What reports are submitted for a foreign representative office in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

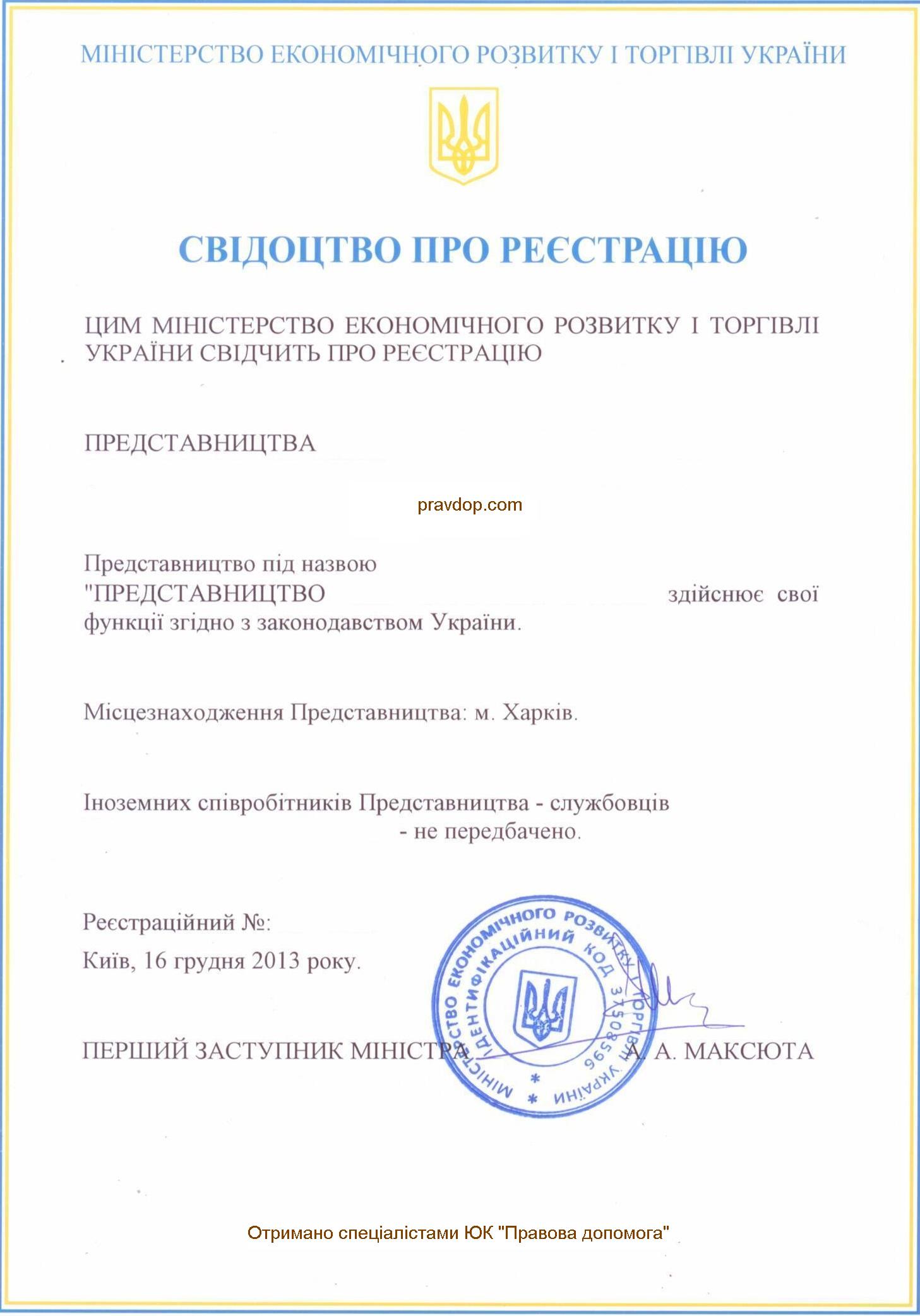

A foreign company can conduct business in our country in different ways, for example, through the registration of a representative office. Ukrainian legislation defines a representative office of a foreign legal entity as an institution or a person who represents the interests of a foreign company in Ukraine and has the appropriate authority to do so, duly executed.

A permanent representative office that started its business activities before registering with the supervisory authority is considered to evade taxes, and the income it receives is considered to be concealed from taxation.

This means that in order to avoid problems with the tax or other controlling authorities, the procedure for registering a representative office must be followed from A to Z, and with due regard to the deadlines. Only after that can you start legitimate activities.

Representative offices operating in Ukraine must maintain accounting and tax accounting records in compliance with the law, and submit tax and financial statements to the tax authorities at the place of their registration. Statements must be filed correctly and in a timely manner.

We will focus on the reports that must be filed by the representative office.

You may also like: Personnel Records and Personnel Issues in the Representative Office

What types of reports should a foreign representative office submit in Ukraine?

Consequently, the financial statements of permanent representative offices shall be filed to:

- tax authorities;

- statistical authorities.

Today the taxation rules of representative offices are changing - the foreign company itself must be registered with the tax authorities, and it must pay taxes such as income tax, etc. But a representative office must keep records, especially if the representative office employs employees, both foreigners, and Ukrainian citizens.

In addition, if the representative office uses hired labor, it must submit reports on withheld income tax and contributions to state social insurance funds.

Accounting in the permanent establishment is organized and conducted according to the general procedure, but with its own nuances. For example, if the representative office employs foreign employees, it is necessary to take personal income tax into account and calculate everything so as not to be subject to double taxation.

