Open an account in Ukraine for a foreigner

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

-

Consulting on the procedure and process for opening a bank account in Ukraine.

-

Compiling the required document package.

-

Obtaining additional documents for a foreigner to open an account, as requested by the bank.

-

Accompanying the client during their visit to the bank.

-

Assisting with the completion of bank applications and questionnaires.

-

Overseeing the account opening process and communicating with bank managers.

Documents required

Opening a Bank Account in Ukraine for Foreigners

Our company assists foreign clients in opening bank accounts, managing the entire process on their behalf. Ukrainian banks generally require the client’s personal visit to a bank manager for document submission and verification. However, all preparation and coordination tasks are handled by our legal experts.

By delegating the account opening process to our team, you save time, minimize the need for lengthy bank visits, and avoid bureaucratic complications.

Our advantages:

- Minimal involvement on your part: You’ll only need to spend about an hour at the bank.

- We’ll help you choose the type of account and the bank that best meets your needs in Ukraine.

- Beyond account opening, we can assist with other matters in Ukraine, such as property acquisition, business establishment, and support for other activities.

We ensure your business or personal financial activities in Ukraine begin without unnecessary obstacles!

Timeline and Costs for Opening a Non-Resident Bank Account in Ukraine

The time required to open a bank account for a non-resident depends on the selected bank, account type, and the availability of necessary documents:

- For foreign legal entities, accounts are usually opened within 2–5 business days, provided all documents meet the bank's requirements.

- For non-resident individuals, the process is quicker, typically completed within 1–2 business days.

However, according to Ukrainian law, banks are not bound by strict deadlines for verifying client documents. The speed of opening an account largely depends on the quality of the documents submitted and the clarity of explanations provided to the bank, such as the nature of your activities and the source of funds.

Remote account opening via power of attorney may take longer. The power of attorney must first be pre-approved by the bank. Depending on the bank and the complexity of the compliance review, this process can take from a few days to several months. The power of attorney requires notarization, translation, and legalization if issued abroad.

Please note! The timeline for opening an account varies depending on individual circumstances, as banks may request different compliance documents depending on the specific case.

Are There Any Costs Associated with Opening a Bank Account?

When opening a bank account in Ukraine for business or personal financial purposes, it is essential to account for all potential expenses. Key costs associated with opening a bank account for a non-resident include:

- Ukrainian SIM card and mobile operator fees: A Ukrainian-registered phone number is often required for transaction confirmations and online banking access. This number is linked to the bank's system for secure authentication.

- Bank fees: Banks charge monthly service fees, which vary depending on the bank and the type of account (e.g., corporate or personal).

- Notarization fees: Powers of attorney and identity documents for founders and beneficiaries may require notarization, especially if the individuals are outside Ukraine.

- Translation and legalization of documents: Foreign documents must be translated into Ukrainian and undergo apostille or consular legalization procedures.

During a consultation, we will help you identify all potential expenses associated with the process and provide tailored recommendations for optimal solutions. This ensures you are fully prepared and avoids unexpected financial obligations or surprises.

Service packages offers

- Obtaining a Tax Identification Number (TIN)

- Assessing the Client’s needs and selecting a bank for account opening

- Document review and preparation of the application package

- Purchasing a Ukrainian SIM card (phone number)

- Accompanying the Client to the bank and assisting with document (form) completion*

- Legal oversight of the compliance process, communication with the bank manager*

- Collecting from the client and submitting additional documents requested by the bank following application review

- Assisting the Client with setting up online banking

- Assistance in obtaining a digital signature (PrivatBank)

*The package includes 2 hours of lawyer support with the bank. In case of complications, additional hours are billed at UAH 4,000 per hour.

**Document translation is not included in the package price.

- Obtaining a Tax Identification Number (TIN)

- Assessing the Client’s needs and selecting a bank for account opening

- Providing a power of attorney template for account opening

- Document review and preparation of the application package

- Purchasing a Ukrainian SIM card

- Submitting documents to the bank and completing required bank forms

- Legal oversight of the compliance process, communication with the bank manager*

- Collecting from the client and submitting additional documents requested by the bank following application review

- Assisting the Client with setting up online banking

*The package includes 2 hours of lawyer support with the bank. In case of complications, additional hours are billed at UAH 4,000 per hour.

