Legal support for IT companies in Ukraine

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

-

Assist in starting a business in Ukraine by registering it and selecting the appropriate taxation system;

-

Advise on the taxation of IT business;

-

Analyze and draw up contracts in the field of IT, including software development contracts. For example, waterfall and agile;

-

Prepare responses to inquiries from the supervisory authorities, and if necessary, represent the Client before government agencies;

-

Provide accounting services, including the accrual of employee salaries, resolve personnel issues with employees working remotely, help with the reporting;

-

Assist with registration as a Diia City resident, advise the lawyer and accountant on the benefits of migration to Diia City for the IT company;

-

Develop gig contracts and other documents for Diia City;

-

Advise on copyright and other legal issues that may arise in the course of business of an IT company.

Documents for servicing an IT company

Diia City residency in Ukraine for IT companies

Diia City is a new legal and tax space for IT companies in Ukraine. This is a "program" created for companies and specialists whose activities are related to the provision of IT services. Participants or "residents" of Diia City are promised a number of benefits, including tax benefits:

-

Special tax regime, tax discounts for investors

-

Expanded options for registration of employment relations: gig contract, sole proprietorship, employment agreement under the Labor Code.

-

Protection of intellectual property of IT company.

-

Venture investments.

-

Protection against unlawful interference of law enforcement agencies. Criminal liability.

For those who have been working in the field of IT in Ukraine for a long time, Diia City is first of all an opportunity to solve the inherent problem of working with individual entrepreneurs. It offers an opportunity to work through gig contracts.

To take advantage of Diia City, you need to register. You can apply for registration online.

The term of preparation of documents with us is from 2 to 10 days. The term of their consideration is 10 working days.

However, first, you need to calculate whether the transition to the Diia City regime will be beneficial for you in terms of workflow organization and taxation.

Service packages offers

- providing advice on obtaining the status of a resident of Diia City;

- providing advice on taxation of Diia City residents;

- provision of advice on employment of employees, work with sole proprietorship and gig contracts;

- recommendations of a lawyer regarding the organizational and legal form for a resident of Diia City, a package of documents and necessary actions for obtaining residency.

- providing advice on obtaining the status of a resident of Diia City;

- providing advice on taxation of Diia City residents;

- provision of advice on employment of employees, work with FOP and gig contracts;

- assistance in forming a package of documents for obtaining Diia City residency;

- preparation of a gig contract template and signing them with employees;

- assistance in confirming the status of a resident of Diia City, including for startups.

- providing advice on obtaining the status of a resident of Diia City, tax features and employment of employees for residents of Diia City;

- preparation of documents for obtaining the status of a resident of Diia City, including for a startup, organization of registration as a resident of Diia City;

- study of risks, prevention of grounds for cancellation of residency in Diia City;

- assistance in the legalization of foreigners on the basis of an employment permit or on the basis of a concluded gig contract, in accordance with the chosen model of wage taxation;

- obtaining an employment permit or preparing a draft gig contract;

- preparation of documents and organization of application for D visa, filling out the electronic visa application form;

- preparation of a package of documents and organization of submission of a permit for temporary residence in Ukraine.

Registration of each subsequent employee - 200 USD

Our cooperation offer for foreign Clients.

Consultation of a lawyer on supporting an IT-company

If you want to find out what is included in the package of services offered by a lawyer for supporting an IT-company, and to understand how much you need, we recommend applying to our specialists for an introductory consultation.

A lawyer of our company will answer the following questions at such consultation:

-

What volume of services you can choose (we provide a comprehensive accounting and legal support for IT-companies, as well as perform individual actions, for example, develop contracts);

-

What is suitable for your company, depending on the nature of its work;

-

What the first steps are worth doing to optimize your company.

Introductory consultation is an opportunity for you to get answers to basic questions about the peculiarities of legal support for your IT company.

If you decide to order maintenance of your IT-company at our firm, this cost will be included in the price of the service.

If you have a lot of questions or they are specific and complicated, we recommend you to ask for a "Road Map". This is a self-contained legal opinion with a limited algorithm of actions. You can use this advice independently as a guide to action.

The amount and procedure for payment is discussed with each Client individually.

Our clients

Our successful projects

Work of IT companies through Diia City in Ukraine

A special tax regime has been established for residents of Diia City.

1. Corporate tax: 9% on "withdrawn capital" or 18% on income.

2. Labor tax: 5% personal income tax, unified social contribution 22% of the minimum wage, 1.5% military tax.

3. To stimulate investments:

-

0% on the income of individuals as dividends accrued by a resident company, provided that they are paid no more than once every 2 years;

-

tax benefit: the amount spent on the acquisition of a share in a Ukrainian startup is deducted from the total taxable income.

The employment relations of Diia City residents will differ from the previous usual scheme. You will have the opportunity to choose one option and create a mixed scheme for yourself through:

1. Gig contracts:

-

allow to show real turnover and pay moderate taxes;

-

provide basic social guarantees for specialists;

-

the advantage is a fairly simple administration process.

2. Employment agreements:

-

residents of Diia City still have the opportunity to conclude employment agreements in accordance with the Labor Code.

3. Sole proprietorship:

-

transition period until 2024, there will be no restrictions on working with sole proprietors;

-

from 2024, payments not exceeding 50% can be made without taxation;

-

from 2025, companies paying 18% corporate income tax, whose annual income does not exceed UAH 40 million, will be able to cooperate with sole proprietors without restrictions throughout the entire period of the special regime.

For all other residents, payments to individual entrepreneurs should not exceed 20% of total expenses.

For those companies that will pay tax under special conditions, the amounts over the limit will be subject to a special tax of 9%. The income taxpayers will have to include the expenses for the sole proprietors that exceed the allowed 20% in the financial result.

Important!

If your business intends to hire a foreign IT specialist to work in Ukraine, he/she can obtain a visa to enter Ukraine and a Temporary Residence Permit based on a concluded gig contract.

The obvious advantage of the Diia City regime, in this case, is that you do not need to additionally apply for a Work Permit at the Employment Center, pay for it about UAH 10,000 (for a year) or UAH 15,000 (for 3 years).

Answers to frequently asked questions

Яка вірогідність, що відмінять єдиний податок для ІТ-індустрії?

На даний момент (станом на 30.08.2020) суб’єкти господарювання, види діяльності яких підпадають під визначення ІТ-індустрії, сплачують п’ятивідсотковий податок, як і всі «єдинники», які не є платниками ПДВ. Поступово збільшувати ставку податку поки що залишається на рівні ідеї Мінцифри.

We can also help with the development of all contracts that you need to standardize and organize the work of your IT company: a public offer contract, a service contract, etc.

Procedure for legal services for IT companies

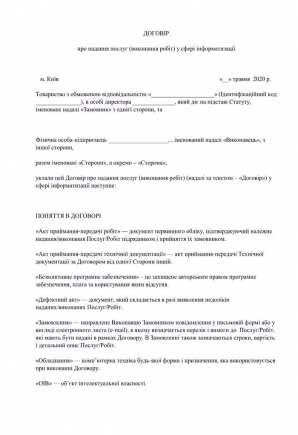

Before starting work, the scope of work and payment terms are discussed with the Client, after which an agreement on the provision of legal services is signed. Work begins after receiving full payment or partial payment, if provided by the terms of the contract.Do you have questions about the organization of your IT company in the legal field of Ukraine? Contact us!

We will help with the preparation of the necessary contracts, the solution of personnel, tax and registration issues of your business.

If you are also interested in services for residents of Dia City, check out our presentation here!