Liability of the members of the Limited Liability Company for its obligations

Cost of services:

Reviews of our Clients

Establishing a Limited Liability Company (LLC) is a strategic move for entrepreneurs seeking to ensure flexibility for their business and protection from personal financial risks. This step, however, also brings the necessity to comprehend the responsibilities borne by LLC members regarding the company's obligations. Our clients frequently inquire about several key issues:

- What responsibilities does a company founder have, and what is included in the scope of an LLC director's duties?

- What consequences do company leaders face for failing to fulfill their responsibilities?

- How can one protect themselves from legal violations while holding a managerial position in a company?

In this article, we'll tackle these significant questions and illustrate how our legal firm can be your dependable ally in protecting you as a director and fostering the growth of your enterprise. Our team, with years of experience, provides a broad spectrum of business services, from company registration to optimizing organizational processes. We have a deep understanding of how to build a sturdy and prosperous business structure.

You may also like: The Legality and Compliance of Managing a Company (Enterprise) as an Owner Rather Than a Director

Key Features of a Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a preferred organizational structure among entrepreneurs, favored for its inherent flexibility and the limited personal liability it offers its members. Let's delve into the defining features of an LLC:

- Legal Autonomy: An LLC is an independent legal entity, possessing its own charter, bank accounts, and the authority to conduct transactions in its own name. This attribute effectively separates the company’s assets and liabilities from those of its individual members.

- Simplified Establishment and Management: Setting up an LLC is comparatively easier than other business structures. Moreover, the company's internal management can be flexibly arranged through its charter, allowing adjustments to suit specific business requirements.

- Ownership by Multiple Individuals: An LLC can have several members, facilitating opportunities for joint ownership and collaborative business management.

Comprehending these key features is vital for entrepreneurs considering the establishment of an LLC. Our legal firm is equipped to offer guidance and support in utilizing the advantages of this business structure to their fullest.

You may also like: A Guide to Registering a Limited Liability Company (LLC)

Differentiating Between the Legal Entity and Individual LLC Members

One of the significant characteristics of a Limited Liability Company is the distinct separation between the legal entity (the company itself) and its individual members (the shareholders). This distinction is crucial in several respects:

- Members of an LLC are not personally liable for the company’s debts. Their financial commitment is limited to their capital contributions. This ensures that the personal assets of the members are protected from the company's liabilities.

- The company's profits are distributed among the members based on their share of the capital. Similarly, any losses incurred are proportionally borne by the members.

- Personal assets of the members, like vehicles or real estate, are not considered part of the company's assets and hence are not subject to seizure for the company’s debts.

This clear separation between the company and its members offers a greater degree of protection, encouraging participation in business ventures without risking significant personal assets. Our legal firm is prepared to provide consultations on optimizing an LLC structure to align with your specific needs and business strategies.

Responsibilities of an LLC Founder

The role of a founder in a Limited Liability Company (LLC) is characterized by specific duties and actions essential for establishing and managing the company.

The founder (or founders) of an LLC bears crucial responsibility for accurately setting up the company, including:

- Defining the share capital;

- Drafting the company charter;

- Completing the company registration and so forth.

Any shortcomings in these processes can result in liability for the founder.

The founder must adhere to all relevant laws and the provisions of the LLC's charter. This obligation extends beyond the company's formation to its ongoing management. If the founder violates laws or the charter, they could face legal consequences.

If the founder engages in actions that endanger the company's financial stability, they might be held accountable.

The founder has the right to protect their interests against any infringement by other LLC members. If other members violate the founder's rights or create conditions leading to potential losses, legal protection might be afforded to the founder.

Understanding these aspects is crucial for LLC founders to avoid legal issues and ensure the stable and efficient operation of the company. Our legal firm offers consultation and assistance in maintaining the proper relationship between the founders and the company and in managing the legal aspects of their activities.

Role and Responsibilities of an LLC Director

The director of a Limited Liability Company (LLC) is integral to the company's management and fulfillment of its obligations. Their responsibilities encompass a broad spectrum of duties:

- The director must uphold the duties stipulated in the LLC's charter and act in the company's best interest. This includes making decisions aligned with corporate goals and legal standards.

