Inheritance Tax in Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Receiving an inheritance often raises numerous questions, such as the necessary steps to obtain it, where to seek assistance, the deadlines for processing, and more. Today, we will focus on one aspect related to financial matters when inheriting, specifically understanding tax obligations and the deadlines for payment. Tax issues can be complex and challenging for our clients to navigate. While receiving an inheritance requires paying the necessary taxes, clarity regarding the amount owed and the anticipated outcomes is crucial for everyone involved.

Our streamlined and fully remote procedure aims to simplify the inheritance process, including tax payment facilitated through power of attorney. We are committed to ensuring the security and accuracy of each step, assisting in resolving any document discrepancies and facilitating the smooth transfer of inherited property. With expertise in handling diverse types of assets, including complex scenarios like inheriting corporate rights or locating inherited assets, our team is equipped to provide comprehensive support. We will accurately calculate taxes, offer temporary management solutions for businesses if necessary, and provide robust legal representation to protect your interests in court, as required.

You may also like: Inheriting Real Estate in Ukraine: A Guide for Foreigners

What are the tax implications when inheriting property?

Inheritance in Ukraine is accessible to both Ukrainian citizens and foreigners. Moreover, Ukrainian citizens who have resided outside the country for a long time and have permanently relocated to another country are treated as foreigners for inheritance tax purposes.

Inheritance tax is levied on each item within the estate acquired by the heir. The Ukrainian Tax Code categorizes these items into various groups:

- Real Estate and Land: This includes both residential and commercial properties, as well as land.

- Vehicles: All types of vehicles.

- Art and Jewelry: Items of artistic value and jewelry.

- Securities, Corporate Rights, and Business Ownership: This encompasses securities (except for deposit and mortgage certificates), rights to a business entity, intellectual property, and rights to income from such properties, along with both tangible and intangible rights.

- Monetary Assets: This includes cash in banks, stored in safety deposit boxes, or circulating within companies.

- Insurance Payouts and Pensions: Compensation from insurance companies, money from pension accounts, and deposits from various funds, both state and private, including various social benefits.

These items form the inheritance estate and are taxed based on the following principles:

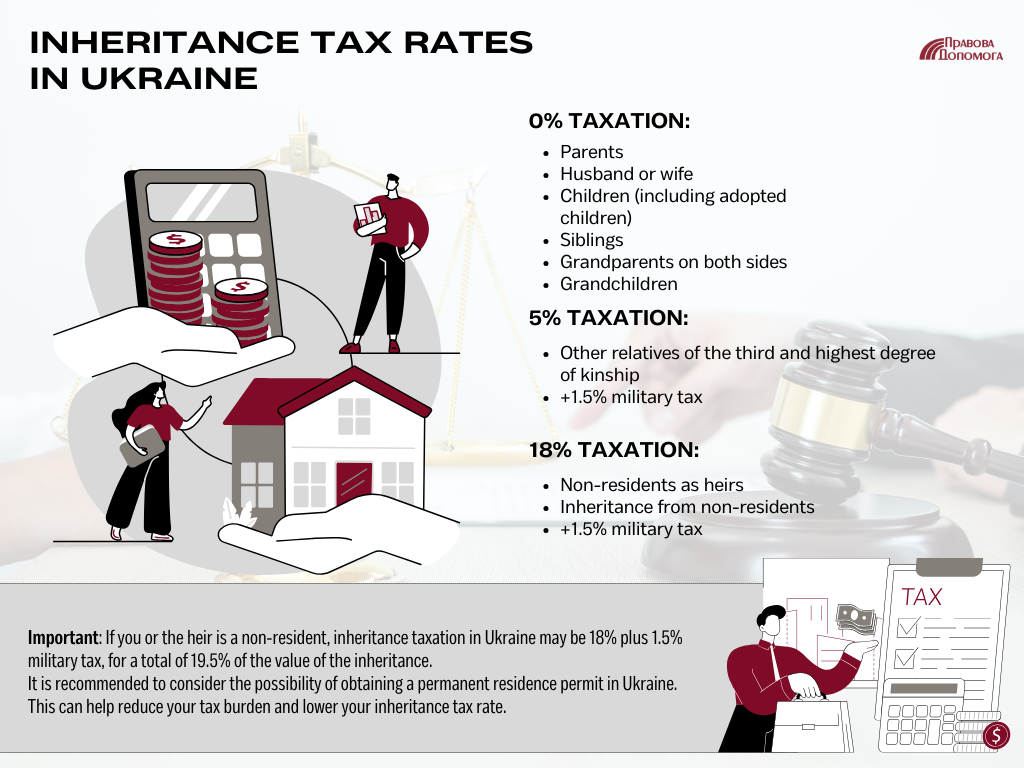

- A 0% tax rate is applied to property inherited by first-degree (parents, spouse, children, including adopted) and second-degree relatives (siblings, maternal and paternal grandparents, grandchildren).

It's crucial to distinguish between 'degree of kinship' and 'order of inheritance' — they are different concepts. For example, a grandchild is considered second-degree kinship but falls into the fifth order of inheritance by law.

Additionally, a 0% rate applies in cases where the heir is a person with a first-degree disability, an orphan, or a child deprived of parental care, as well as for savings deposited before January 2, 1992.

- Property inherited by relatives of the third degree of kinship or beyond is taxed at 5%, with an additional 1.5% military tax.

- An 18% tax rate, plus a 1.5% military tax, applies when the inheritance is by or from a non-resident.

This means that non-residents, or those inheriting from non-residents, should expect to pay a 19.5% tax on the inheritance value. Therefore, non-residents might consider obtaining permanent residence in Ukraine to lessen the tax burden.

It's important to note that inheritance can be claimed indefinitely after it has been opened. For instance, we recently assisted a daughter, the sole heir living abroad, who had retained her Ukrainian citizenship, in renewing her Ukrainian passport and claiming her inheritance. She is currently in the process of transferring the real estate into her name.

You may also like: Inheriting Company and Real Estate in Ukraine by Foreigners

Defining the Value of Property for Inheritance Tax Assessment

The value of property for inheritance purposes is determined through an expert appraisal, but only in cases where taxation occurs. An appraisal of the property is not mandatory for inheritances that are taxed at a zero rate.

For inheritances subject to other tax rates, the following procedures are followed:

- For vehicles, the market valuation or the value stated in the purchase-sale contract is used.

- For all other types of property, an expert appraisal is necessary.

This expert appraisal can be obtained from certified valuation professionals. The appraisal must be current, not exceeding 6 months old. Property valuation adheres to specific standards and rules, making it implausible to appraise real estate at an unrealistically low figure, such as 100 UAH, which could also be legally risky.

Our legal team can recommend experienced valuation experts and will review the documents you obtain to ensure accuracy and compliance.

You may also like: How to Draft an Inheritance Agreement in Ukraine?

The Procedure for Paying Inheritance Taxes

To inherit property with modifications to the relevant registries and issuance of new documents confirming the rights of ownership for the heirs who have a tax obligation, it is mandatory to pay the required taxes properly.

This means, as soon as you begin the process of inheriting property, a tax obligation is established, and the notary will issue you receipts for tax payment. After you have paid these taxes, you provide copies of these receipts to the notary to proceed with the transfer of ownership.

Our legal services include:

- Pre-assessing your tax rates and, if there are opportunities for tax optimization, we will offer you options.

- Providing support in the inheritance process in Ukraine.

- Organizing visits to the notary, translating documents, and handling other technical aspects of the procedure in Ukraine.

- Assisting with the re-registration of property ownership.

The cost of legal services for inheritance matters in Ukraine is available here.

Our clients