How a company can attract private financing in Ukraine: advice from investment lawyers

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Since the start of a full-scale war, many areas of Ukrainian business are on the verge of survival, and there is not much to talk about the current lack of funds for businesses. After the repulsion of Russian military aggression, the Ukrainian economy is expecting explosive growth, but companies lack liquidity right now. There are state financing programs, grants, and soft loans, but these tools may not be available to all enterprises.

Ukraine’s investment culture is still developing, and very few are aware of the attraction of private financing. This process is safe for both sides if it is done properly in legal form. Different mechanisms have already been developed in practice, in particular:

- sale of corporate rights;

- conclusion of loan (financial assistance) agreements;

- acquisition of non-current assets by investors;

- investment agreements, etc.

In this and the following publication we share our experience in attracting foreign investment in Ukrainian companies.

What is crowdinvesting and crowdlending in Ukraine?

In general and in simple words, it is the attraction of funding from a large number of private investors for joint profit making. You can share a “fish” or a “rod”, it all depends on your circumstances.

There is not much difference between the two concepts, crowdlending is about raising a loan, crowdinvesting is about other possible mechanisms. There are no clear definitions in the law, so you need to understand the specific schemes for attracting investment.

Loan (financial assistance) to Ukrainian company

The essence of this concept is clear in most cases: you attract financing from individuals and legal entities and return with interest. We have already written about financial assistance in our publication.

You can conclude a simple written loan or certify the agreement by a notary. If there is a default on an obligation, a notarized agreement can be filed for collection without a court order. The creditor goes to a notary to execute a writ of execution and to a public or private enforcer for forced collection (there are restrictions on forced collection during martial law).

To simplify taxation, investors, who are physical persons, sometimes ask to “fix” the interest in the body of the loan and make it interest-free. For example, a loan of UAH 100,000 at 15% per annum is specified in the agreement as an interest-free loan of UAH 115,000 per annum. This option obviously carries risks for the company[any if, for example, there is an intention to repay the loan earlier.

Borrowers may offer loans in foreign currencies. Under the general rule, payments in Ukraine are only allowed in hryvnia, and there are restrictions on cash turnover (10,000 hryvnia a day between businesses, and 50,000 hryvnia between individuals). The only thing is to peg the size of debt in hryvnia to the exchange rate of foreign currency at a certain date. At the same time we know the ways of full settlement in foreign currency.

Big investors can ask to secure a loan with a pledge or a surety. Such agreements should be legally checked in order to prevent the manipulation of the terms and conditions to take away assets from the company. For example the condition of early collection of debt in the case of any breach of contract terms would give the unscrupulous creditor a wide range of possibilities to put pressure on the debtor.

How do we help our Clients?

- We do not use notary templates, but develop balanced loan agreements without “pitfalls”;

- We work out the legal nuances of depositing and returning financing;

- We advise on the correct transfer of the company’s property in pledge;

- We fully support the transaction.

Sale of a share in a Ukrainian business to a foreign investor

It is not uncommon in the investment market for companies to raise financing through the sale of corporate rights. Statistically, it is likely that your company is operating as a limited liability company. Bypassing the procedural nuances of registration (we wrote about them, for example, here), below we will share the essential points from our professional experience.

It should be decided on the legal entity where the investors will be added as its members. It can be your operating company, a legal entity where assets are accumulated or a project company, specially created for the purpose of investment (special purpose vehicle).

Unfortunately, widespread corporate raiding in Ukraine is a common notion, which includes many schemes, and generally boils down to the fact that individuals get “inside” the company and begin the legal processes of seizing it: through the courts, registrars, notaries, fictitious deals, fake management. There is no need to be afraid of it, but one should be legally armed.

You should work out such a charter of the company that would secure your company’s management and provide investors with transparent algorithms of control and participation in management. You need to determine, in particular:

- options for distributing profit;

- preemptive rights of the new members;

- powers the management and decisions that can only be made by the shareholders’ meeting;

- the withdrawal procedure for investors;

- options for buying shares back from investors (please read about the charter features here).

If you intend to attract investment in stages, you need to take care that previous “waves” of investors do not become a barrier to attracting new members (this includes their preemptive rights). You should also control how much business you can safely sell without the risk of losing control.

When formalizing the relationship, it is likely that you and the investor will enter into an agreement for the sale and purchase of corporate rights (may have another name), in which you will formalize the terms of further cooperation (the provisions must comply with the charter’s provisions). There are also other options of “entry” of the investor (for example, increase of the authorized share capital).

How can we help?

Usually we:

- check the potential investor (read about Russian beneficiaries here and here);

- develop a charter for specific purposes;

- prepare an agreement for the sale and purchase of corporate rights;

- advise on protection of the business assets from unscrupulous investors;

- accompany the notarial transaction.

In fact, we do everything to make sure you get financing safely and stay focused on growing your business.

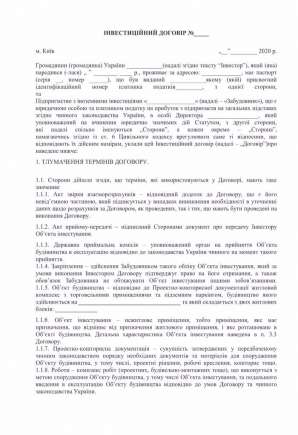

In the following publication read about how you can use an investment agreement, secure your assets and cooperate with investment agents.

You can find out the cost of investment project support from our specialists.

We will ensure protection of your funds and interests. We will take care of the safe attraction of foreign investments for development of your business.