Cases of CFC exemption from taxation in Ukraine

Cost of services:

Reviews of our Clients

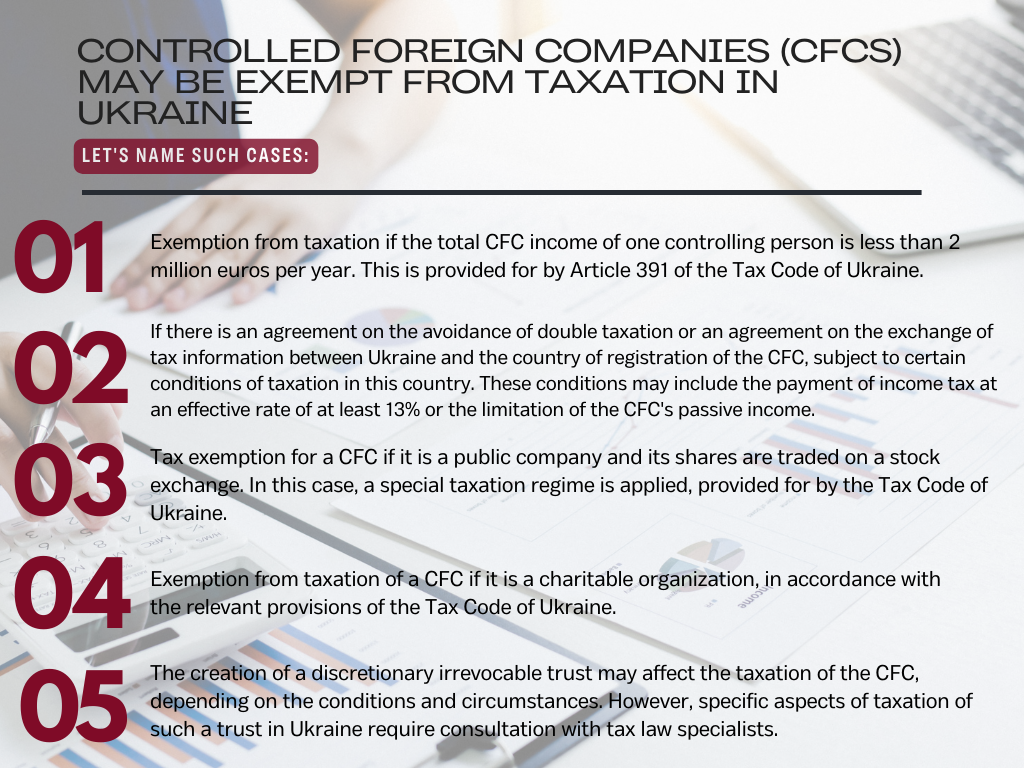

We have already talked in general about the cases when the profit of a CFC can be exempted from taxation in Ukraine. In this article, we will dwell on each case in more detail and tell you about the subtle aspects of this procedure.

So, the first case of CFC exemption is when the total aggregate income of all CFCs of one controlling person does not exceed the equivalent of EUR 2 million per year.

Please note! The income of all foreign companies belonging to one person is taken into account. If an individual is not the sole owner of several foreign companies (i.e. when there are several members in the company) the income belonging to his/her share in each foreign company is summed up.

The second case: if there is a Double Taxation Avoidance Treaty between Ukraine and the foreign jurisdiction (where the CFC is registered), or an agreement on exchange of tax information (most countries have such treaties), and at least one of the conditions is met:

- a CFC pays income tax in the country of registration at the effective rate, which is not less than 13%;

- the share of passive income of the CFC is not more than 50% of the total income of the CFC.

The law does not contain a concept of what should be understood under the “effective rate” of profit tax and, as a result, it is not clear whether companies from such countries as Malta, Estonia, Georgia, Latvia, Poland (where profit tax is not paid until its distribution to the shareholder) will be subject to taxation.

At this point it is not clear whether the tax office will look at the standard rate of profit tax in Malta, which is 35% (clearly more than the threshold of 13%), or will focus on the tax actually paid, which may be 5% (for trading companies) or 0% (for holding companies).

Similarly, it is not clear whether the tax authorities will look at the Estonian tax rate of 20% or proceed from 0%, which is recorded in the financial statements.

