Accounting support when a business enters the market: our practical experience.

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

When a new enterprise enters the market, it seems that you can ignore the accounting service - they say that the volumes are not large, I can handle it myself. This is the biggest misconception.

It is important to select competent specialists at the very start of your business, who will help and guide, advice and monitor the correct and timely submission of documents. In addition, the legislation is changing, and the forms and procedures for the submission of documents are changing as well. All this must be constantly monitored to ensure proper accounting of business.

Today we will talk about what accounting support usually consists of when a business enters the market and what it’s worth considering in the process.

You may also like: Accounting For A Sole Proprietorship In 2021: News

What accounting-related questions most often arise at the start of a business?

At the start of the business, one may face a lot of questions, including:

- What taxation system to choose?

- Will all market participants be able to sell their goods/services?

- What documents do I have to register when starting a business?

- Which permits do I need?

- Where should I apply and what are the time limits?

- In what form should reports be kept and submitted?

This is just the tip of the iceberg and a small part of the questions that we hear from our Clients. Needless to say about the cases, when all permissions and certificates have been obtained, but deadlines for submitting reports and paying taxes have been missed. Here, you are charged with the first fines.

Let’s talk about the case from our practice. We were contacted by a sole proprietor, who by that time had already registered and paid the initial taxes. The sole proprietor made some pauses in its business activity, during which he simply forgot to pay taxes, as well as submit reports. Due to late payment of taxes and submission of reports, he was removed from the single tax group, and knew nothing about this. Accordingly, the sole proprietor had to pay another amounts of taxes and submit completely different reports.

When he asked us for accounting support, the situation was deplorable. We helped to make correcting reports, letters for accepting taxes, calculate taxes correctly and define fines. Did you know that if you personally impose the fines, they are significantly lower than those of the inspection bodies?

This case demonstrates the importance of continuous accounting and development of the initial strategy of your business.

You may also like: Source Documents Of Sole Proprietors In Ukraine

Obtaining the required documents

Once you have decided on your market entry strategy, you will need to obtain permit documents. Of course, all documentation will depend on the type of your business and strategy.

Here are some examples of what an accountant can advise you on. We give only some examples, because it is impossible to elaborate on the nuances of all business models within one material. If you have any questions or would like to get information concerning your business scheme, don’t hesitate to contact us.

For example, you are a retailer and you plan to work with a cash payments. In most cases, you will need to register a cash register. The algorithm for working with it, regardless of whether you have a hardware or software-based cash register, is as follows:

- It must be duly registered;

- You must conclude an agreement for the maintenance of hardware-based cash register;

- You shall submit an application to the tax office for the cash register registration;

- You must obtain a certificate of reservation of the cash register number, and on the basis of this certificate, introduce it with fiscal memory and seal the device;

- After the launch of the cash register, you must submit daily and monthly cash register “internal” reports to the tax authorities.

If you want to trade in excisable goods, you must take into account the mandatory minimum prices and submit monthly reports.

Registration of employees. It applies to anyone who is going to hire employees. You should keep in mind the mandatory submission of your employment report. It shall be filed before the employee starts working.

Accounting policy. This is also a quite broad issue concerning most business activities. It is important to correctly create an order on accounting policy, to establish a structure for accounting of income and expenditures. You must correctly allocate the costs to form the net cost of goods/services, because in addition to direct costs, there are also fixed costs (rent, salary, etc.).

Tax optimization of foreign business in Ukraine. It is, in fact, a whole separate block of questions and frequently arising problems, which require more than one material to be properly scrutinized. In general, non-residents usually use the accounting outsource services in order to understand all the nuances of registration of documents and services necessary to start a business.

It is necessary to choose correctly the form of the foreign representative office, register current accounts in the bank, get the necessary electronic keys. Besides, it is necessary to decide on the type of taxation schemes that non-resident can apply for and learn about the legal restrictions.

You should study these and other nuances before starting your business.

We will help you understand all the peculiarities of your activity, the specifics of the business and choose the best accounting support.

If you want to provide your business with quality accounting and direct personal forces to the development of your business, don’t hesitate to call us.

