Payment of taxes by residents of Ukraine abroad

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

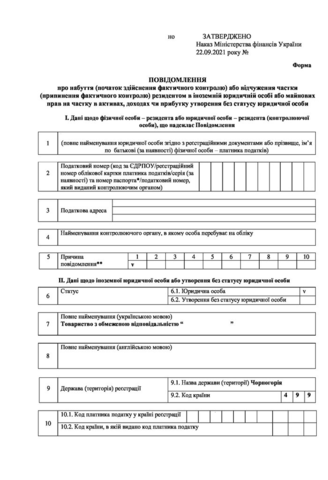

In September 2024, an international exchange of tax information will take place under the Common Reporting Standard (CRS), in which Ukraine will participate as a full member. This global initiative aims to enhance transparency and combat tax evasion. However, this exchange will affect not only large businesses but also many ordinary Ukrainians who have moved abroad or hold financial assets in foreign countries.

Dear visitor,

the full text of this article is available only in Ukrainian and Russian versions. If you are interested in this issue and you want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law company.

Our clients