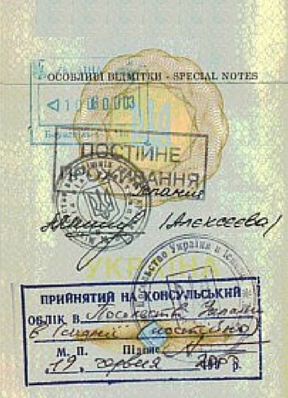

Permanent Departure from Ukraine: How to Confirm Loss of Tax Residency

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

The number of Ukrainians relocating abroad for the long term or permanently continues to grow. However, while packing their suitcases, many forget about the “invisible baggage” that remains in Ukraine — tax residency.

The consequences of ignoring this issue become apparent when the automatic exchange of tax information (CRS) comes into play. Without an official exit from Ukrainian tax residency, you may face worldwide income taxation, fines, bank account blocks, and questions regarding the source of your funds.

Dear visitor,

the full text of this article is available only in Ukrainian and Russian versions. If you are interested in this issue and you want to get a paid consultation on the topic - contact us via the forms of communication, by phone or through any other convenient way.

With all respects,

Team of "Pravova dopomoga" law company

Our clients