Who are the beneficiaries of a charitable foundation in Ukraine? Who to specify in the structure?

Cost of services:

Reviews of our Clients

For several years now, the topic of ultimate beneficial ownership has been a hot topic among entrepreneurs. This issue became particularly prominent in 2021 when everyone was required to provide the relevant information by mid-October. In December 2022, there were further changes to the legislation regarding beneficiaries. So, let's take a closer look at who the ultimate beneficial owners are for charitable organizations, who should be listed, and whether beneficiaries can be left out altogether.

Our company has extensive experience working with charitable organizations, assisting them in initiating their activities, executing projects, and maintaining stable operations. We thoroughly understand all nuances of legislation related to ultimate beneficial owners and excel in minimizing risks and optimizing the operations of charities. Offering a comprehensive service that encompasses legal, accounting, and personnel matters, we become a reliable partner for the development of charitable organizations and ensuring their compliance with new legislative requirements.

Who are the ultimate beneficial owners of the charitable foundation?

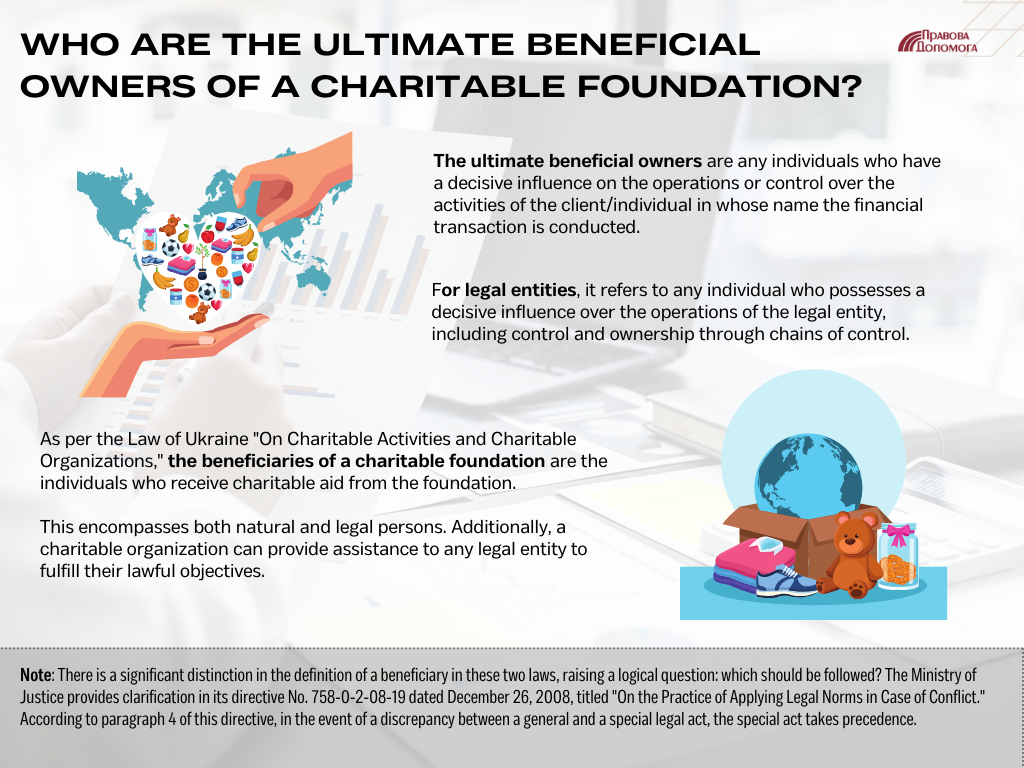

According to the law on "Preventing and Combating Money Laundering," ultimate beneficial owners are any individuals who exercise decisive influence over the activities or control of a client, or any individual on whose behalf a financial transaction is carried out.

For legal entities, it's any individual who exercises decisive influence over the activities of the legal entity (including through chains of control/ownership).

According to the law on "Charitable Activities and Charitable Organizations," beneficiaries are the recipients of charitable assistance who receive help from donors. These can be both individuals and legal entities. The beneficiaries of a charitable organization can also be any legal entities that receive assistance to achieve lawful goals.

As we can see, even in these two laws, the concept of a beneficiary differs significantly. This raises a logical question: what should we rely on? There's an explanation from the Ministry of Justice No. 758-0-2-08-19 dated 26.12.2008 on "The Practice of Applying Legal Norms in the Case of a Collision."

According to paragraph 4 of this explanation (letter), in case of discrepancies between a general and a special normative legal act, preference is given to the special one.

In this case, for charitable organizations, the special act will be the law on "Charitable Activities and Charitable Organizations."

As a reminder, according to this law, beneficiaries are the recipients of assistance. Therefore, everyone who has ever received or will receive help should be considered a beneficiary. So, who should be listed as the beneficiary? No one!

You may also like: Accounting and Other Reporting Requirements for Charitable Foundations in Ukraine

Is it possible for a charitable foundation to exist without a beneficiary in its ownership structure?

The legal system provides room for maneuvering, so it's usually possible to find a way to establish a foundation without a clear beneficiary in the ownership structure. If the foundation has only one or two founders who can easily provide notarized copies of their passports (if they are of the old format) and submit them along with the ownership structure to the registrar, those founders can be identified as the ultimate beneficiaries in the structure.

However, if there are many founders, or if they are located far away, it is perfectly legal to use a "life hack" of an empty ownership structure. In other words, the ownership structure indicates that there are no individuals who meet the definition of a final beneficial owner.

We have already used this practice, and registrars accept it without any problems. However, in some cases, we recommend disclosing the ownership structure to prevent possible questions from banks or donors.

When all the founders are natural persons or even Ukrainian legal entities, it is easy to see who is behind the foundation. But when foreign legal entities are among the founders, it remains a matter of speculation who is behind them. This may be important for some (primarily banks and potential donors). Therefore, in cases where there are foreign legal entities among the founders of the foundation, we still recommend disclosing the ownership structure fully.

Our company is actively assisting in registering charitable foundations in Ukraine. Our clients include well-known foreign charitable organizations that wish to operate in Ukraine. We provide the following services:

- Finding the optimal path for launching charitable organizations - either through opening new charitable foundations or, for example, accrediting an existing non-profit organization in Ukraine.

- Taking care of all organizational procedures for launching a charitable organization in Ukraine.

- Providing recommendations on registration, ownership structure, taking into account the wishes of the founders, and more.

- Providing accounting, HR, and legal support at the start of the organization's activities.

- Preparing start-up document packages to begin the work of a charitable foundation.

You can find the cost of registering charitable organizations here.

We can also offer a ready-made charitable foundation for purchase if your goal is to launch quickly or if you need an existing foundation.

If you want to create a charitable organization in Ukraine, don’t hesitate to contact us.

Didn’t find an answer to a question?

Everything you need to know about charitable activities in Ukraine here.

Our clients