Practice of Filing CFC Reports in Ukraine in 2024: Challenges, Tax Authority Clarifications, and Trends

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The introduction of mandatory reporting for Controlled Foreign Companies (CFCs) in Ukraine in 2024 presented a new challenge for taxpayers with foreign assets. This requirement demanded that Ukrainian residents, both individuals and legal entities, engage in thorough preparation and understand the new legal and tax obligations.

In this article, we will explore the CFC reporting process, the main difficulties faced by taxpayers, and the trends and clarifications provided by tax authorities that helped clarify contentious issues.

You might also like: How to Submit a Notification for a Controlled Foreign Company in Ukraine?

Key Requirements and Legislative Changes on CFCs

Since 2022, Ukrainian legislation has required residents who own foreign companies to submit reports on the financial performance of these companies and pay taxes on their profits. The reporting obligation applies to:

- Direct or indirect owners of CFCs, if their ownership share exceeds 50% or 10% (when the total share of Ukrainian residents in the company exceeds 50%);

- Individuals who have actual control over foreign companies, even without formal ownership.

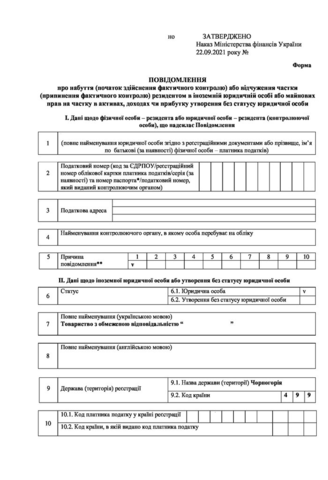

A key aspect of the reporting campaign was the requirement to submit notifications within 60 days of gaining control over a CFC or changing the ownership structure. These notifications had to be submitted before the CFC report to avoid penalties for failure to submit the notification.

Thus, in 2024, the following submissions were required: the CFC report for 2022 (which must be a full report);

*The option to submit a shortened report for 2022 was no longer legally available. Those who submitted shortened reports for 2022 in 2023 were required to submit full reports in 2024.

For 2023, a shortened report could be submitted, provided the full report for 2023 is filed by the end of 2024. A crucial point: to qualify for submitting a full report for 2023 with an extension, taxpayers must ensure that the financial statements for the foreign entity were prepared (signed and submitted) after the deadline for submitting the CFC report in Ukraine. In other words, the preparation date must be after May 1, 2024.

Reporting Practice: Key Stages and Challenges

1. Data collection and report preparation. To submit a CFC report, a resident must collect data on the ownership structure, profits, expenses, and assets of the foreign company. This proved to be a challenging task for owners, especially if the CFC is located in a jurisdiction where tax legislation or accounting systems differ from Ukrainian standards. Companies that use accounting systems different from international financial reporting standards often required additional efforts to adapt the data to comply with Ukrainian legislation. During the preparation of financial statements, several questions arose, such as:

- Whether the report needs to be translated into Ukrainian;

- Whether a signed copy of the report is required, how this can be arranged if the director is a non-resident, and other issues.

These may seem like technical issues. However, failure to comply with the "formal" requirements could lead to the rejection of the reports. As a result, an agreement was reached with the tax authorities that: financial statements may be submitted in the language in which they are prepared (without the need for mandatory translation); they do not need to be apostilled; notarization is not necessary if you have a color scan that can be accepted as the original, but if you only have a copy (black and white), it will be sufficient to have it certified by the controller's E-signature.

2. Issues with determining actual control. The distinction between legal and actual control raised many questions among owners of foreign companies. Actual control, defined as the ability to influence a company’s decisions, turned out to be difficult to assess objectively. For example, there were disputed situations where an individual holds a small share in a company (10%) but, as the director, de facto exercises full control over the company’s management.

As a result, clients raised questions about whether the presence of exclusive management powers (or a general power of attorney) would be sufficient to recognize an individual as a controller. This situation is certainly contentious and will depend on the circumstances of each case (the specific powers of the director, etc.).

3. Challenges with submitting notifications on acquisition and change of control. In practice, there were frequent instances where changes occurred in the company structure during the years 2022-2023, but the controllers failed to submit notifications regarding the CFC (because, initially, a moratorium on such notifications was in place in 2022; and later, when the moratorium was lifted, high penalties for non-submission began to be imposed). Additionally, it was not entirely clear which specific penalties would apply for late submission, as the law did not distinguish between "non-submission" and "late submission."

This issue was resolved just before the deadline: had the individual submitted the CFC report first, the tax authorities would have had sufficient grounds to impose a penalty for non-submission (as non-submission occurs when the controlling authority becomes aware of the violation and notifies the taxpayer). Therefore, it was more prudent to first submit the notification (as if we were voluntarily declaring the facts), and then submit the CFC report.