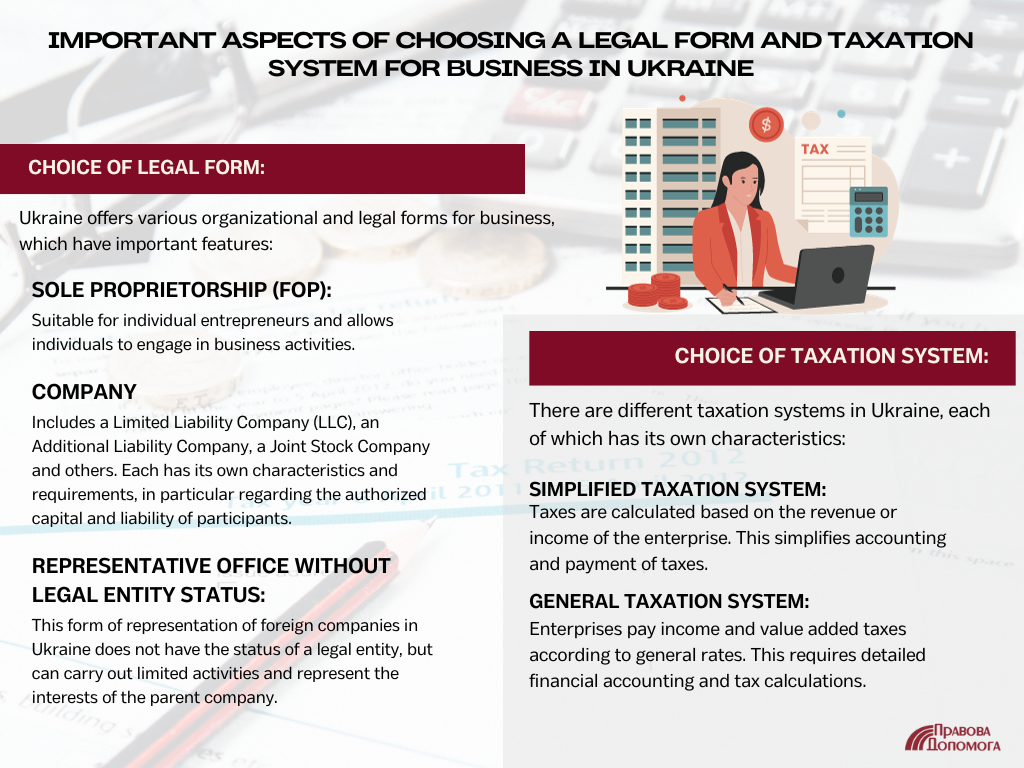

Choosing an organizational and legal form, as well as the tax system for a business in Ukraine

When starting a business in Ukraine, one of the first legal questions you'll need to address is choosing the right organizational and legal form, as well as the appropriate tax system. After all, nobody wants to pay more taxes than necessary.

These decisions are often intertwined and require the expertise of a knowledgeable lawyer to navigate. Furthermore, it's important to have ongoing legal support for your business, not just at the outset, and we'll provide you with 15 compelling reasons why.

1) Choosing the right organizational and legal form

You have several options for the organizational and legal structure, including:

- Sole proprietorship: This is when an individual registers as an entrepreneur under Ukrainian law (Физическое лицо предприниматель).

- Legal entity: This includes various forms such as Limited Liability Company (LLC), Additional Liability Company, and Joint-Stock Company, as well as charitable and public organizations.

- Representative office without legal entity status: This refers to a representation of a foreign non-governmental organization, a branch of a foreign charitable foundation, a representation of a foreign economic entity, or separate units of legal entities.

The most common options for starting a business in Ukraine are sole proprietorship and LLC. Below, we've highlighted some criteria to consider when it comes to servicing LLCs, sole proprietors, and representative offices.

|

Criterion |

Individual Entrepreneur |

LLC |

Representative Office |

|

|

1 |

Asset formation |

Assets belong to an individual |

Assets are formed through contributions from participants |

The representative office acts on behalf of and for the account of the parent organization, accordingly the assets of the representative office are the property of the parent organization. |

|

2 |

Liability to creditors |

An individual is liable with their property |

The members of the LLC are liable to the company within the scope of their contributions to the authorized capital. The company is solely responsible to creditors. |

The non-resident bears the responsibility to creditors. |

|

3 |

Tax system |

The individual may be classified as a payer of the simplified tax system (groups 1-4), an income tax payer, or a VAT payer. |

Unified tax – groups 3 and 4 Income tax payer VAT payer |

Income tax payer VAT payer |

|

4 |

Restrictions for the organizational and legal form |

The restrictions apply to cases where legislation establishes requirements for the organizational and legal form, such as during the registration of banks, financial institutions |