Standard tax rates for commercial representative offices:

- 20% VAT if the amount of income over 1 million a year;

- taxes on wages and salaries of employees.

The group and the scheme of taxation depend on the type of activity in Ukraine, your main contractors, and the scheme of the company.

Who has to file reporting for a foreign representative office in Ukraine?

Non-residents with a registered permanent representative office must prepare financial statements and submit them to state authorities. There is some uncertainty as to who shall draw up such financial statements.

Given that non-resident taxpayer will determine the taxable income of its permanent establishment separately, the financial statements should reflect the results of non-resident activities conducted through such permanent establishment for the relevant reporting period.

This is a controversial issue in the legislation, there is no clarity. As far as can be understood, non-residents submit financial statements based on the results of the activities of a permanent establishment.

And as income taxpayers it is non-residents, but not permanent establishments must prepare a tax return on corporate income tax.

That is, financial statements (balance sheet) and the statement of profit, losses, and other comprehensive income (statement of financial performance), is a supplements to the tax return on corporate income tax (statement of the use of income (profit) of a non-profit organization, the calculation of the net profit (income), dividends to the state share) and its integral part.

You may also like: Taxation on Representative Offices

Deadlines for submission of financial statements of foreign representative offices in Ukraine

According to the norms of current legislation for foreign representative offices, the financial statements in the balance sheet and the report on financial results are reduced in terms of indicators.

Permanent representative offices prepare financial statements of a small company (forms No. 1-m and 2-m). At the same time, representative offices of foreign business entities do not submit indicators of the average number of employees. Permanent representative offices have no other privileges in the preparation of financial statements.

Financial statements shall be submitted to the tax authorities with the same frequency as the tax return on corporate income tax, as it is an integral part of the declaration. Therefore, if a non-resident is a quarterly payer of income tax, then the financial statements shall be submitted to the authorities on a quarterly basis. If a non-resident is an annual payer of income tax, then only annual financial statements shall be submitted to the tax authorities.

Permanent representative offices also submit financial statements to the statistical authorities.

Permanent representative offices together with small businesses make up the Financial Statements of a small business, which means that they are required to submit financial statements to the statistical authorities on a quarterly basis and at the end of the year.

Peculiarities of accounting of foreign representative offices in Ukraine

There are certain peculiarities of accounting of a permanent representative office. For example, the financial expenses of the representative office are recognized as expenses of the period for which they have been accrued (recognized as liabilities). That is, financial expenses are not capitalized.

Transactions on the reflection of funding received from a foreign non-resident are quite controversial. Now transactions between a resident and its representative office in the territory of Ukraine are considered controlled operations. That is, "a resident, if its business transactions with a non-resident carried out through its permanent representative office fall under the definition of controlled transactions, must submit a report on controlled transactions and notify of its participation in an international group of companies" - ITC of 13.09.2021, N 3400/ITC/99-00-21-02-03-06.

A representative office must comply with transfer pricing, under which profits are calculated according to the arm's length principle.

What is the reporting procedure to be followed?

- Controlled Transactions Report (the penalty for failure to submit it is UAH 630,600);

- Notice of participation in an international group of companies (the penalty for failure to submit it is UAH 105,100).

Make sure you have a qualified accountant, because there are a lot of nuances, and the penalties are quite high.

You may also like: How to Obtain a Residence Permit for Employees of a Representative Office?

Legal and accounting support of foreign representative offices in Ukraine

Our legal company helps with the accounting and personnel issues in a foreign representative office. We provide full legal and accounting services for the representative office in Ukraine, including Payroll services.

Not every representative office, carrying out its activities, is ready to provide comprehensive accounting services, because it is not a business, but a routine. Especially if the employees, or their overwhelming majority, are foreigners. It is necessary to study the Ukrainian tax legislation and get acquainted with the so-called local "bureaucracy".

We will provide personnel and accounting support to the foreign representative office, which consists of the following operations and processes:

- keeping records of employees by specialty and position - from hiring to career advancement;

- accrual of salaries to employees of foreign nationals and citizens of Ukraine;

- filing of payroll reports;

- drawing up financial statements;

- preparation of payment orders to the bank;

- accrual of sick pay;

- record-keeping of vacation pay;

- drawing up staffing charts;

- preparation of orders on hiring, firing, and transfer to another position;

- internal, tax, and financial audit;

- consulting assistance and analysis of the representative office.

See the service fee here.

In supporting the activities of representative offices of foreign companies, we pay attention to:

- development of objective understanding of legal risks by the head of the representative office or responsible person taking into account realities of Ukrainian laws;

- control over compliance with anti-corruption laws of the state of the parent company, as well as the FCPA norms;

- confidentiality of our relations with the Client, as well as any data obtained as a result of our cooperation (Client's data is protected by technical means and procedures within the company).

When working with our Clients we offer comprehensive legal support of the foreign representative office. This scheme of work includes the joint work of a lawyer and an accountant, which guarantees the safety of your activities in Ukraine.

Even with the presence of a staff lawyer at the representative office, there are one-time tasks, which require a narrow qualification and constant practice. Our staff includes specialists, who constantly practice in specific areas of law. Therefore, working with us, you get experienced staff for one-time complex tasks, which greatly simplifies and speeds up their solution. Working in this field, we have developed a reporting procedure, which transparently demonstrates our work.

We optimize the legal and accounting services, ensuring comprehensiveness - shortening the time for approval, receiving correct answers, recommendations for solutions, responsibility on one company, and providing protection against legal and tax risks or additional expenses.

Didn't find an answer to your question?

Everything about registration of a foreign representative office in Ukraine here.