How is CFC profit calculated in Ukraine in 2023?

Cost of services:

Reviews of our Clients

Next year (2023) will be the first year of CFC filing in Ukraine (for 2022). That is why last year many people rushed to get rid of CFCs: some restructured their financial flows, and some deliberately moved into this year and will report on CFCs for the first time next year. By the way, let us say that any "manipulations" with foreign companies already have to be reported this year, but not yet within the framework of CFC reporting, but by notifying the tax authorities. But let's take it one step at a time.

When shall the CFC report be submitted in Ukraine?

The CFC reporting period is a calendar year.

The CFC report must be submitted by the Controller, together with the annual declaration of property status and income for a physical person (i.e., by May 1 of each year for the previous year). A special appendix to the tax declaration has been developed for this purpose.

The CFC report must be accompanied by the CFC financial statements confirming the amount of profit of the CFC for the reporting year.

If the legislation of a foreign jurisdiction does not provide for the obligation to draw up financial statements, the controlling person must still draw them up, and such statements must comply with international standards. For example, if the CFC's controller has a company in an offshore jurisdiction, which has never (until recently) had the requirement to draw up financial statements, and there are no physical statements - the Ukrainian tax authorities will not care, and the individual will still need to ensure the preparation of statements (alternatively, you may order them from Cypriot auditors).

In addition, the tax authorities have the right to request that the financial statements of the CFC be audited (by a certified company).

Without reporting, it is impossible to check the correctness of the CFC tax base calculation, which is why the Tax Code contains such requirements.

Moreover, our tax office has obtained the right to do cross-checks, i.e. to check counterparties for the purpose of reconciliation of the documents provided.

You may also like: Cases of CFC Exemption from Taxation in Ukraine

What shall the CFC report include?

In addition to the standard information (company registration data, the size of the controller's share, the ownership structure of the company), the CFC report must also include certain financial data:

- the amount of CFC's income;

- calculation of adjusted CFC profit (according to the rules set forth by the Ukranian legislation, which will be discussed below);

- the grounds for CFC tax exemption in Ukraine (if any);

- dividends received by a foreign company from Ukrainian legal entities

- dividends paid to the CFC's controller;

- transactions with non-resident related parties ;

- the number of CFC's employees;

- information on CFC profits from a permanent establishment in Ukraine (if any).

Let us remind you that the person responsible for paying tax on CFC profit is the CFC controller (individual or legal entity).

The individual will have to increase his/her taxable base by the amount of CFC profit (in proportion to the share owned by the individual in the CFC).

You may also like: Strengthening Substance Requirements in the European Union in 2022

How to calculate CFC's adjusted profit?

When calculating the CFC adjusted profit in Ukraine, the following peculiarities shall be taken into account:

1. The financial result of CFC operations with securities and corporate rights is calculated as follows:

- If the foreign company incurred losses from securities transactions following the results of the year, such losses can reduce CFC tax base of the following reporting periods (not the current one).

- If the foreign company made a profit from securities transactions following the results of the year, this profit will increase CFC tax base of the current reporting period (not carried forward).

2. Expenses from devaluation of non-current assets (fixed and intangible assets) are recognized only at the time of their sale.

3. Only 30% of interest (on loans) can be charged to CFC expenses.

4. Revenues and expenses of CFC on transactions with non-resident related persons shall be determined taking into account compliance with "arm's length" principle (i.e. they shall meet market conditions, otherwise certain adjustments are subject to application):

- If a CFC "under-receives" profit from transactions with related parties, the tax base of the CFC is increased by the amount of such shortfall.

- If CFC's expenses in transactions with related parties are overstated, CFC's profit is increased by the amount of overstated expenses

The logic is quite obvious: all transactions must be market-based. Non-market transactions will be "market-leveled," and taxes will have to be paid on prices that the market considers fair.

5. The CFC profit can be reduced by the amount of dividends received by it from another CFC (the same controller).

For example, if a Cypriot company is a member of a British company (with a person of Ukrainian nationality standing over both companies), then the profit of the Cypriot company can be reduced by the amount of accrued (paid) dividends to it from the British company. The same approach will be applied if the CFC owns a share in a Ukrainian legal entity.

6. If the CFC receives income, for example, through a permanent establishment, which is located and registered in Ukraine, then the adjusted profit of the CFC is reduced by the amount of profit received through such a permanent establishment.

For 2022 the adjustments mentioned in clauses 5 and 6 will be applied. The remaining adjustments will be applied from 2023 onwards.

The adjusted profit of each CFC is determined separately.

You may also like: New Rules for Application of Double Taxation Treaties

What is the difference between a CFC report and a notification to the tax authorities on the acquisition, change or termination of a share in a CFC?

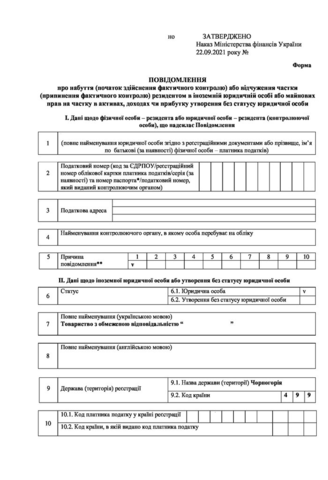

Please note that in addition to reporting on CFCs, the Tax Code also contains a requirement to notify the tax authorities within 60 days of each CFC acquisition / change of interest in a CFC / cessation of control over a CFC / liquidation of a CFC.

This norm entered into force on January 1, 2022, and, consequently, it does not apply to all operations with CFCs, which took place in 2021. Anything that took place in 2021 need not be notified to the tax authorities.

These two reports, starting from 2023, will coexist in the following way: every year by May 1, the client will have to disclose available CFCs as part of the annual return. In addition, if during the year the client's share in the CFC changes, or he terminates his participation in the CFC, or liquidates the CFC, he will additionally have to notify the tax authorities as soon as the respective event occurs.

If you are already planning to prepare the financial statements of your CFC today, it is the right decision. We can help you with this task.

Our lawyers will analyze the CFC's financial statements and help determine the adjusted profit of the CFC to be taxed in Ukraine.

In addition, we will develop a set of emergency measures aimed at reducing the tax burden of the CFC, as well as strategic solutions for the preparation of the group of companies in the CFC reporting.

Our clients