Stages of liquidation of a representative office in Ukraine

Cost of services:

Reviews of our Clients

Liquidation of a foreign representative office in Ukraine is quite a complicated and multi-stage procedure, which is insufficiently regulated by the current legislation.

Taking into account all the difficulties, we will try to explain the procedure of foreign representative office liquidation step by step.

Note: We shall provide you with the general algorithm of actions. Of course, each separate case shall be considered from the point of view of how exactly the representative office work was arranged, how soon you are planning its liquidation, and other peculiarities.

Use our legal "hint" for the organization of the process of liquidation of the foreign representative office. If you do not plan to do it yourself and want to entrust the entire procedure to reliable specialists, please see the our service fees here.

You may also like: Liquidation of Business on Parent Company's Decision

Step 1: Decision to terminate the representative office of a foreign company.

This decision shall be taken by the supreme governing body of the parent company. Additionally, a power of attorney is issued to the liquidator, which provides the powers necessary for the liquidation procedure.

Please note that all documents must be translated into the Ukrainian language with notarial certification. The relevant procedure is carried out in Ukraine, except in cases where there is a need for the documents to be legalized. In this case, documents must be translated before they are sent to Ukraine.

Lawyers of our company render assistance with preparing a package of documents for the liquidation of a foreign representative office in compliance with all the requirements of the current legislation.

Step 2: Appointment of a liquidation commission or liquidator, execution of powers of attorney.

The procedure for processing the relationship with the liquidator or liquidation commission must be decided by the foreign company. The transaction can be carried out in the form of an employment or civil law contract (e.g. a contract for the provision of services for the liquidation of a company, a contract for work, or for the provision of services free of charge, with the consent of the liquidator).

Current legislation does not provide for a clear composition of the liquidation commission. Usually, it consists of the Chairman of the liquidation Commission, the head, the chief accountant, and persons who are not representatives of the company, for example, lawyers. The number of persons on the liquidation commission should be odd for a quality counting process.

Upon completion of the procedure for the appointment of a liquidator or liquidation commission, all the powers of management of the representation are transferred to them. This is important because the liquidator must perform all the actions stipulated by the liquidation procedure.

You may also like: Important Issues of Closing a Foreign Representative Office

Step 3: Notifying creditors of the liquidation procedure of the representative office and the corresponding settlements.

The liquidation commission analyzes all financial documents, independently identifies creditors and sends notices so that they can make their own claims. Creditors are given a period of two to six months.

After this stage, the liquidation commission or liquidator draws up a liquidation balance sheet, which is approved by the foreign company and submitted to the Taxpayer Service Center at the place of taxpayer registration.

There is a certain sequence for satisfying all creditors' claims.

- The first priority is given to claims for compensation for damage caused by injury, other health damage, or death, and claims of creditors secured by a pledge or in any other way.

- The second priority is given to employees and authors for the use of the results of intellectual, creative activity (if there were such cases).

- The third priority is to satisfy claims relating to taxes and levies.

- The fourth priority is all other claims. First, the claims of creditors who have applied for recovery in time, to the extent of the remaining property on a pro-rata basis, because the creditors who have filed their claims in time are treated equally. Other creditors are settled on a residual basis.

The claims of creditors declared after the deadline set by the liquidation commission or the liquidator, are levied on the property of the company, which remains after all previous claims of creditors have been satisfied.

Step 4: Issuing an order to dismiss the employees.

In addition, it is necessary to make all settlements with the employees of the representative office.

2 months before the date of dismissal, employees must be notified of their dismissal, along with the order against signature, and not earlier than the day on which the decision to liquidate the representative office was made. Each employee must also receive severance pay in connection with the liquidation of the representative office.

At this stage, the director of the representative office is also dismissed, although his powers are actually terminated after the appointment of the liquidation commission.

As for foreign employees, it is necessary to return the employee cards to the Ministry of Economy of Ukraine.

It is also necessary to notify the territorial bodies of the State Migration Service and the employment center regarding the early termination of the employment agreement. The applications may be made in any form because there are no requirements for them in the regulations.

It is necessary to draw up an additional agreement to the employment agreement or notification of the termination of the employment agreement by the employer's initiative. On the basis of these documents, an order of termination is prepared and a notice to the Employment Center about the termination of the employment agreement with a foreigner must be sent in writing.

The foreigner has to leave the place of registration by submitting an application to the Administrative Services Center, having with him a temporary residence permit. Together with the notice of termination, the view is submitted to the bodies of the State Migration Service. As a result, a copy of the decision is provided, stating that the permit is invalid. Upon completion of the procedure the foreigner must leave the territory of Ukraine.

Step 5: Property inventory and evaluation.

This stage involves an inventory of fixed assets, documents, intangible and tangible assets, and cash.

The stage of evaluation of the property of the company is necessary because it is the source of repayment of debts of the representative office. This assessment is aimed at identifying additional liabilities or reducing the collateral for future expenses arising in the liquidation of the representative office.

