The order and procedure for the liquidation of a representative office in Ukraine in 2023

Cost of services:

Reviews of our Clients

There is a list of cases for closing a representative office, but the most common is the liquidation procedure by the decision of a foreign company.

Here is the basic algorithm of actions for carrying out the procedure of liquidation of a foreign representative office in Ukraine.

Attention! We give a simplified plan of your actions. Of course, it will need to be adjusted depending on the specifics of the organization of work processes in your business. You can use this plan as a "cheat sheet" if you intend to terminate your representative office in Ukraine.

How to Terminate a Representative Office in Ukraine?

First, a decision on the closure of the representative office must be made and adopted by the supreme governing body of the foreign company. In this case, the liquidator or liquidation commission is given a power of attorney to carry out the liquidation procedure. When appointing a liquidator or liquidation commission, it is the foreign company that decides on the procedure.

The stage of notifying the creditors of the liquidation procedure includes the analysis of financial documents, independent identification of creditors, sending a message to the creditors so that they could make their claims, and the preparation of the liquidation balance sheet by the liquidator or the liquidation commission.

Regarding the dismissal of employees of the representative office, they must be notified 2 months before the date of dismissal, and the head of the company is dismissed along with an order against signature. Also at this stage, there are certain procedural peculiarities of dismissal of foreign workers and return of their service cards.

Subsequently, an inventory and evaluation of the property should be carried out. This shall be performed by a liquidator or liquidation commission. The results are recorded in tax and accounting records, and an interim liquidation balance sheet is drawn up accordingly.

Closing the bank accounts of a foreign representative office involves carrying out the procedure according to the general procedure. According to the NBU regulation dated 12.11.2003 No. 492, it is necessary to draw up an application in any form, specifying:

- the name of the bank and the client;

- numbers of the account to be closed;

- details of the account to which the balance of the customer's current account is transferred, or the request of an individual to withdraw the balance in cash and the date of the application.

It is also necessary to provide a decision on the liquidation of the representative office. Please note that it is necessary to leave a liquidation account, required to pay the payments.

The next step is de-registration with the tax authorities. It is necessary to send an application according to form No. 8-OPP and pay all fees and payments. The tax authorities accordingly start checking the correctness of their payments and at the same time conduct a documentary check on the correctness of the charging and payment of unified social taxes. As a result, you are provided with certificates of no debts.

You also need to send a notification on the representative office liquidation to the Social Insurance Fund and to the State Customs Service. They will perform inspections and issue a certificate of results.