LLC can engage in almost any type of activity, except for those activities for which another organizational and legal form is established by law (such as banking institutions) |

Any activity, permit, or license that is intended for legal entities is not applicable to the representative office. |

|

5 |

The difficulty of establishing or making changes |

Opening the business is relatively straightforward, with only minor challenges. The key is to select the right tax system, and making any necessary changes is generally uncomplicated |

Development of documents and registration of an LLC. |

The registration and amendment process requires careful preparation. Not recommended without proper preparation. |

|

6 |

Maintenance |

Needs professional accounting services for financial reporting and tax compliance. Accounting maintenance is a relatively straightforward process. |

Requires the expertise of a qualified accountant for financial reporting and tax compliance. |

Requires the assistance of a qualified accountant to handle financial reporting and tax payments. It is necessary to determine the status of a 'permanent' or 'non-permanent' establishment and register the parent company for accounting purposes. |

|

7 |

Attracting investments |

Not an appealing investment tool |

The most attractive investment instrument. |

Not commonly utilized for attracting investments in practice. |

|

8 |

Legal services |

In most cases, periodic legal services are required |

A functioning organization requires comprehensive legal services |

Requires comprehensive legal services. |

2) Choosing Tax System

|

THE SIMPLIFIED TAXATION SYSTEM (as of 2023) |

||||

|

Criterion |

Individual Entrepreneur of the 1st group |

Individual Entrepreneur of the 2nd group |

Individual Entrepreneur of the 3rd group / LLC of the 3rd group, 3% + VAT or 5% without VAT |

Individual Entrepreneur of the 3rd group, 2% |

|

Suitable for business purposes |

Provision of household services to the public and trading at markets |

Manufacturing and sale of goods, provision of services in the restaurant industry, and offering services to the public, such as coffee shops, small retail stores including online shops, and businesses providing services to the public |

The most optimal form for most businesses. Suitable for small businesses and startups due to income limits. |

Can be used during a state of emergency. Suitable for most types of businesses. |

|

Maximum income limit for 1 calendar year |

167 minimum wages = UAH 1,118,900 |

834 minimum wages = UAH 5,587,800 |

1167 minimum wages = UAH 7,818,900 |

Without limitations |

|

Tax rate |

Unified tax - no more than 10% of the minimum wage (UAH 268.40) and social security tax UAH 1474 |

Unified tax - no more than 20% of the minimum wage amount = UAH 1340 Social security tax – UAH 1474 |

There are two options: 1. 3% of income + 20% VAT. 2. 5% of income, without VAT. Social security tax – UAH 1474 |

2% of income for social security tax – UAH 1474 |

|

The number of employees |

No employees |

No employees |

Without limitations |

Without limitations |

|

Restrictions based on the type of activity |

Only certain types of activities related to trading in the market and providing household services to the population are allowed, according to Article 291.7 of the Tax Code of Ukraine. Other types of activities are not permitted. |

Prohibited activities include intermediary services for real estate transactions, the sale of jewelry and household items made of precious metals and stones, and the provision of services by legal entities under the general system, as per Article 291.7 of the Tax Code of Ukraine. |

Types of activities, excluding the restrictions set by the Tax Code of Ukraine. |

Any type of activities, except for the limitations as specified in the law; applicable to both individuals and legal entities who are non-residents. |

|

Reporting |

Annual declaration for the Unified Tax – due by March 1st |

Annual declaration for Unified Tax (in Russia) until March 1st. If there are hired employees – report on employees. |

Quarterly declaration for Unified Tax. Declaration for VAT. If there are hired employees – corresponding reporting. |

Monthly declarations for the Unified Tax. If there are hired employees – corresponding reporting. |

|

Tax payment deadline |

Unified Tax – by the 20th day of the current month Single Social Contribution – by the 20th day of the month following the quarter. |

Unified Tax – by the 20th day of the current month Single Social Contribution – by the 20th day of the month following the quarter Payment of personal income tax, single social contribution, and military tax for employees – monthly. |

Unified Tax – within 10 days after the deadline for submitting the declaration. Single Social Contribution – by the 20th day of the month following the quarter Payment of personal income tax, single social contribution, and military tax for employees – monthly. |

Unified Tax – within 10 days after the deadline for submitting the declaration. Single Social Contribution – UAH 1,774. Payment of personal income tax, single social contribution, and military tax for employees – monthly. |

The simplified taxation system can be applied to most business sectors in Ukraine. However, it's important to consult with a lawyer before choosing a taxation system:

- There are turnover limits for each group (except for Group 3 at 2%), exceeding which may result in penalty sanctions and loss of the right to use the simplified system.

