukrainian and Russian versions.

If You are interested in this issue and You want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law firm

Cyprus is interesting in that, in addition to standard approaches to determining tax residency (in particular, a test for 183 days a year), since 2017 there has been a program that allows you to acquire tax resident status on a preferential basis, staying only 60 days a year in Cyprus. At the same time, tax residents of Cyprus enjoy a number of tax advantages, which will be discussed below.

Dear visitor, the full text of this article is available only in Ukrainian and Russian versions.

If You are interested in this issue and You want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law firm

Our clients