**Document translation is not included in the package price.

Which Type of Account Should a Foreigner Choose: What Account Is Needed and for What Purpose?

For a foreigner planning to open an account in a Ukrainian bank, the choice of account type depends on the intended purpose and specific needs. We assist in selecting the most suitable account type based on your requirements and provide comprehensive legal support throughout the account opening process.

Main types of bank accounts for foreigners in Ukraine:

- Current Account: Ideal for daily expenses and banking transactions, such as transfers, receiving income, or salary payments. This type of account is a great choice for foreigners residing or working in Ukraine on a permanent basis.

- Deposit Account: Designed for securely storing funds while earning interest. This type of account is suitable for long-term financial investments but is not intended for regular expenses or daily transactions.

- Investment Account: Specifically tailored for purchasing real estate, securities, or other capital investments. When opening this type of account, the bank will require documentation verifying the source of funds.

Which Bank Should a Foreigner Choose for Opening an Account in Ukraine?

For a foreigner planning to open a bank account in Ukraine, selecting a bank with high reliability, user-friendly services, and advanced digital capabilities is crucial. While we collaborate with all banks, we recommend focusing on major financial institutions that offer a widespread branch network, modern online banking services, and support for electronic digital signatures to simplify account management. Some of the banks that meet these criteria include PrivatBank, PUMB, Oschadbank, Raiffeisen Bank, and Ukrsibbank.

Advantages of selected Ukrainian banks for non-residents:

- Access to international transfers: These banks offer a wide range of services that make international transactions easy and efficient.

- High-quality technical support: They provide prompt service and dedicated assistance to non-residents for any inquiries or issues.

- Remote account management: Modern online banking systems enable users to manage their finances from anywhere in the world.

- Electronic signature: This feature ensures convenience when submitting applications, reports, or accessing banking services.

When choosing a bank, it is also important to consider the tariff plans and fees for international transactions, as these can vary significantly between banks. Our company is ready to assist you in selecting the most optimal option that will be both cost-effective and convenient for your specific situation.

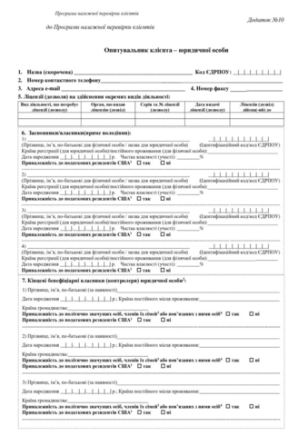

What Documents Does a Foreigner Need to Open a Bank Account in Ukraine?

To open a bank account as a non-resident individual, you must provide the following documents to the bank:

- A passport containing details of your registered address or place of residence

- A tax identification code issued in Ukraine

- A document confirming the right to temporary or permanent residence in Ukraine, including registration of your place of residence, or a document verifying your legal stay in Ukraine

If the foreign national is a U.S. citizen, the bank may request their TIN. In most cases, this set of documents is sufficient to open an account.

For opening a corporate account for a non-resident legal entity:

- Charter (except for LLCs operating under a model charter))

- Extract from the register of legal entities

- Description

- Order appointing the director.

- Ownership structure (it is advisable to have this document prepared in case the bank requests it)

- Financial reports for previous periods (if available)

- Minutes of the general meeting/a resolution by the sole participant on the director appointment

- Extract from the register of non-profit organizations (for non-profit entities)

- Description of activities

If the LLC previously held bank accounts, the bank may request additional information about those accounts.

For opening an account for a representative office of a foreign company or non-governmental organization:

- Power of attorney for the Head of the Representative Office

- Registration documents of the parent company

- Extract from the trade/banking/court register concerning the parent company

- Information about the ultimate beneficial owner

- Details of open accounts in Ukraine and abroad

- Certificate of registration of the Representative Office

- Statistical certificate

- Certificate of tax registration for both the Representative Office and the parent company.

- Passport and ID code of the Head

In certain cases, if the manager or director is a foreign national, additional documents may be required, such as a copy of their residence permit and a rental agreement for housing. Some banks also require the legal entity’s manager to be their client. In such cases, a personal account for the manager must be opened first.

The above list of documents is not exhaustive—banks may request additional items, such as proof of initial capital contributions, a description of business activities, or a business plan. Therefore, we recommend that clients be prepared for potential requests.

