Registration of a charitable foundation in Ukraine

Cost of services

Reviews of our Clients

What we offer

-

Advise the Client on choosing the best form of charitable organization according to its needs;

-

Develop a full package of documents for registration, including the charitable organization’s charter, and send it to the Client for approval;

-

Register the charitable foundation with the relevant state authorities;

-

If necessary, we assist in the production of a charitable organization seal;

-

Obtain the non-profit status under a separate agreement;

-

Obtain an identification number for foreign founders (if necessary and for a fee) to register the charitable foundation;

-

If necessary, we organize an appointment at the notary to execute a power of attorney for our lawyers.

Documents

What do you need to know about registering a charitable foundation in Ukraine?

Both a Ukrainian and a foreign person can become a founder of a charitable foundation.

In this case one of the most important stages of the charity registration is preparation of documents and development of a personalized charitable foundation charter.

Remember! The Charter template taken from the Internet will not correspond to the purposes of your foundation, but also may be out-of-date and not corresponding to the actual requirements of the Ukrainian legislation.

Our specialists develop all the documents for the registration of the foundation from scratch, which guarantees you:

- A clear stipulation of the purpose, mission and scheme of work of your charitable foundation;

- Possibility to prescribe the desired structure of your charitable foundation’s management bodies. It is important to provide the possible procedure of liquidation of the foundation, the order of accepting members of the foundation;

- Fixing the sources of formation of the foundation’s assets, the procedure of accepting charitable assistance.

All these procedural issues, stipulated before the registration of the foundation, will greatly simplify its work in the future.

You can also buy a ready-made charitable foundation from us.

The period for registration of a charitable foundation

The term of registration of a charitable foundation is 1-2 business days from the date of receipt of a notarial power of attorney and signed constituent documents from the Client.

The term for entering the foundation into the register of non-profit organizations is 3 business days from the moment of its registration (assignment of the EDRPOU code). Production of the paper code and its signing by the management of the fiscal service usually takes about a week.

Service packages offers

- Advising on the process and nuances of registration

- Preparation of a protocol on the establishment of the Fund

- Preparation of the standard Charter of the Fund

- Organization of signing of power of attorney by the Founders at the notary

- Submission of documents to the registrar

- Obtaining a decision on granting non-profit status

- Advising on the process and nuances of registration

- Preparation of a protocol on the establishment of the BF

- Preparation of the individual Charter of the Fund taking into account the peculiarities of the activity

- Organization of signing of power of attorney by the Founders at the notary

- Submission of documents to the registrar

- Obtaining a decision on granting non-profit status

- Production of the stamp

- English-speaking lawyer (in the presence of a foreign founder)

- Advising on the process and nuances of registration

- Preparation of a protocol on the establishment of the Fund

- Preparation of the Charter of the Fund

- Organization of signing of power of attorney by the Founders at the notary

- Submission of documents to the registrar

- Obtaining a decision on granting non-profit status

- Production of the stamp

- Assistance with instructions in English (foreign founder)

- Obtaining the TIN code for a foreigner

- English-speaking lawyer (in the presence of a foreign founder)

- Nominal head of the Fund for 1 year

- Nominal address for 1 year

- Advising on the process and nuances of registration

- Preparation of a protocol on the establishment of the Fund

- Preparation of the Charter of the Fund

- Organization of signing of power of attorney by the Founders at the notary

- Submission of documents to the registrar

- Production of the press

- Obtaining non-profit status

- Application for a work permit for a foreigner (excluding state payment)

- Employee notification

- Support for opening an account

- Assistance with instructions in English (foreign founder)

How much does it cost to register a charitable foundation in Ukraine?

In the case of partial legal support for the registration of the foundation (e.g., only the development of documents), the cost is formed on the basis of the specific task.

Work on preparation of documents starts after we receive from the Client a hundred percent advance payment.

The cost of our services for registration of a charitable foundation in Kyiv does not include expenses for notarial certification of documents.

At the Client’s request, we can take the decision on the inclusion in the register of non-profit organizations and hand it over to the Client in any way convenient for him/her.

Preparation of Charter and meeting of the founders of the donation fund

To properly prepare all documents, which are needed to register the donation fund, our lawyers help to arrange a meeting of founders, at which the decision to establish a fund shall be made.

In addition, at the meeting the founders shall adopt the creation of the Charter of the donation fund and management bodies of the fund.

