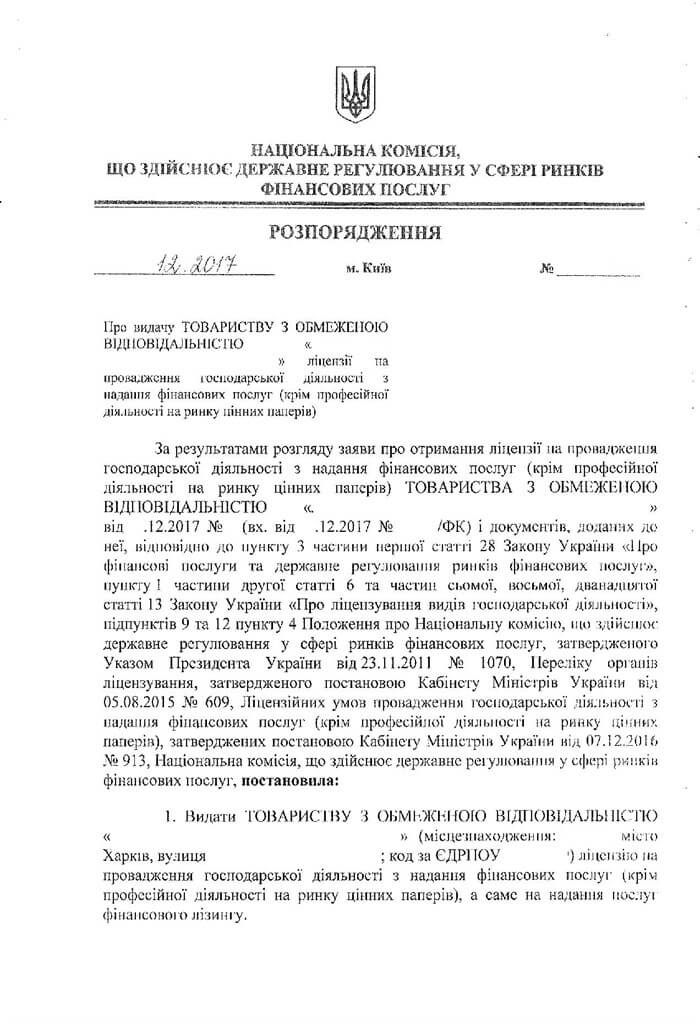

Financial services license

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

- Receive any license from the National Bank of Ukraine (hereinafter - the NBU);

- Develop and consult on the package of documents required for obtaining a license and carrying out further business activity;

- Ensure the company’s inclusion in the the State Register of Financial Institutions of Ukraine (if necessary);

- Assist in drafting additional documents (rules and regulations, agreements);

- Help to obtain an audit report and to successfully undergo the audit, we can offer our partner auditors;

- Analyze a set of the documents provided by the Client, and assist in collecting missing documents;

- Advise on the requirements for business activity depending on the type of license (factoring, leasing, guarantee, lending services, etc.).

Documents required for obtaining a license

The Client shall provide us with the following list of documents for the Financial services license obtainment:

- Articles of association;

- Financial records;

- Audit report;

- Certificate on availability and compliance of the form of organization of accounting, hardware and software with legal requirements;

- Copies of internal rules and regulations on financial services provision;

- Copies of diplomas and certificates confirming that the director and chief accountant have successfully completed the professional development programme;

- Copies of the director’s and chief accountant’s employment records;

- Certificate confirming compliance of the director and chief accountant with the requirements of the law;

- Certificate on the premises, technical equipment and software available;

- Financial Services Agreement Templates;

- Schematic representation of the ownership structure.

Service packages offers

- Oral advice on the requirements for financial companies and their officials when obtaining a financial license

- Oral consulting on the procedure for the provision of financial services, the list and form of documents for obtaining a financial license

- Oral advice on the conduct of the company's activities in accordance with the requirements for each type of license (factoring, granting loans, leasing, surety, loan, etc.)

