Is it possible to prevent the tax authorities from conducting an audit?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

When running a business in Ukraine, both individual entrepreneurs and legal entities of various organizational structures may face tax audits conducted by regulatory bodies. Is it possible to prevent tax inspectors from conducting an audit? This question often concerns entrepreneurs, and we are ready to help you navigate it.

We not only provide valuable information but also offer practical assistance. Before a tax audit begins, thorough preparation is essential. Our team of accountants and lawyers will help you understand your risks and offer optimal solutions even before the audit commences. If avoiding the unpleasant consequences of the audit isn't possible, we'll develop a plan to minimize its impact. Your involvement will be minimal, as we'll handle the most challenging aspects.

You may also like: Business Taxes in Ukraine: What to Expect When Starting Operations in Ukraine?

The lawful right to refuse access to a tax audit: consequences and risks for the entrepreneur

According to the Tax Code of Ukraine, taxpayers have the right to deny tax authorities access to documentary on-site and/or factual audits. This is possible when the tax inspectors have not presented or issued an inspection order within the timeframe specified by the Tax Code of Ukraine. Furthermore, if these documents were prepared in violation of legal requirements, taxpayers also possess the right to decline the audit.

Nevertheless, it's important to note that exercising this right (refusing a tax audit) may result in the administrative seizure of assets. This occurs if the tax authority's claim to substantiate the legitimacy of the administrative seizure of assets is upheld in a court proceeding, typically based on a court decision.

You may also like: Tax Inspection Refunds: How to Prepare?

Changes in the Practice of Administrative Asset Seizure

Until recently, taxpayers, despite the potential risk of administrative property seizure, still exercised their rights and did not allow inspectors to conduct checks. To avoid the application of administrative property seizure by the supervisory authority, taxpayers took measures to appeal the order for the corresponding tax audit.

Such actions by taxpayers negated the procedure for applying administrative property seizure, as disputes over rights arose between the supervisory authority and the taxpayer. Therefore, cases related to administrative matters that questioned the validity of property seizure were closed.

Since February 23, 2023, such a method of avoiding administrative property seizure is no longer possible, as the Supreme Court has decided to depart from its previous position. In case No. 640/17091/21, the Supreme Court concluded that taxpayers' appeals against orders for inspections or the actions of tax authorities during their conduct cannot be considered a "dispute over rights," and that the corresponding actions of taxpayers do not hinder the court's consideration of tax authorities' applications to confirm the validity of administrative property seizure.

In essence, the court confirmed that such property seizures can be imposed even if the taxpayer files a lawsuit to declare the inspection order unlawful. Therefore, the approach that previously allowed taxpayers to avoid administrative property seizure in the event of denial of inspection is no longer effective.

Taking into account the relevant Supreme Court decision, we conclude that although the Tax Code of Ukraine still grants taxpayers the right to refuse inspectors access to tax audits, we believe that risking property potentially subject to administrative property seizure by exercising this right is not advisable.

Preparing for a Tax Audit: Assured Support for Taxpayers

Today, there exists a well-established legal stance from the Supreme Court regarding the appeal and declaration of the tax authority's actions in issuing an audit order and conducting a tax inspection based on such an order, as follows:

"Even when granted access for an inspection, the taxpayer retains the right to challenge tax notifications-decisions made as a result of such an inspection, citing violations of tax requirements during its execution."