Please note! Personal presence is typically required for the individual or the manager of the legal entity to open an account. However, we can facilitate remote account opening with certain banks, significantly simplifying the process for non-residents.

The procedure for preparing the necessary documents to open a bank account for a non-resident includes:

- Requirement Analysis: We carefully examine the requirements of the bank chosen by the client for foreign founders and non-residents. If needed, our specialists assist in selecting a bank that best meets the specific needs.

- Preparation of Founding Documents: We ensure that corporate documents are prepared in compliance with Ukrainian legislation and the bank’s requirements. If the documents were issued abroad, they must be translated and legalized (either through apostille or consular legalization).

- Preparation of Power of Attorney: If necessary, we draft powers of attorney to represent the client’s interests at the bank.

Submission of the Application and Communication with the Bank: We prepare and submit all required documents to the bank, complete bank application forms and questionnaires, and assist with all communication with the bank’s representatives.

Why us

Our clients

Our successful projects

Procedure for Opening a Bank Account in Ukraine for Foreigners

The process of opening a bank account for a non-resident involves several stages, each requiring careful preparation to ensure a smooth procedure within expected timeframes. To open an account, the bank must identify the individual or the director of a legal entity (KYC procedure). This usually necessitates an in-person visit to a bank branch. For personal accounts, some banks, such as Monobank, allow applications to be submitted online, with cards issued without requiring a branch visit. However, for legal entities, the procedure is more complex. Banks typically require the company director to appear in person to verify documents and confirm their details.

Thus, there is a specific algorithm for opening an account for non-resident legal entities:

- Visit the bank branch with the required documents and complete the necessary forms

- Bank verification of submitted information

- Opening an account or the bank requesting additional documents or comments. After submitting the documents and addressing the issues, you must re-submit the documents

- Set up banking services

- Open foreign currency accounts and obtain an electronic signature (if provided by the bank)

Some banks, such as PrivatBank, offer remote account opening options if the company director is already a client of the bank. In such cases, the application can be completed online, with a visit to a convenient branch for submitting required document copies. We assist our clients in online account opening, helping them save time and avoid unnecessary complications when working with banks.

Opening Accounts for Non-Residents in National and Foreign Currencies

Can non-residents open bank accounts in foreign currencies in Ukraine? Yes, they can. A foreigner, as an individual, can open accounts not only in the national currency (UAH) but also in foreign currencies. Typically, the process begins with opening an account in UAH, which is mandatory in most Ukrainian banks. This account provides foreigners with basic access to banking services and enables them to perform essential operations. Once the UAH account is active, the individual can apply for a foreign currency account. These applications are usually submitted online through the bank’s personal banking portal. Upon successful approval, the account will be opened in the selected foreign currency.

Permissible Banking Transactions for Non-Resident Companies in Ukraine

Non-resident companies can open current accounts in Ukrainian banks to carry out a limited range of operations. Although the scope of transactions is restricted, the available services allow companies to efficiently handle core business processes and maintain international connections. The main permissible transactions include:

- Receiving funds from abroad: Transferring financial resources to the account from a parent company or business partners.

- Foreign currency transactions: Converting foreign currencies into Ukrainian hryvnia and vice versa when needed.

- Settlements with Ukrainian partners: Paying for services, rent, or salaries for employees in Ukraine.

- Payment of dividends and outward transfers: Distributing profits to founders, subject to Ukrainian legal provisions.

Tax payments: Paying taxes and contributions if the company is registered with the Ukrainian tax authorities.

Answers to frequently asked questions

Can a bank refuse to open an account for a foreigner?

Yes, a bank may refuse to open an account for certain individuals, such as those holding citizenship of Russia or Belarus, individuals under sanctions, or those who fail to provide the necessary documents to the bank. Additionally, a bank may decline if it does not wish to have you as a client, for instance, if it considers your type of activity or the origin of your funds suspicious. In such cases, the bank may continuously request documents and additional information.

Is it possible to open an account for a legal entity through an authorized representative?

Yes, some banks allow this, and our lawyers successfully open accounts for our clients via a power of attorney, without requiring their visit to Ukraine. However, banks typically request the legal entity’s director to visit the bank in person.

Can someone other than the director have access to banking?