- Oral advice on the requirements for financial companies and their officials when obtaining a financial license

- Oral counseling on the procedure for the provision of financial services

- Oral advice on the conduct of the company's activities in accordance with the requirements for each type of license (factoring, leasing, granting loans, surety, loan, etc.)

- Preparation and submission of documents to the NBU for the issuance of a financial license and entry into the register of financial institutions without a guarantee of consideration

- Monitoring the decision to issue a license for the provision of financial services

- Oral advice on the requirements for financial companies and their officials when obtaining a license

- Oral counseling on the procedure for the provision of financial services

- Oral advice regarding the conduct of the company's activities in accordance with the requirements for each type of license (factoring, leasing, surety, loan, etc.)

- Preparation and submission of documents to the NBU for issuing a license and entering into the register of financial institutions

- Monitoring the decision to issue a license for the provision of financial services

- Accompanying the Client when connecting to credit history monitoring systems

- Advising the Client on the possibility of providing services related to the financial sector

Legal advice on obtaining a financial services licence

If you want to understand what type of financial services licence you need and how the process will work, you can contact us for an initial consultation.

With such a consultation you will get answers to the following questions:

-

What are the steps involved in applying for a Financial Services Licence?

-

How long does the whole process take?

-

How much does it cost to get a financial services license?

-

What advantages do you gain by working with us?

The cost of the introductory consultation is included in the price to be paid for the main service.

The period of obtaining a license depends on a number of factors, but it usually takes about two weeks.

In addition, there is a number of other legal actions to be carried out in advance that also require some time. They include:

- Registration of a legal entity - about two days.

- Inclusion into the State Register of Financial Institutions - about 35 days. This stage involves consulting on the requirements for the financial institution, assistance in obtaining an audit report, etc.

The services mentioned above are not included in the cost of service for obtaining a license and are provided via separate agreement with our lawyers.

Thus, the whole procedure for obtaining a license, including all the necessary steps, can take about two months. But we can speed up each of the stage upon the agreement with our specialists.

A one-time fee in the amount of one living wage for able-bodied persons is charged for the issuance of a license. The amount of this payment changes several times a year. You need to pay exactly the amount that was established on the day the license was issued. You can not worry about this, we will provide you with the payment details and indicate the current amount.

Over the years of continuous operation, we have developed the most convenient scheme of cooperation, since we have experience in working with managers and top-managers of financial institutions, as well as with external and internal attorneys of the companies.

In addition, we have sufficient expertise to:

- Provide you with a turnkey service (registration, inclusion in the Register, licensing);

- Assist you in obtaining any kind of the Financial Services License;

- Assist in arranging the further activities of any financial companies.

Why us

We are ready to help you!

Contact us by mail [email protected] or by filling out the form:Our successful projects

Answers to frequently asked questions

We can obtain a Financial Services License for any type of activity subject to licensing according to the present law of Ukraine.

The total work experience of the financial institution’s (except the pawnshop) director shall be at least 5 years, and at least two years of the overall experience shall be in managerial positions.

No. When including the company into the State Register of Financial Institutions, the Client shall already know what license the company intends to obtain in the future.

The amount of the authorized capital depends on the type of a financial institution and the number of financial services the company intends to provide. The amount of the authorized capital of a financial company, which will provide one type of financial services, shall be not less than UAH 3 million, and if it intends to provide two or more types of financial services, then it shall be not less than UAH 5 million. In addition, there are exclusive requirements for pawnshops and some other types of licenses.

According to the law of Ukraine, financial institutions are legal entities, which are registered in the manner prescribed by law and provide one or more types of financial services.

To provide several types of financial services, the company shall obtain several types of licenses. This means that a legal entity can carry out four types of activities at once:

- Lending, including on the terms of financial credit;

- Guarantee services;

- Factoring;

- Finance lease.

However, there are also so-called “exclusive” types of licenses.

Thus, if a company, for example, intends to provide services related to fund management for purchasing goods in groups, it can obtain only one type of license, which is exclusive.

If You want to obtain Financial services license easy and fast - call us!