Sale of real estate by a legal entity in Ukraine

Cost of services:

Reviews of our Clients

A legal entity in Ukraine has the authority to possess both movable and immovable property under ownership rights. Naturally, such property owned by a legal entity can be legitimately sold.

However, how does one go about this correctly? Is it necessary to document such a sale in the accounting and other reporting records? Who should the sale of real estate by a legal entity be coordinated with, and what challenges might arise in the process?

Does the property sales process entail additional procedures, such as a mandatory preliminary property assessment?

Mistakes in this process could result in fines and issues with tax authorities – all of which can be avoided by appropriately organizing the real estate sales process.

You may also like: How is Commercial Real Estate Inspected?

Legal Consultation on Real Estate Sale by a Legal Entity

Selling real estate as a legal entity involves specific processes, including:

- Selling property owned by a legal entity, such as an LLC or a joint-stock company, necessitates a resolution from the General Meeting of Participants. Even if you are the sole participant in an LLC, a resolution from the single participant is still required for property sales.

- When selling company real estate, it's crucial to consider not only legal norms but also the provisions outlined in the company's statutory documents. There are cases where the Articles of Association prohibit the alienation of specific property or prescribe a particular method of alienation. In such instances, amendments to the Articles of Association can be made before proceeding with the sale. If there's a need to gift real estate, the Articles of Association should allow for such a possibility, potentially specifying a required quorum for approving property sales.

- The sale of a legal entity's property is executed by the director or a representative who must possess a power of attorney authorizing them to sign documents on behalf of the legal entity, enter into agreements, establish legal relationships, pay fees, etc.

- In real estate transactions, dealings with a legal entity are typically conducted through non-cash settlements.

- Selling real estate may be deemed a significant transaction; therefore, the leader of the legal entity must have the authority to conclude such deals.

Today, we will explore interesting aspects of the real estate sale process by a company. If you haven't found the answer to your question, feel free to reach out to us for a personalized consultation. We will address your specific case and help you navigate potential issues in the real estate sale process.

Please note! Selling or purchasing real estate through a legal entity presents an advantageous scheme for foreign individuals acquiring property in Ukraine.

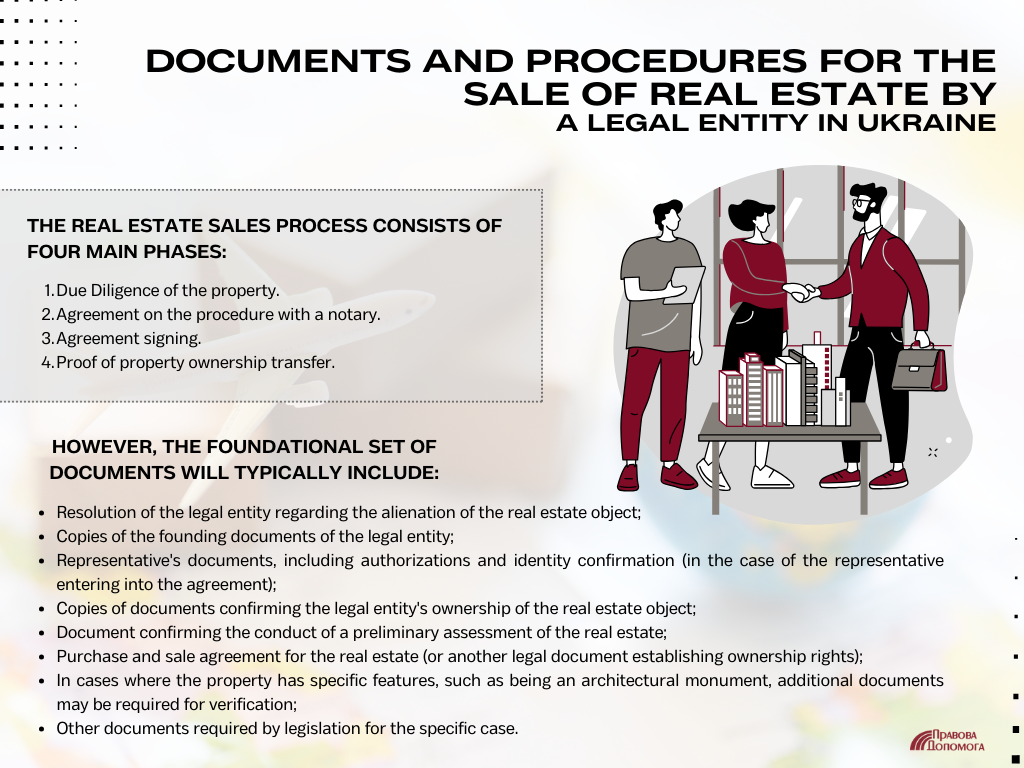

Documents and Procedures for the Sale of Real Estate by a Legal Entity in Ukraine