Yes, it is possible to add another person who will have access to the bank account.

What currencies can a bank account in Ukraine be opened in?

In any currency offered by the bank. Typically, these include the Ukrainian hryvnia (UAH), US dollars (USD), and euros (EUR).

Challenges for Non-Residents in Opening a Bank Account

While opening a bank account in a Ukrainian bank is often easier than in European banks, in practice, it can still be challenging to succeed on the first attempt. This is because banks thoroughly verify clients, their documents, and the information they provide. In our experience, non-residents frequently encounter difficulties opening a bank account on their own because:

-

The bank requests additional documents or explanations after the initial submission.

-

The application form was filled out incorrectly.

-

The bank manager neglects to follow up and asks the client to visit the bank multiple times.

These obstacles can cause significant delays, which in turn negatively affect both business operations and daily life. We help our clients avoid these issues, saving them time and effort.

Conducting High-Value Transactions Through a Bank Account in Ukraine

High-value transactions conducted through a bank account in Ukraine may be subject to financial monitoring, which involves thorough scrutiny by the bank of each such transaction. Typically, financial monitoring applies to:

-

Bank transactions exceeding 400,000 UAH;

-

Certain cash operations;

-

High-risk transactions, such as those involving offshore jurisdictions, "toxic" countries, or individuals with questionable business reputations.

In such cases, the bank may request additional documentation or explanations regarding the purpose and origin of the funds. This can result in delays in processing the transaction. It is a critical issue, as failure to provide the required information on time could lead to account suspension or transaction delays. Our specialists are ready to assist you with preparing all necessary documentation and overseeing financial transactions to prevent delays and avoid issues with the bank.

Managing Personal Accounts by Proxy

In most cases, an individual can grant another person the right to manage their account. To do this, the following steps are required:

-

Provide a notarized power of attorney granting authority to manage the account.

-

Add the designated person to the client-banking system and authorize their access.

This process allows the authorized person to perform account operations without restrictions. However, it is important to note that the bank may request additional documents or explanations, depending on its internal policies.

Closing a Bank Account in Ukraine

Alongside requests to open bank accounts for non-residents, we also receive inquiries about how to properly close a Ukrainian bank account for a foreigner. Closing a bank account for a non-resident is typically not a complicated procedure. In the absence of any claims or outstanding balances, and after settling accounts with the bank, the account can be closed upon the client’s request. In some banks, it is possible to submit a request to close the account online. However, the bank is required to verify the identity of the account holder in all cases. Therefore, a visit to the bank or identity verification via online banking will be mandatory to close the account.

If you plan to conduct business in Ukraine that requires a bank account, feel free to contact us! We can assist you in opening both personal and corporate accounts.

Why Choose Pravova Dopomoha Law Firm for Opening a Bank Account in Ukraine?

When you choose the legal firm "Pravova Dopomoha," you gain a reliable partner in Ukraine who understands your needs and is committed to providing efficient solutions. We recognize that opening a bank account is a crucial step but can be challenging for non-residents. Our goal is to make this process as simple and convenient for you as possible. Whether you are opening an account as an individual non-resident or for a legal entity, we consider every possible nuance and help you avoid any issues during the process, always staying by your side.

In the past two years, we have successfully opened more than 30 bank accounts for foreign clients. Our extensive experience working with non-residents in Ukraine allows us to navigate the requirements and intricacies of the process effectively, guaranteeing a high standard of service. With us, you get:

-

Customized bank selection: We know how to choose the bank that best suits your needs, taking into account all specific requirements and potential risks.

-

Remote account opening: Save time on travel and document collection—we handle everything remotely (if needed) with maximum convenience for you.

-

Comprehensive support: We take care of all stages, from document preparation and proof of funds to obtaining electronic signature keys, tax identification numbers (TIN), and any other necessary actions.

-

Reliable guidance: Our team supports you from selecting the bank to submitting documents and coordinating all details with the bank.

-

Translation and legalization: We ensure proper translation and legalization of all required documents for opening the bank account.

-

Security and confidentiality: Your data is fully secure—we guarantee confidentiality at every stage of the process.

-

On-site support: We can arrange for a bank manager to visit our office or any bank in Ukraine for your convenience.

With us, opening a bank account is fast, secure, and hassle-free!