Tax rate for IT specialist in Ukraine in 2023

As of today, the tax rates for IT specialists in Ukraine are among the most attractive for work and business activity. So, working in Ukraine on an IT project you will have to pay:

-

18% personal income tax and 1.5% military tax if the specialist works as an employee (paid from the salary by the employer). In addition, the employer pays 22% single social security tax for each employee;

-

5% as a single tax rate for group 3 if working as a sole proprietor.

Taking into account the above rates, it becomes clear why 85% of IT specialists in Ukraine choose to work as sole proprietors. In addition to a lower tax rate, sole proprietorship allows also to work on several projects and with several counterparties.

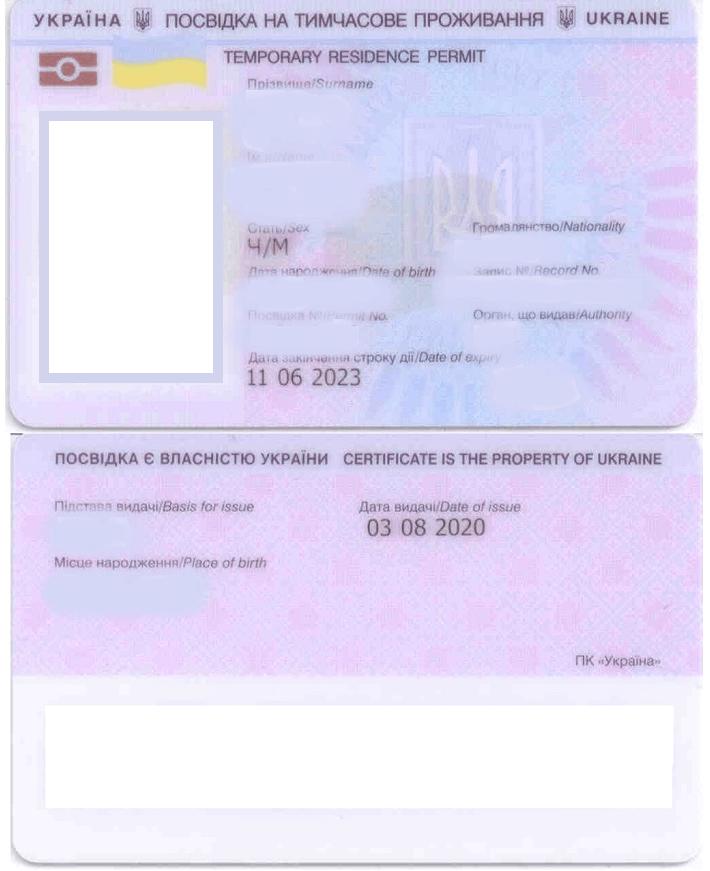

However, foreign IT specialists in Ukraine face another question. Can a foreigner work in Ukraine at a 5% tax rate through a sole proprietorship in Ukraine, without having a Temporary Residence Permit?

And how to proceed, if you want to work at the Ukrainian rates, but don’t have any grounds for obtaining a Temporary Residence Permit?

You may also like: What Is the Better Option for an IT specialist to Work in Ukraine: Sole Proprietorship or Employment?

Can a foreigner work in Ukraine as a sole proprietor at a 5% tax rate?

In order to answer this question, the State Tax Service of Ukraine (STS) had to provide some clarifications in 2020. This issue was raised by the Ministry of Digital Transformation of Ukraine and the IT Ukraine Association.

The lack of clarity on this issue significantly reduced the migration of IT specialists, despite the introduced quotas and special conditions for relocation of specialists in this sector.

The STS letter directly explained that the foreign IT specialists, if they decide to immigrate to Ukraine under the quotas, can start a sole proprietorship and work at the 5% tax rate while waiting for their Permanent Residence Permit.

Please note! Working as a sole proprietor in Ukraine does not give the right to a Temporary Residence Permit. That is, if you intend to work in Ukraine as a sole proprietor, you have two options:

-

Obtaining a Temporary Residence Permit on some other grounds: marriage, work in a Ukrainian volunteer organization, company registration, etc;

-

Obtaining a Permanent Residence Permit in Ukraine within the IT specialist quota, while working as a sole proprietor.

Our specialists will help you to decide which option is better for you. It all depends on your situation, the anticipated timing of the migration, activity plans in Ukraine, etc.

The main difference between the two options is that you will have to wait for a Permanent Residence Permit at least 1 year, and until then you can only stay in Ukraine the allowed number of days (90 consecutive days, not more than 180 a year).

The procedure for obtaining a Temporary Residence Permit is much faster, but it requires a clear ground. The list of such grounds, unlike the quota, does not include the profession of IT specialist.

You may also like: How to move to Ukraine Within the Quota for IT Specialists?

Sole Proprietorship for IT specialists in Ukraine

Having started your business activity in Ukraine as a tax resident, you will need to carefully monitor the accuracy of filling out accounting documents, keeping tax records in general.

We have previously written about the primary documentation for the single taxpayers of Group 3. When working with our Clients, we provide tax advisory services, and if necessary - accounting outsourcing service for a specified period. Thus, working with us you will not only get the opportunity to move to Ukraine, but will also have all the information you need for conducting your business activity here.

Our company offers a full complex of services for your business activity in Ukraine:

-

Analysis of the Client's situation and lawyer’s recommendations on the best way to achieve the Client’s goals;

-

Registration of a sole proprietorship in Ukraine;

-

Obtaining a Temporary Residence Permit in Ukraine;

-

Assistance with obtaining a Permanent Residence Permit in Ukraine within the quota for IT specialists;

-

Health insurance policy in Ukraine, translation of documents and its notarization;

-

Tax and other advice on doing business in Ukraine.

The price of legal services will depend on the amount of services you need and their nature. For a personalized package of services, please contact our specialists. You can see the cost of obtaining a Permanent Residence Permit within quotas here.

Do you want to start your business activity in Ukraine as profitable and effective as possible? Don’t hesitate to contact us! We will not only help you to develop the best roadmap for your business activity in Ukraine, but will also help with its implementation.

Didn’t find an answer to your question?

Everything about immigration to Ukraine within the IT quota here.

Details on obtaining a Temporary Residence Permit in Ukraine here.

Our clients