4. Clarifications on taxation of undistributed profit.

The tax on undistributed profit of CFCs was an innovation for Ukrainian residents. During the filing process, numerous practical questions arose, including:

- Whether it is necessary to calculate the adjusted profit (line 25) if the CFC’s profit is negative, or if the income is positive, but the profit is negative;

- What basis for tax exemption should be selected if the taxpayer is entitled to exemption under multiple grounds;

- Whether subsidiary companies should be listed if no dividends were paid;

- Whether it is required to fill out lines 31, 32, and 33 (on transactions with related companies and companies listed under Transfer Pricing Rules in Article 39 of the Tax Code) if the CFC’s profit is exempt from taxation in Ukraine, and what would be the consequences of failing to complete these lines;

- What qualifies as a “transaction” for the purposes of lines 31, 32, and 33: signing a contract, a bank account transaction, or other actions?

The State Tax Service of Ukraine, in its informational letter No. 3/2024, responded to numerous questions related to the practical aspects of CFC (Controlled Foreign Company) reporting. Unfortunately, this letter was issued just a few days before May 1, 2024, and taxpayers were forced to urgently make adjustments to the drafts of their declarations or submit new reporting declarations (for those who had already submitted CFC reports by that time).

*The new reporting declaration differs from an amendment in that an amendment is submitted after the deadline for submitting the report, whereas the new reporting declaration is submitted before the deadline for submitting the CFC report.

For instance, the informational letter clarified whether CFC reports should be submitted by individuals who left Ukraine due to the war. If an individual was a resident of Ukraine during the period for which the CFC report is being submitted and acted as a controlling person, they are required to submit the report, even if, by the time of submission, they have already changed their tax residency and become a resident of another country.

It was also clarified whether it is mandatory to submit an asset declaration on income if such a declaration was previously not required (in particular, due to all income being received through a tax agent). The Tax Service clarified that, yes, it is mandatory to submit even in this situation. Additionally, the following must be done: 1) complete the CFC Appendices (which are attachments to the declaration) and 2) separately add the completed CFC reports.

Another question raised before the tax service was whether, if there are uncovered losses from previous years (before January 1, 2022) in the CFC's balance sheets, but the company showed a profit for the current reporting period, these old losses can be used to reduce the adjusted CFC profit. The tax service responded negatively. The first reporting year for CFC reporting purposes is 2022 (or a period starting in 2022, if it does not coincide with the calendar year).

The controlling person must calculate the adjusted CFC profit solely based on the financial statements for the reporting period, as stipulated in paragraph 39-2.2 of the Tax Code. If the CFC demonstrates a loss for the reporting year, this loss can be carried forward to future periods, but only to reduce the profit of the same company in the future. However, losses accumulated before 2022 are not taken into account when calculating the adjusted profit for the current period.

You might also like: Ukrainian Tax Residency and CFCs: Tax Optimization for International Business

Does the Cancellation of CFC Penalties Abolish the Obligation to Submit CFC Reports?

The cancellation of penalties for violations in the reporting of controlled foreign companies (CFCs) in Ukraine has sparked interest among taxpayers, particularly those owning foreign assets. Many residents have perceived the cancellation of these penalties as an opportunity to forgo submitting CFC reports, believing that in the absence of penalties, their reporting obligations could be postponed or even nullified. However, this is a misconception that could lead to serious consequences. The cancellation of penalties is temporary and does not relieve taxpayers from the obligations established by tax legislation.

According to the Ukrainian Tax Code, residents who have control over foreign companies are required to submit a CFC profit report and report any changes in the ownership structure. Failure to submit CFC reports, even during the temporary suspension of penalties, is considered a violation and may lead to future tax risks. It is important to understand that even if penalties are not imposed at this time, the tax authorities retain the right to conduct an inspection at any point and, if violations are discovered, hold the taxpayer accountable.

You might also like: What is the Difference Between a Notification and a Report on CFCs? What Needs to Be Submitted Now?

Key Considerations When Preparing CFC Reporting in Ukraine

The first CFC declaration campaigns in Ukraine demonstrated that the system is still in the process of development, and taxpayers require time to adapt to the new requirements. The experience of 2024 revealed that, despite the support and clarifications provided by the tax authorities, a number of issues remain challenging for practical implementation.

It should be noted that by the end of 2024, Ukrainian taxpayers are obligated to submit full reports on controlled foreign companies (CFCs) for the year 2023. This process includes the preparation and submission of reports on the financial indicators of CFCs, as well as calculations of the adjusted profit subject to taxation in Ukraine.

Even though the reporting rules have been in effect for the second year, they remain complex for many taxpayers, particularly in cases involving intricate ownership structures or when adapting foreign reporting to Ukrainian requirements. The anticipation of audits by tax authorities makes compliance with the requirements especially critical, as deficiencies in reports may lead to penalties and sanctions in the future.

In this process, we offer a full range of services to simplify compliance with all requirements. Our specialists will provide consultations on all stages of report preparation, from analyzing the CFC structure to drafting declarations and submitting them electronically. We will assist clients in adapting the financial reporting of foreign companies to Ukrainian standards, calculate the adjusted profit, and provide support in documenting actual control.

Do not delay resolving important tax matters. Contact us for consultation and support for your company under Ukrainian legislation!

The cost of services for submitting a notification or CFC report can be found here.

Our clients