- They are required to keep LLC members informed about key operational aspects and to protect their interests. Failure to fulfill these duties could result in accountability to the members.

- The director bears financial responsibility for the proper financial management of the company. Mismanagement or violation of financial discipline could lead to their liability.

In certain scenarios, if the director's actions cause financial harm to the company or violate laws, their liability could extend to personal assets. This could include cases like bankruptcy, tax evasion, or other serious violations.

Ensuring the company's activities are compliant with all applicable laws is a critical duty. Non-compliance could lead to legal problems and the director's liability.

Legal Support for Successful Business Management

With limited liability being a significant advantage of an LLC, correct management and adherence to legal norms are key to maintaining this protection. Our legal firm is ready to become your reliable partner in this process, helping you navigate legal complexities and ensuring the successful operation of your LLC.

Specifically, we can:

- Offer consultation on managing your business's legal aspects, including LLC members' liability under current laws.

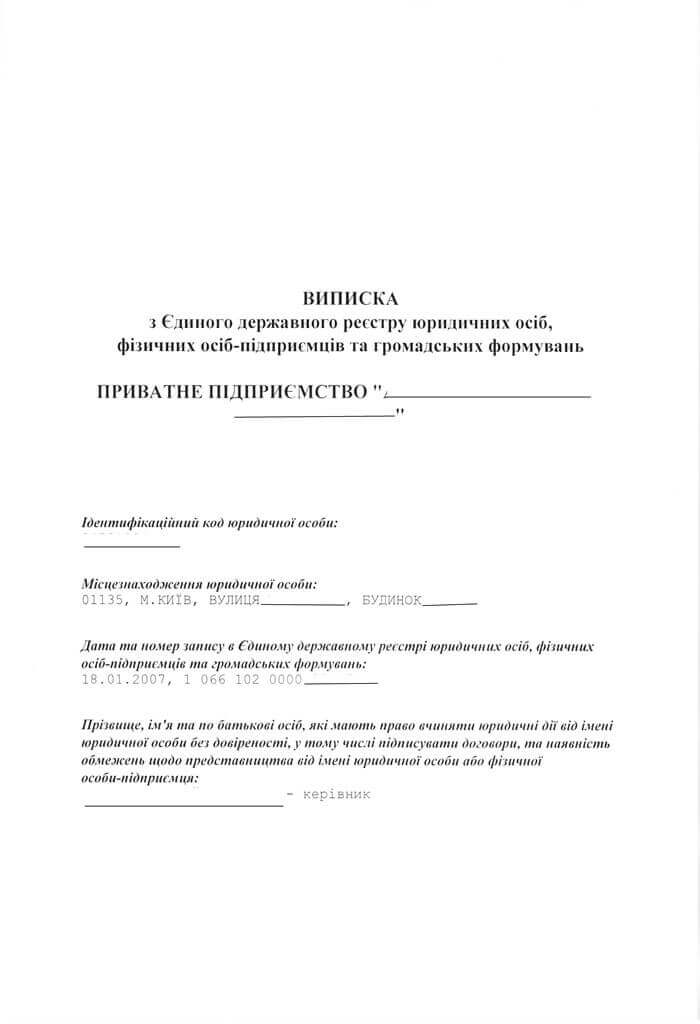

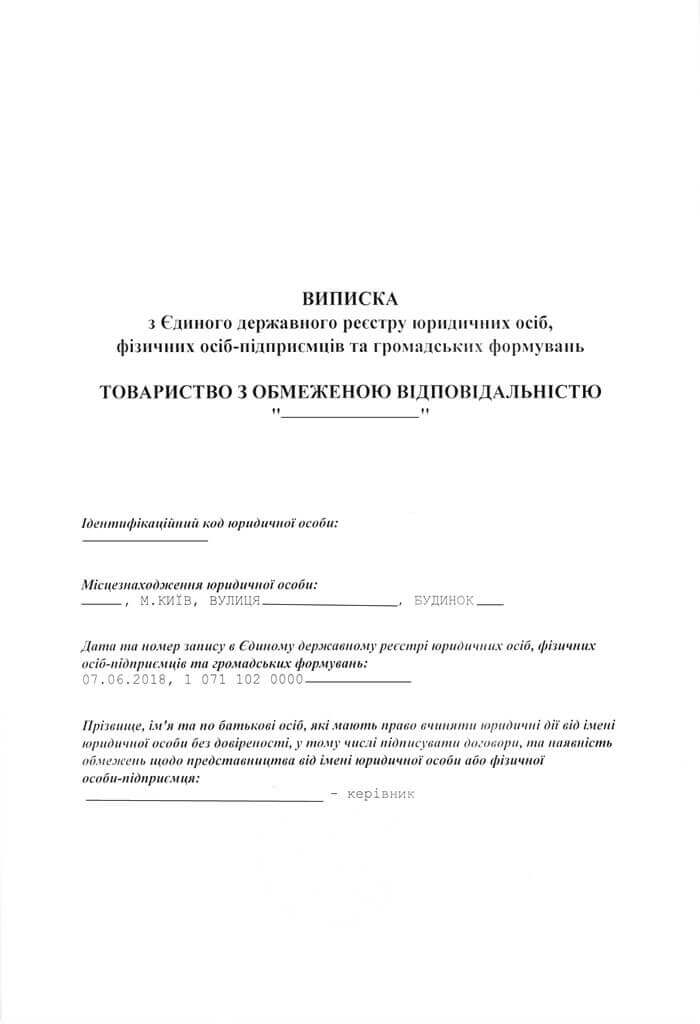

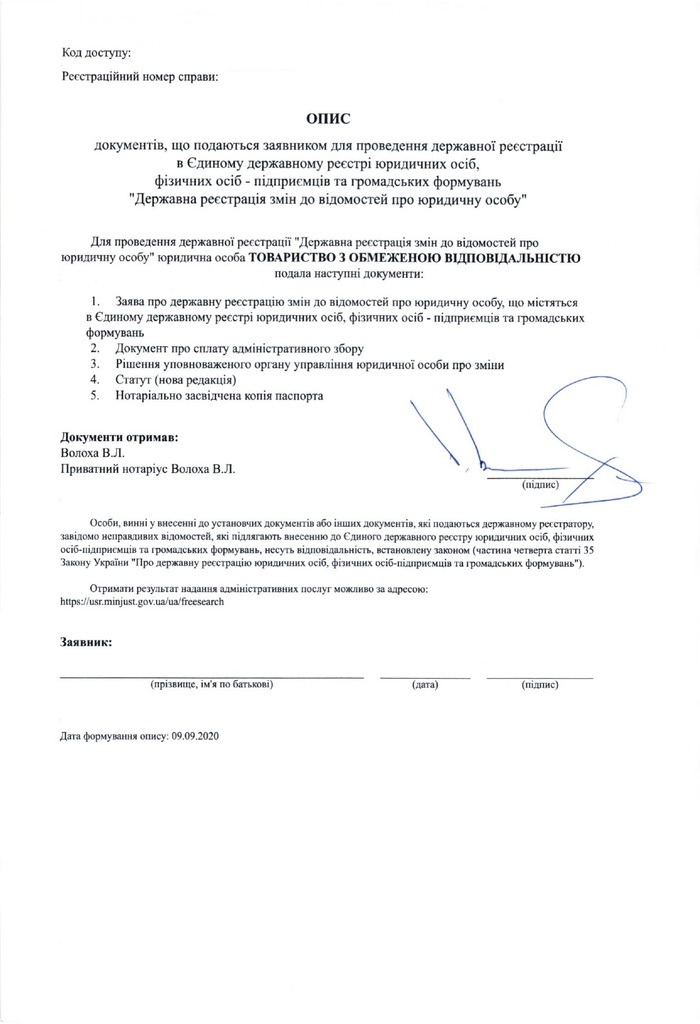

- Assist with document preparation and LLC registration.

- Develop and customize LLC founding documents to suit your needs.

- Review agreements for legal compliance and offer legal protection when necessary.

- Create strategies for optimizing your LLC's tax obligations.

Entrust your business to our legal experts, and we will ensure the protection of your interests and the prosperous development of your company.

Learn more about our business support services here.