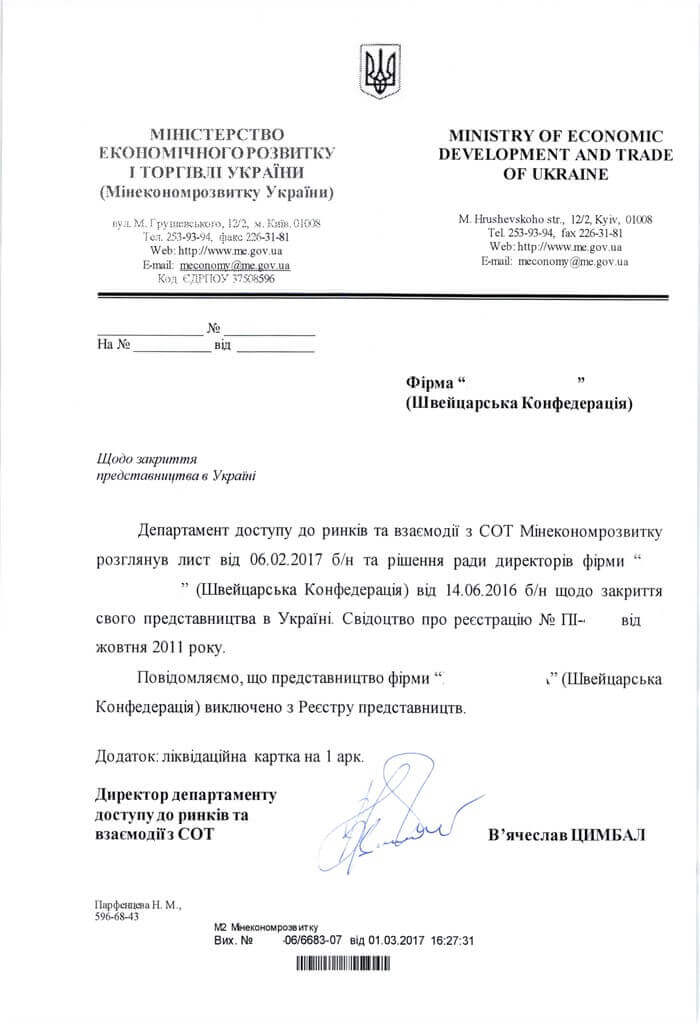

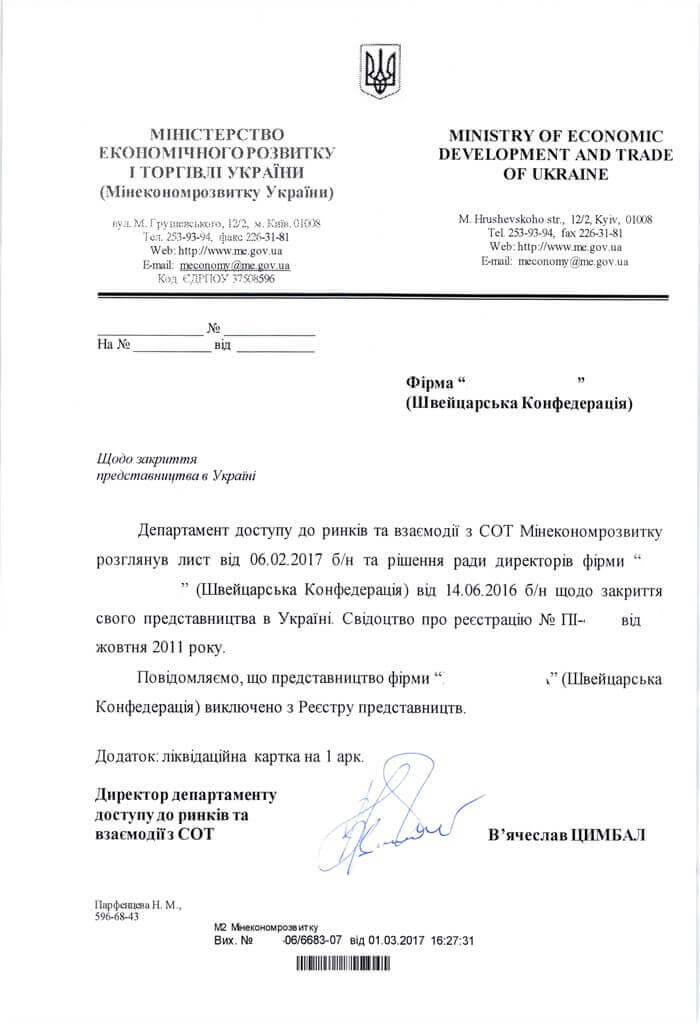

After completing all of the above actions you need to send all documentation to the Ministry of Economy, which cancels the record of the foreign representation in the register of foreign economic entities in Ukraine, as a result of which the applicant receives a written notice of termination of the representative office.

Following the preliminary examination, all documentation is transferred to the National Archive Fund of Ukraine and a registration form on exclusion from the Unified State Register of Legal Entities is submitted to the statistical authority. As a result of each of these procedures, you receive relevant certificates.

The last stage is the destruction of the seals and stamps of the representative office. You can control the procedure yourself and close the liquidation account.

You may also like: Frequently Asked Questions on Liquidation of Representative Office in Ukraine

List of documents for terminating the representative office in Ukraine

- A copy of the document on registration of the legal entity in the country of its location (the document should be translated, notarized and legalized);

- The decision to shut down the representative office, adopted by the supreme governing body of the foreign company;

- Documents certifying the rights of the person signing the documents of the branch on behalf of the parent company translated and legalized;

- A power of attorney for the liquidator or liquidation commission to carry out the liquidation;

- The certificate of registration of the foreign representative office (the original).

- The certificate from the Unified State Register of Legal Entities;

- Certificate 4-ОПП or 30-ОПП, if any;

- Payment documents from the bank;

- Primary accounting and information about the salary;

- Statement or decision of the body entrusted with the termination of the legal entity to close the bank accounts. Additionally, it is necessary to provide the decision on the liquidation of the representative office and the card with the signature of the liquidator and a notarized impression of the seal of the representative office;

- For deregistration with the Pension Fund: the decision of the owner or its authorized body on liquidation; the dispositive document on the creation of the liquidation commission; the dispositive document on termination of independent entrepreneurial activity of a physical person;

- The filled-in application form No.8-ОПП;

- Notification about termination of business activities - an arbitrary form of such notification, which our specialists help to conclude. Calculation of tax liabilities of non-residents and report on withholding and payment of taxes to the budget;

- All reports from funds (Pension Fund, Social Security Fund) and tax authorities;

- Information relating to the officials of the foreign representative office, including such data as full name and details of the administrative document granting them authority, and on the employees of the foreign representative office, including full name and position. You should also add all employment documents and information about the absence or presence of arrears in the payment of wages. If any, note the period for which it arose for each employee;

- A certificate of current accounts in banking institutions, information on the balance of funds in the cash of the foreign branch, and statements of cash flows;

- To exclude a representative office from the statistical authorities: notification of the Ministry of Economy on the cancellation of the entry in the register of representative offices; certificate of deregistration with the tax authorities; a record card for exclusion from the Unified State Register of Legal Entities

You may also like: Liquidation of a Representative Office by Decision of the Parent Company

What difficulties may arise in the liquidation of a foreign representative office?

Due to insufficient legislative regulation, uncertain procedure and lack of clear deadlines for many registration actions, it is necessary to determine the procedure on their own, which leads to misunderstandings with state authorities and, ultimately, to time delays and financial losses. Domestic laws are often taken as a basis and applied by analogy, but even in this case there are many gaps, which complicates the procedure.

Lawyers of Pravova Dopomoga Law Firm:

- assist in preparing a package of documents for the liquidation of a foreign representative office;

- advise on issues arising in their preparation;

- explain the algorithm of actions for implementation of this procedure;

- independently submit the necessary documentation to the relevant state authorities with subsequent legal support.

Our services not only save time but also guarantee the result.

The main disadvantage of closing a representative office for a foreign investor is the long time frame and the need to be in constant contact with the local state authorities. Any inaccuracies in the process drag it out not for weeks but for months.

We offer a simple solution - liquidation of the representative office on a turnkey basis. Our company will take care of the organizational issues and full control of the process. This is an easy solution to your legal problem.

The cost of representative office termination in Ukraine here.

Didn't find an answer to your question?

Everything about the procedure and terms of closing of the foreign representative office here.

Our clients