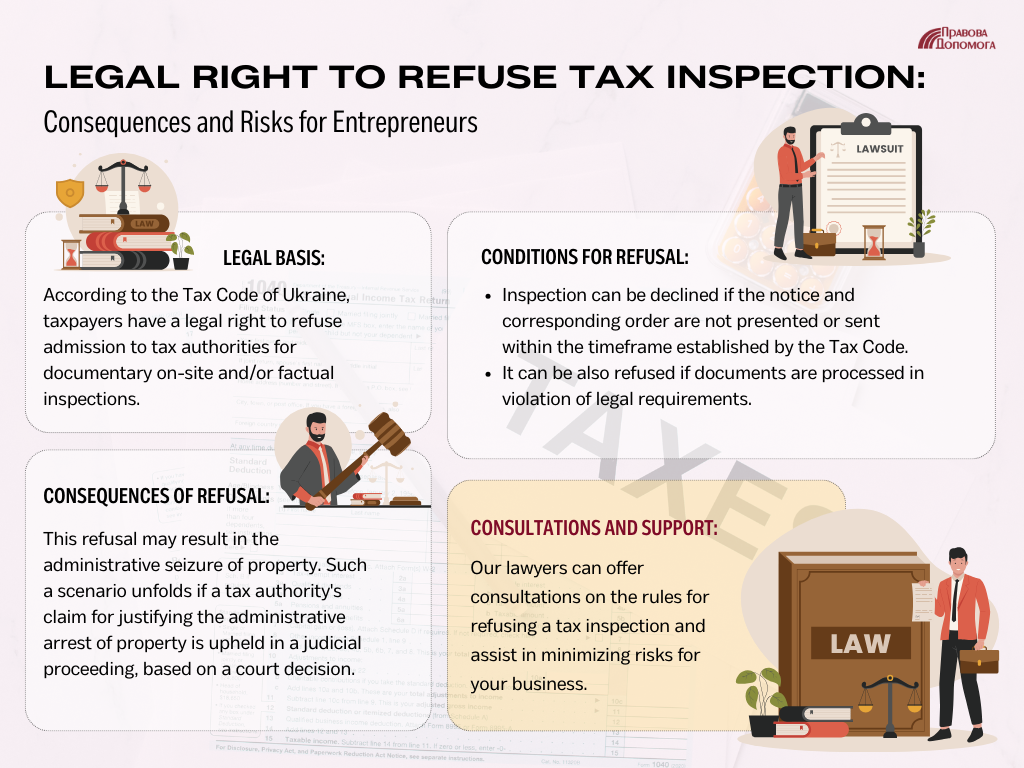

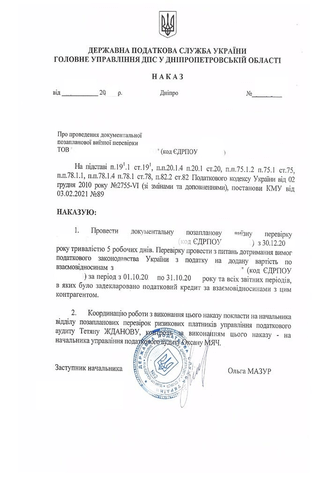

To illustrate this with a real-life example, let's consider a situation where a client (the taxpayer) received an order and a notice of a planned documentary on-site inspection of their business for a three-year period via mail.

Before we collaborated with the client, they were entirely unaware of monitoring the official website's plan schedule, making the receipt of the corresponding order a complete surprise. Therefore, our team ensures ongoing monitoring of the relevant plan schedules to prevent such situations for our clients.

However, the client promptly reached out to our company and notified us of receiving the said order.

Together with the client, we decided to grant the supervisory authority access for the inspection. However, because the order contained specific information regarding the start and duration of the inspection, our team worked diligently and swiftly (before the inspection commenced) to prepare both the primary documentation covering the relevant audit period and to train the staff for their interactions during the tax inspection.

Thanks to our collaboration, we were able to identify all potential risks associated with the supervisory authority's imposition of penalties and additional tax liabilities related to corporate income tax and value-added tax, and we adequately prepared the client for these possibilities.

Following the examination carried out by the regulatory body, additional tax obligations were imposed for both corporate income tax and value-added tax. Unfortunately, the tax authority did not consider our explanations, despite our reference to primary documentation. This was due to the tax authority's strict interpretation of tax regulations and their disregard for well-established legal precedents from the Supreme Court.

Nevertheless, through legal proceedings managed by our team, the aforementioned assessments and the application of penalty sanctions were successfully overturned, being deemed unlawful. Consequently, tax notifications-decisions amounting to a total of 5.8 million UAH were annulled.

Our team provides services aimed at preparing you, as a taxpayer, for tax inspections. We will take all necessary steps to ensure that your interaction with the inspectors is as comfortable and stress-free as possible for both you and your team. We also anticipate the potential outcomes of the inspection, including any tax obligations and penalties that you may potentially face.

In case you disagree with the results of the inspection, we offer professional assistance in filing a lawsuit to contest the tax notifications-decisions stemming from the inspection. Please do not hesitate to contact us! We are ready to provide you with our professional expertise and support.

Check out the cost of our tax law services here.

Our clients