When preparing the Charter of the donation fund, you need to take into account the following points:

-

Specify a unique name for the donation fund. We have seen cases where the founders of the donation fund have chosen very unusual names, including obscene language. Find more information about the procedure for registering a fund with a non-standard name here.

-

Specify the purposes of the charitable foundation. All charitable assistance coming to the account of the foundation shall be aimed at achieving the objectives of the foundation (as a non-profit organization), so the objectives and mission of the foundation shall be correctly formulated and initially enshrined in the Charter.

-

Specify the composition and procedure for creating the management bodies of the fund. It is necessary to provide for the procedure of suspension or liquidation of management bodies.

-

The Charter shall also specify the sources of formation of the fund’s assets. We have already written about the risks of reimbursable financial assistance for a charitable foundation here. Our lawyers can advise you on the possible sources of assets, their safety and accounting procedures.

-

The Charter must contain the provisions necessary to obtain a non-profit status.

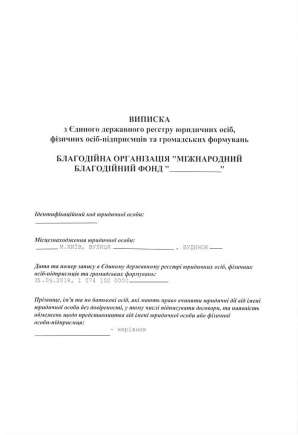

How to register a charitable foundation in Ukraine: documents for registration

If the founder of a charitable organization is a foreign legal entity, you need to provide a properly legalized document, translated into Ukrainian, which confirms the registration of the foreign legal entity in the country where it is registered (you may use our company services for a notarized translation).

We also need information about the name, location, goals and objectives of the organization, the desired management structure (collective or sole executive body).

If the founder of the charity is a foreign physical person, he/she has to get a tax identification code in Ukraine. Our company can help to get a tax identification code for a foreigner.

A complete list of documents for registering a charitable foundation includes:

-

Minutes of the meeting of founders of the foundation;

-

Application for registration of a charitable foundation;

-

Constituent documents of the charity;

-

Documents confirming the identity of the founders of the charitable foundation, you also need to disclose the ownership structure.

A power of attorney shall be also prepared for the representative, if the documents are submitted by a legal representative.

Please note! If there are several founders, a notarial power of attorney must be prepared from each founder.

Registration of an aid foundation with the tax authorities and obtaining a non-profit status

The non-profit status is not automatically assigned to aid foundations or public organizations - in order to obtain it, you have to register with the tax authorities and submit the corresponding application.

Of course, the non-profit status needs to be maintained during the activity of the foundation, which obliges you to take care of the correct organization of the aid foundation accounting.

How to register a charitable foundation with a non-standard name?

Choosing a name for a new organization is a creative process. We want the name to be sound, to reflect the essence and mission of the company. So, the options are sometimes very expressive.

So, we were contacted by a Client who wanted to register a charitable foundation, the name of which would contain a common obscene expression. Of course, documents with such a name failed the inspection of the Ministry of Justice and registration was denied.

We offered to register the foundation with a different name, which is similar to the intended one within the meaning. This helped us to smooth the situation with the Ministry of Justice. So when choosing a name, it is important to understand that not all words are equally acceptable.

How to recognize charitable contributions on the foundation’s account?

A charitable foundation can receive several types of funding: earmarked, unearmarked and passive. We have already told in detail about the types of charity funding here.

The main rule of accounting and distribution of incoming funding is that all expenses of the foundation should be of two types:

-

expenses to fulfill the core mission and purposes of the foundation;

-

expenses for the maintenance of the fund.

Failure to follow this rule will result in the foundation having income and, consequently, losing its non-profit status.

Does a charitable foundation need real estate or a legal address?

If you are thinking about buying or renting premises specifically for the registration of a charitable foundation - you do not have to do this. The law does not require the foundation to have its own real estate. As for the need to provide a legal address for registration - you can just buy it. Our company offers such service along with the registration.

If you are looking for premises for the work of the charitable foundation - as its office or for the activities aimed at achieving the goals and mission of the foundation, you should understand that:

-

the expenses for maintaining such real estate must be documented as the foundation’s expenses aimed at ensuring the operation of the fund;

-

when renting premises, the object shall be specified in the off-balance sheet account 01.

