It is necessary to disclose the structure of ownership in LLC in Ukraine until October 11, 2023

Cost of services:

Reviews of our Clients

Ukrainian legislation, requiring all Ukrainian LLCs to make timely disclosure of their ownership structure, has recently been amended. The requirement to provide information on ultimate beneficiaries applies to all enterprises, including those where the beneficiary is a foreigner, or a foreign company — special requirements are set for them.

Attention! The established period for disclosing the ownership structure is 3 months. The period begins on 11 July, which means that you should hurry up.

You have to provide the data on the beneficiaries even if the company has a simple structure of ownership (the owner is a natural person) and even if the information on the final beneficiary owner is already in the USR. Perhaps you have no final beneficial owner? In this case you must specify the reason.

The ultimate beneficial owner information is also expected to be confirmed annually from the date of incorporation. This is already scheduled for 2022. That is, if your company was incorporated on August 5, 2021, you are required to file beneficiary information within 14 calendar days beginning August 5, 2022.

However, there’s no need to worry. The main thing is to settle these organizational issues in a timely manner and to properly execute the documents so you don’t waste time on re-filing. This approach will protect you from unnecessary problems and financial losses.

If you want to avoid queues at the Administrative Services Center, re-execution of documents and penalties for late submission, don’t hesitate to contact us.

You can also find useful information on the procedure in this article, or on our website.

You may also like: Accounting Operations When Making Changes to LLC Members

How to submit information on disclosure of ultimate beneficiaries?

Legal entities must keep up-to-date information on ultimate beneficiaries and ownership structure, declare changes, if any, to the registrar with documentation confirming these changes within 30 business days.

In order to register the information, you will have to prepare a package of documents, which is defined by the current legislation:

-

Application for confirmation of information about the ultimate beneficial owner.

Our experts will correctly prepare a Form 6 application.

The following documents are required from you in the number of beneficiaries:

- copy of passport of each beneficiary;

- registration number of the registration card of the taxpayer — beneficiary (if the beneficiary is a Ukrainian resident).

-

A free-form schematic representation of the ownership structure, indicating all persons who directly or indirectly own the legal entity (alone or together with other persons). It is necessary to indicate the size of the shares of each owner.

Please note! The registrar may not accept, or simply not understand what is indicated in the schematic representation of the ownership structure. For example, it may ask to change the direction of the arrows, remove unnecessary information, simplify the scheme or on the contrary to deploy in more detail. And the question arises, How to properly prepare such a scheme?

We use the samples published on the website of the Ministry of Finance. We make everything as close as possible to the official information about the legal entity, and the schematic image - understandable to the registrar.

The scheme must be signed by the authorized person. This can be the director or an authorized person, such as our lawyer, acting under a power of attorney. The latter option will minimize the time and simplify the procedure for you.

-

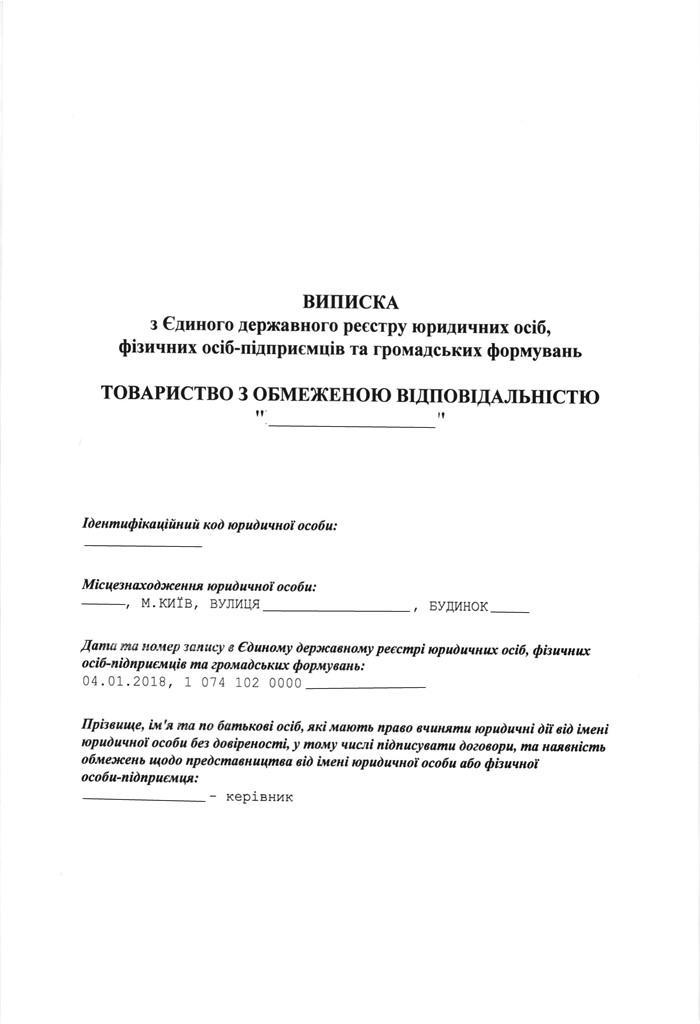

Extract, or any other document of court, commercial, bank register certifying the registration of a non-resident legal entity at its location — only if the founder of the legal entity is a non-resident legal entity. The document must be obtained in the country of location.

-

Notarized copy of the document certifying the person who is the ultimate beneficial owner of the legal entity.

Please note! Legislation requires that all passport copies are certified by a notary, but does not specify which notary may certify a passport copy: foreign or Ukrainian.

It is worth remembering that a document issued in a foreign language must be translated into Ukrainian with a notarization of the translation or the translator’s signature, according to the current legislation. Our company cooperates with reliable translators, who provide translation of documents as required by law and their certification.

In addition, some registrars require passports to be legalized (consular legalization or apostille) in the manner prescribed by law, unless otherwise provided in international treaties.

The procedure for submitting information on beneficiaries has a lot of subtle aspects, which directly affect the speed of procedure, and the number of possible reissuance of documents.

We offer you the registration of changes in the USR in 1 business day, on the first try.

Penalty for failure to provide or late provision of information on ultimate beneficiary in Ukraine

Failure to provide or untimely provision of information on ultimate beneficiaries or their absence to the registrar will lead to an administrative fine from 1,000 to 3K of tax-free minimum income of an individual for the director of a legal entity or a person authorized to act on behalf of the legal entity. As of today, the fine amounts to UAH 17,000-51,000.

We would like to remind you that all LLCs registered in Ukraine must submit or update information by October 11, 2021.

We advise you not to miss the statutory deadline and to avoid penalties. Our lawyers are always ready to meet your needs correctly and within the established deadline.

Didn’t find an answer to your question?

Find more information about the cost and procedure of making changes to the USR.