Opening a corporate account in Turkey: how to choose a bank

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Our company has been actively involved in the field of relocation for over five years, providing services for both personal and business needs. Recently, a critical consideration for businesses has been the opening of corporate accounts in foreign jurisdictions. Notably, this procedure is often carried out not in the country where the company is registered, or where the owner or beneficiary resides, but in other jurisdictions connected to the location of the company's partners or clients.

One reason for this approach may be the risk of account closure in the current jurisdiction or inconvenient service conditions. Another factor is that counterparts often set conditions specific to certain countries or banks, and they may view transferring funds to such accounts as a risky operation.

Certainly, exploring numerous jurisdictions and finding reliable and accommodating banks can be challenging, but nothing is impossible. Hence, our specialists willingly take on such challenges.

For instance, one of our recent clients, the founder and manager of a company registered in the UK, expanded their client base to many countries. This led to the need for opening corporate accounts in other jurisdictions.

Using this case as an example, we will walk through the process of selecting a jurisdiction and a bank for opening an overseas corporate account.

You may also like: How to Open a Personal Account in a Turkish Bank for Ukrainians?

How to Choose a Bank in Turkey for Opening a Business Account?

The initial step in such requests always involves a consultation, during which our lawyer discusses key conditions that are important to the client and must be adhered to when selecting a jurisdiction and a bank.

Taking these conditions into account, our specialists, considering the nature of the company's activities, turnover, and other factors, selected several jurisdictions and presented them for the client's approval. In this process, we analyzed not only the bank's reliability, its rating, and the conditions set by banking institutions but also:

- Account opening timelines.

- Convenience.

- The possibility to complete all procedures remotely or through power of attorney with minimal client involvement.

In our case, the client chose Turkey. Previously, opening an account for a company not registered in the country was nearly impossible, but recently, banks have become more lenient, and compliance gives consent to opening such accounts.

Our company sent inquiries to several banks, and within a week, we received the first proposal. An essential aspect when working with Turkish banks is that compliance requires the company's documents to fully comply with the legislation of the country where it is registered.

In other words, if it is a company from the UAE, all founding documents must comply with the legislation of the Emirates. In the case of our client, the documents must align with the legislation of the United Kingdom.

The next step to consider is that it's advisable to translate and notarize documents for the bank in Turkey. Turkish banks prefer documents that are translated and notarized by Turkish translators and notaries. It's crucial to have an apostille on all documents.

If the company is structured, meaning it owns another legal entity, documents for that company will also be required. The more complex the company's structure, the more documents the bank will demand, making the approval process more intricate and time-consuming.

The bank needs a clear understanding of who the founder is, who the owner is, the company's counterparties, the sources of funds, and where the funds are being withdrawn. It is also important to explain the company's activities, and for this purpose, contracts facilitating payments can be provided.

Another peculiarity when dealing with Turks is their limited enthusiasm for online and remote collaboration. Negotiations and agreements are better conducted in person.

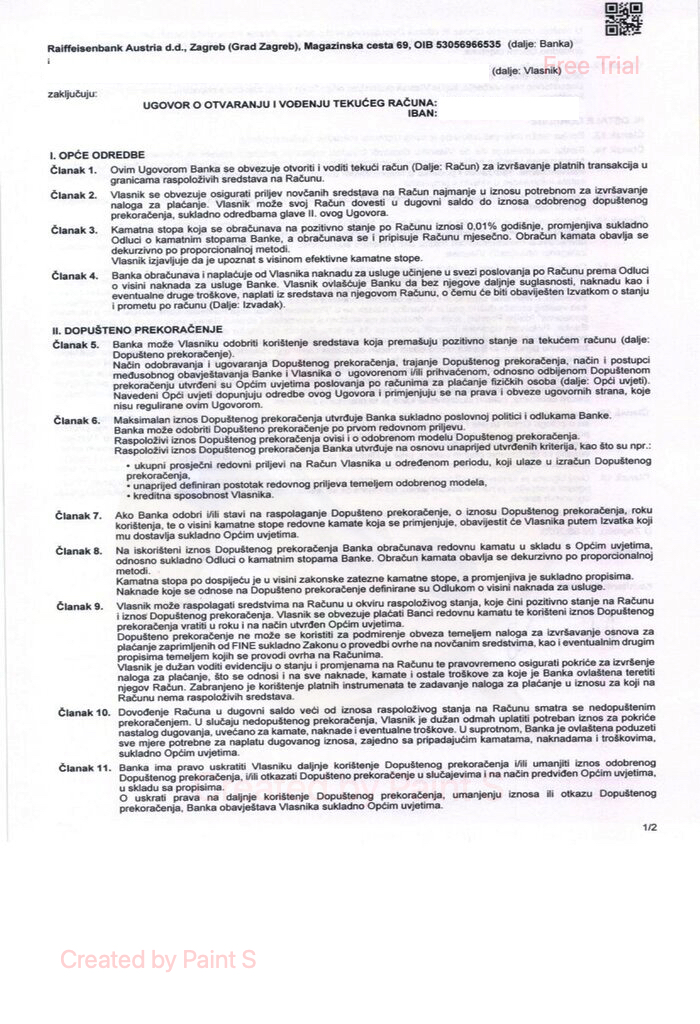

For this reason, after coordinating all details with compliance and bank managers, including document preparation, translation, and notarization, we scheduled a business trip for the client to Istanbul and arranged a face-to-face meeting to sign the account opening agreement.

In total, our specialists spent just over a month on correspondence with the bank, preparing necessary documents, negotiating terms, and obtaining compliance approval. The client's visit to the bank lasted only forty minutes.

You may also like: Establishing a Company in Cyprus for Ukrainian Citizens

Tips for Those Planning to Open a Company Account in Turkey

Turkish banks have a unique approach where obtaining tariff rates and account servicing interest rates is not possible until the contract is signed. In some cases, all fees and hidden charges only become visible after the initial transactions. This strategy aims to encourage clients to engage with their bankers and negotiate conditions that are essential for them.

In addition, we consistently recommend our clients who have opened accounts in Turkish banks liaise with their bankers for each action. It is prudent to provide advance notice about every transaction, import-export operation, SWIFT transaction, significant fund transfer, etc. By doing so, you safeguard yourself from fund blockages and delays while fostering trust with your banker, resulting in more favorable treatment, expedited processing of your requests, and more.

Our company consistently monitors changes in various foreign jurisdictions and collaborates with agents from different countries to ensure our clients can quickly and comfortably obtain any legal service.

Today, we offer services such as:

- Choosing a jurisdiction for opening an overseas account.

- Opening personal accounts abroad.

- Opening business accounts abroad.

- Business relocation abroad.

- Personal relocation abroad.

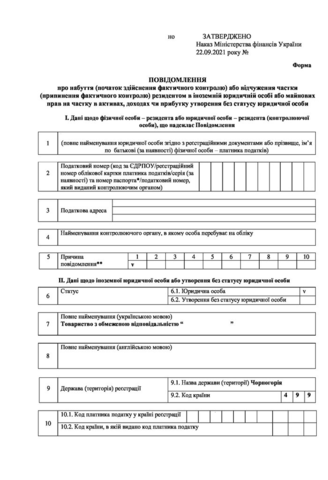

- Submission of reports for CFC (Controlled Foreign Corporation).

- Tax optimization, and more.

If you are seeking Ukrainian-level service overseas, feel free to contact us! We will handle all communication with foreign authorities and banks, minimizing your involvement to a comfortable minimum!

Our clients