In our opinion, we should not expect that the standard income tax rate will be taken into account. It is very likely that the tax service will analyze the data from the financial statements of a foreign company (based on the experience of neighboring countries, such as Russia), and if it is established that in fact the company did not pay any tax at all in the reporting year, then it is unlikely to count on tax exemption due to the application of a rate exceeding 13%.

As for determining the type of income (active or passive) so that one can count on tax exemption under the second criterion, one must first analyze the essence of the income.

Let’s look at the example of investment income from stock trading.

The laws of different countries classify this type of income in different ways. For example, in Cyprus, this type of income is “active”. Consequently, if the Cypriot company only trades in shares (and investment income is 100% of its income), the company will be considered as active, despite the fact that it is not involved in the standard trading processes.

If the company has exclusively or predominantly passive income (rents out real estate, receives dividends, interest, royalties, etc.), but it has a real economic presence in the country of its registration – this company will be considered “active” for the purposes of our legislation.

Each case has to be considered individually. For example, if a “passive company” is equipped with sufficient substance (real presence), it can become “active” for our tax services, and it will be the basis for exemption from taxation.

You may also like: How to Withdraw Money Abroad During the War in Ukraine?

Other cases of tax exemption for CFCs in Ukraine

In addition to the cases discussed above, CFC profits are also exempt from taxation if:

- a CFC is a public company and its shares are traded on the stock exchange;

- a CFC is a charitable organization.

Another case of “exception to the rule” is the establishment of a discretionary irrevocable trust. The very establishment of such a trust (or fund) does not, in and of itself, exempt the founder from being a controlling person, nor does it exempt it from the obligation to declare the establishment of the trust (fund).

However, the notification to the tax authorities of the trust establishment essentially ends there, because until the beneficiaries (whose names are not known in advance) receive their income, there is essentially no one to collect taxes from.

From the point of view of maintaining control, trusts are divided into two types:

- revocable;

- irrevocable.

The difference between the two is simple. If the trust is revocable, then its founder can manage the assets of the trust, can at any time recover the transferred assets and initiate the liquidation of the trust.

If the trust is irrevocable, the founder cannot remove the assets from the trust and cannot decide the “fate” of the trust (liquidate it, distribute the assets, etc.).

From the point of view of determining the beneficiaries, trusts are divided into:

- fixed;

- discretionary.

In a fixed trust, the distribution of income and assets is based on clear instructions from the founder, and the beneficiaries are listed by name from the beginning.

In discretionary trusts, the beneficiaries are defined as “some class”, without naming them (e.g., “children of my first spouse, born to me”). The trustee of a discretionary trust has the power to segregate specific individuals from that class and to distribute income and assets among them at its discretion. Thus, the beneficiaries of a discretionary trust are not predetermined, and remain unknown to anyone.

Our tax code also suggests what conditions a “discretionary irrevocable trust” must meet in order to be outside the scope of Ukrainian taxation.

For example, the founder of such a trust:

- has no right to give instructions on the distribution of profits in its favor;

- has no right to return the property previously transferred as part of the assets of the trust (this is the principle of irrevocability);

- has no right to terminate the trust (i.e., liquidate it, terminate the trust deed).

In fact, the founder does not have the right to exercise actual control by any means over the trust.

As for the beneficiary of a trust, he or she is defined as a person who:

- has the right to demand the accrual and payment of income;

- has the right to dispose of the property of the trust;

- has the right to receive part of the trust’s income in the event of liquidation, etc.

The beneficiaries of a fixed trust do run the risk of being recognized as controlling persons of the CFC, and may be forced to pay taxes if their names are known in advance.

However, if you specify the beneficiaries in general classes, or somehow streamlined (discretionary trust) - this risk is mitigated, because their names are not known in advance, and will be determined in the future by the decision of the trustee.

It turns out that at the time of the trust establishment, the tax authorities must be notified of this fact (the obligation is imposed on the founder). But since the founder loses control over the trust (in fact, “withdraws from” it), he/she has no obligation to pay taxes on the undistributed profits of the trust in Ukraine.

This obligation (to declare and pay taxes) does not arise for the beneficiaries either - as long as their names are not known to anyone, and as long as there is no distribution of income.

Each CFC case is unique. But each has a simple solution, which we will help you find.

Please click here to see the cost and conditions of the consultation.