Measures for the inventory of the property of the representative office are carried out by the liquidator or the liquidation commission. The final results should be reflected in the tax and accounting records and prepare an interim liquidation balance sheet, which contains information on the property of the liquidated representative office, the claims of creditors, and the results of consideration on them. This balance sheet is approved by the body which took the decision on liquidation.

Step 6: Closing bank accounts.

All bank accounts of the representative office must be closed, except for the liquidation account, because it is needed to pay the payments. This account is closed based on the liquidator's application to close the account.

Bank accounts are closed according to the general procedure, as there is no clearly defined procedure for foreign representative offices by the current legislation. The account shall be closed on the grounds of the application, drawn up in any form, indicating the name of the bank and the client; the number of the account to be closed and details of the account to which the client's current account balance is transferred, or the individual's request to withdraw the remaining funds in cash and the date of the application.

Additionally, it is necessary to provide the decision on the liquidation of the representative office and the card, in which the signature of the liquidator and notarized impression of the seal of the representative office is presented.

Step 7: Deregistration and obtaining certificates.

At the tax authorities: First, it is necessary to send an application according to Form No. 8-OPP and ensure payment of all fees and taxes, after which the relevant authorities must check whether all payments have been accrued and paid correctly. As a result, an act of absence of arrears or the presence of tax liability is drawn up. At the same time, this body starts a documentary check on the correctness of payment and accrual of ERUs. If there is no debt, you will also receive a certificate of no debt.

At the Social Insurance Fund: You need to send a message about the liquidation of foreign representation.

The State Customs Service will issue a certificate of the results after the audit.

We carry out the entire procedure and provide legal support for our clients from filing documents to de-registration with the regulatory authorities.

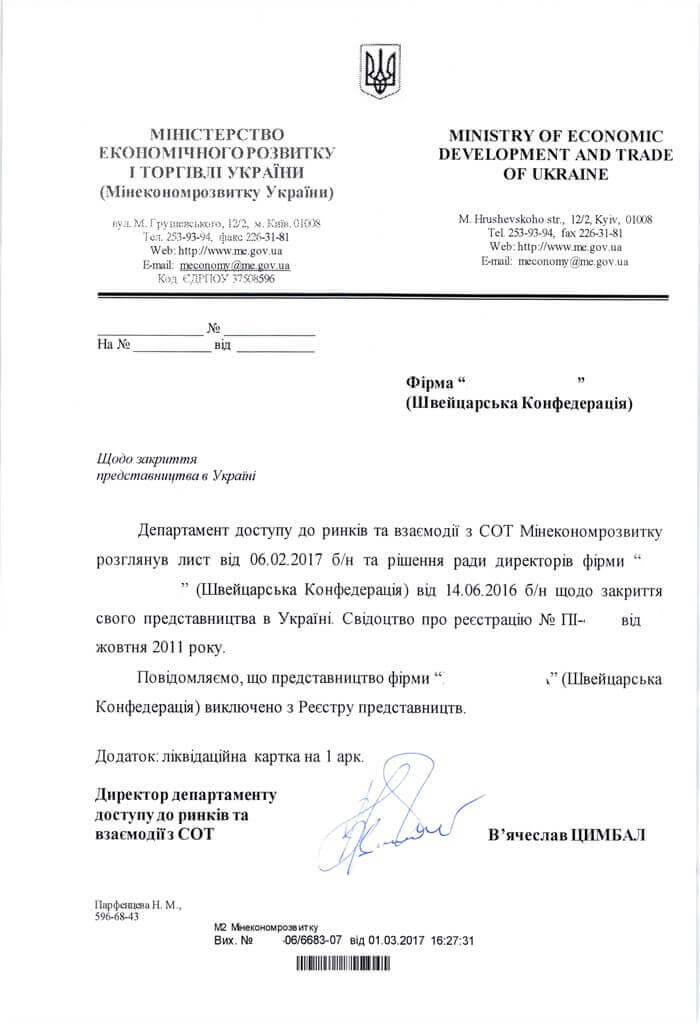

Step 8: Notification of the Ministry of Economy of Ukraine about the liquidation of the representative office.

This stage includes the submission of all documentation to the Ministry of Economy, which cancels the entry in the register of foreign economic entities in Ukraine and notifies the representative office in writing about the termination.

Stage 9: Transfer of documents of the representative office to the archival institution for storage.

After a preliminary examination at the initiative of the owner, the National Archives of Ukraine accepts all documents and provides a certificate of acceptance of the documents into the archive.

Stage 10: Submission of the registration form on exclusion from the State Register to the statistical office.

After exclusion from the register, the statistical authorities shall provide the relevant certificate.

Stage 11: Destruction of seals and stamps of the representative office and closure of the liquidation account.

There are no regulatory requirements for the destruction of seals and stamps now, so you can organize this process yourself and record it in an appropriate act.

Lawyers of Pravova Dopomoga Law Firm have many years of experience in carrying out this procedure and perfectly understand in detail each of the stages. We will help to save your time and efforts, guaranteeing the reliability and effectiveness of our mutual cooperation.

Didn't find an answer to your question?

Everything about the foreign representative office termination in Ukraine here.