Why us

We can also offer postal service for this address and receiving correspondence.

We are ready to help you!

Contact us by mail [email protected] or by filling out the form:Our successful projects

How to register a charitable organization?

You can create a charity in the form of:

- charitable foundation (may be founded by one person or more, acts on the basis of the charter, the funds of the fund may be formed both at the expense of participants and other benefactors)

- charitable establishment (can be created by one or more founders, acts on the basis of a founding act, founders cannot manage a charitable establishment)

- a benevolent association (created by at least two founders, acts on the basis of the charter).

The vast majority of charitable organizations are created in the form of a foundation.

Amendments to the charter of a charitable organization

In order to change the provisions of the charter of a charitable organization, the members of this organization must vote for it at the general meeting. At the same time, a quorum must be gathered. That is, the number of votes that, according to the organization's charter, have the right to make such a decision.

The general meeting considers the new edition of the charter and approves it. After that, the relevant package of documents, including the new version of the charter and the protocol by which the charter was approved, is submitted to the state registrar (now private notaries can perform their function).

Our team helps with making changes to charitable foundations:

-

Exit from the members of the charity fund

-

Change of head of the charity fund

-

Other changes in the blog fund (name, location, updated version of the charter, etc.).

Procedure for establishing a Children’s Charitable Organization

All charitable organizations are divided into three types only: foundation, society and institution. No other types are envisaged by law. Therefore, if you want to set up a charitable organization to help children, this should be stipulated in the charter of the future organization.

You can also specify the kind of help to be provided:

- Treatment and rehabilitation of sick children;

- Development of talented and gifted children;

- Assistance in implementing advanced technologies in educational institutions, etc.

But you should bear in mind that this will narrow the scope of the organization’s activities, and if you decide to provide assistance not only to children, you will need to amend the organization’s charter and register its new edition.

Answers to frequently asked questions

The availability of the authorized capital in the charity fund is not provided for by applicable law.

Each of the participants (members) of the organization has a single vote. Since the charity fund does not have an authorized capital, and, accordingly, its parts, it is impossible to distribute votes on interest.

According to the current legislation, notarization of statutory documents is not required during the initial registration of the organization, or when making changes.

No, they don’t. You can choose the head of the organization from non-members.

Registration of a charitable foundation (organization) in Ukraine (Kyiv and regions)

Registration of this type of organization consists of the following steps.

Preparation of documents for registration of a charitable foundation.

As soon as the Client makes a final decision about registration actions, we agree on prepayment, cost of our services, terms of registration. As a result, we sign a Legal Services Agreement.

Then we get the necessary information and documents from the Client, after that we put everything in order and prepare documents for submission to the registrar. All documents will be agreed with a Client and registered with local authorities.

As a result, the Client receives all the documents for a registered organization (charity foundation, institution, society) for running charity activity.

If you wish, you may additionally consult a lawyer on administrative expenses, in order to find out what kind of expenses may arise for charitable organizations in the course of their activities.

The founders of a charitable organization can be citizens of Ukraine, citizens of other countries, and legal entities. A charitable foundation may be registered with one founder only.

It is also possible to register a charitable organization (foundation) in Ukraine to the address of residence of the founder or head of the foundation.

Development of the Charity Charter, and submission of documents for the registration of the charitable foundation.

This service includes the development of the foundation’s charter (based on the model charter), minutes of the founding meeting to establish the organization, registration cards and other documents.

Particular attention should be paid to the “Goals and objectives of the foundation” section when drafting the charter. This is extremely important, since it is in this section that it will be defined what exactly the charity will do. Incorrect indication of the directions of its activity will make it impossible to further obtain a non-profit status.

It is also necessary to be attentive to drawing up the section of the charter, which describes the procedure of termination (liquidation) of the foundation. Assets of the foundation upon its liquidation may not be distributed among its founders, and must be transferred to the organization corresponding to its goals and objectives or transferred to the ownership of the state.

Notarization of the founders’ signatures on the charter and minutes of the general meeting of the charitable foundation is not required by the current Ukrainian legislation.

As soon as the registration process in the relevant register is over - we submit necessary documents for receipt of a certificate of inclusion of the foundation into the register of non-profit organizations. We prepare the necessary application, which the Client has to sign.

The final step is obtaining all the finished documents on the registration of the charity.

If you want to register a charity quickly and easily – call us!