The complete list of documents and preparatory steps will depend on the specific property, nuances outlined in the legal entity's founding documents, and even the identity of the buyer. However, the foundational set of documents will typically include:

- Resolution of the legal entity regarding the alienation of the real estate object (Minutes of the General Meeting or Resolution of the Sole Participant);

- Copies of the founding documents of the legal entity;

- Representative's documents, including authorizations and identity confirmation (in the case of the representative entering into the agreement);

- Copies of documents confirming the legal entity's ownership of the real estate object;

- Document confirming the conduct of a preliminary assessment of the real estate;

- Purchase and sale agreement for the real estate (or another legal document establishing ownership rights);

- In cases where the property has specific features, such as being an architectural monument, additional documents may be required for verification;

- Other documents required by legislation for the specific case.

The real estate sales process consists of four main phases:

- Due Diligence of the property. During this phase, our lawyers carry out a preliminary analysis of the Client's situation, scrutinize the founding documents, check the property, and ensure all necessary documents for the sale are available. We also prepare the required documents on behalf of the legal entity for the sale of the property, such as minutes, powers of attorney, etc.

- Agreement on the procedure with a notary. We coordinate the procedure with notaries in advance to ensure optimal conditions. This includes preparing the sales contract and other documents beforehand and aligning the procedure with the bank.

- Agreement signing. The agreement is signed at the notary's office, followed by the execution of payments.

- Proof of property ownership transfer. Following the sales procedure, the notary is responsible for updating the property rights registry and issuing a new extract.

Please note! If the space you intend to sell is currently leased to a third party, Ukrainian law requires you to first offer the property to them. If the lessee does not wish to purchase, you must obtain a document confirming their refusal of the purchase right.

Please note! Selling real estate previously on a legal entity's balance sheet entails paying a State Duty for notary services – 1%, and a 1.5% military tax from the transaction sum. The income tax rate on property sales will vary based on several factors.

Selling Land by a Legal Entity

Selling land, which is also real estate and can be owned by a legal entity, involves specific considerations. The sale of land has always been a distinct topic in Ukraine, hence we'll discuss it separately, highlighting the nuances of the procedure.

To sell a land plot, the following conditions must be met:

- The land must have a cadastral number, and you must possess documents confirming your ownership rights;

- Compliance with the rules for selling specific categories of land in Ukraine is required. For example, the sale of agricultural land to foreigners or foreign companies is currently prohibited.

Please note! It's common to have a building on the land being sold. You can sell the land along with the building on it. However, if the building is self-constructed, selling it can be more challenging. You may need to either register the built house or separately discuss this matter with the buyer.

Just like with any other real estate sale, our lawyers will manage the entire process from start to finish.

You may also like: How to Arrange a Land Lease by a Legal Entity?

Legal Services for Organizing Real Estate Sales by a Legal Entity

Our lawyers offer a full range of services to assist with the sale of real estate by a legal entity in Ukraine:

- Analyzing your situation and advising on the optimal steps for acquiring or disposing of real estate.

- Preparing necessary documents for the acquisition or sale transaction;

- Consulting on accounting and documentation post-sale;

- Drafting or reviewing the sale or acquisition contract for the legal entity's real estate;

- Drafting a power of attorney for selling the property;

- Organizing the transaction at our partner notary's office.

- If needed, assistance with recording the sale in company accounting and tax payment.

Need help with a real estate purchase and sale transaction? Contact us! We'll ensure a favorable deal for you and oversee the entire process from A to Z.

Our lawyers will ensure the property sale is accurately reflected in your company's accounting and founding documents.

Need more information?

Find everything about real estate sales and purchases in Ukraine here.

Details on property verification costs are available here.

Details on the cost of facilitating commercial real estate transactions are available here.

Our clients