- Group 3 at 2% is only applicable during periods of martial law, and after martial law ends, businesses will revert to their previous taxation system. This may not always be beneficial for import and export operations.

- There are also restrictions on certain types of activities for each group under the simplified system.

- There are other limitations, such as prohibited barter operations, which need to be understood to avoid penalties.

For businesses under the general taxation system, specific criteria apply:

|

Criterion |

Individual Entrepreneur |

LLC |

|

Tax rates |

Personal Income Tax at 18% of the profit. Military Fee at 1.5% of the profit. Single Social Contribution at 1474 UAH per month. |

Corporate Income Tax at a rate of 18% of the profit, and other taxes that may arise |

|

Types of activity |

Without limitations |

Without limitations |

|

Tax payment deadlines |

Personal Income Tax and Military Fee are due by the 20th day of the month following the end of the quarter. Single Social Contribution is due by the 20th day of the month following the end of the quarter. |

Personal Income Tax is determined by the legislation. The deadlines for other taxes and fees are also set by the legislation. |

|

The use of Cash Register Equipment/Simplified Cash Register Equipment |

The use of Cash Register Equipment/Simplified Cash Register Equipment is mandatory, except for cases specifically exempted by law |

The use of Cash Register Equipment/Simplified Cash Register Equipment is mandatory, except for cases specifically exempted by law |

|

VAT |

If the income exceeds UAH 1 million within the last 12 months, it is mandatory to transition to the VAT system. |

|

The general system is applicable in the following scenarios:

- When it makes business sense to opt for the general system.

- When the activity is prohibited under the simplified system.

- When licenses need to be obtained or activities need to be carried out that are not covered by the simplified system.

- In other similar cases.

It is crucial not only to understand the differences, but also to thoroughly analyze your specific business, activities, counterparties, and the need for various types of contracts in order to choose the most optimal tax scheme and stick with it as long as it benefits your business. Our team of experts specializes in precisely these tasks.

Legal assistance when entering the Ukrainian market

Running any business comes with legal complexities that require the attention and expertise of a lawyer. Here are 15 compelling reasons why legal services are essential for your business:

|

No. |

Arguments |

Our cases |

|

1 |

Contractual work |

|

|

2 |

Corporate matters |

|

|

3 |

Consultation services |

Offering comprehensive consultations on legal compliance and regulatory matters. |

|

4 |

Tax planning and structuring |

Providing guidance on optimizing tax strategies and selecting the most advantageous taxation system. |

|

5 |

Intellectual property management |

Offering assistance with intellectual property transactions, including licensing, acquisition, management, and registration. |

|

6 |

Foreign workers' employment and obtaining permits for foreigners |

If you are hiring a foreign worker or setting up a business as a foreigner, it's important to obtain a work permit, taxpayer identification number, and, if needed, a temporary residence permit for staying in Ukraine. |

|

7 |

Acquiring regulatory permits |

Some specific business activities may require permits or licenses. Our company specializes in assisting with obtaining these necessary documents. |

|

8 |

Information and security |

Protecting business information, ensuring confidentiality, and managing personal data in compliance with regulations. |

|

9 |

Resolution of disputes through pretrial negotiations |

It's often best to resolve disputes through out-of-court negotiations for a mutually agreeable settlement. |

|

10 |

Assistance with inspections and audits |

Assisting with regulatory inspections, including active participation in the inspection process, and appealing inspection results through administrative channels. |

|

11 |

Real estate |

Real estate rental, property buying and selling, and property management services. |

|

12 |

Personnel issues |

Handling employee-related matters, including leaves, terminations, transfers, and other HR issues, as well as maintaining personnel records. |

|

13 |

Representation of interests in court |

Sometimes, businesses need to protect their rights and interests through legal litigation. Our team offers expert and practical legal assistance in handling court cases. |

|

14 |

Conducting due diligence on business partners |

Before partnering with a business, it's important to assess potential risks. We offer comprehensive due diligence checks to help you make informed decisions. |

|

15 |

Handling inquiries and requests |

During business operations, you may receive inquiries or requests from individuals, legal entities, government bodies, or local authorities. |

When you choose to work with us, you'll receive comprehensive legal support for all the issues mentioned. No need to search for multiple lawyers for different legal matters or worry about the quality and outcomes of the legal services provided.

Our clients