Taxes on business in Ukraine: what to expect when starting an activity in Ukraine?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Getting acquainted with the tax system of Ukraine and the tax legislation may at first throw off kilter. And it is not about tax rates determined for your business, but about the complexity of understanding all the norms of tax law. This is especially difficult for representatives of foreign businesses whose goal is to bring their business to Ukraine without losing money.

Many have heard about the possibilities of tax optimization in Ukraine, and that for many types of activities there are very favorable tax rates. Of course, one would like to take advantage of this favorable offer for a business. All that remains is to figure out how to do this. It is impossible to cover all the peculiarities of business taxation or come up with a universal tax scheme for all types of businesses. But we will try to highlight the most important aspects and describe the most common situations that will help you form a basic understanding of business taxation in Ukraine.

If you want to get an answer exactly for your business activity in Ukraine, please contact our specialists for personal consultations. Our team will not only help you understand the complexities of tax legislation but also provide effective tax optimization solutions that comply with all legal norms. We ensure the legality and transparency of our methods, providing you with peace of mind and confidence for the future. Additionally, we offer support at every stage of our collaboration, both within Ukraine and internationally.

You may also like: Registration of a Company with Foreign Investments in Ukraine

General and simplified taxation system in Ukraine for business

The general taxation system is a frequent choice for many legal entities registered in Ukraine. Please read about who will benefit from this system here.

In simple terms, the tax rates under this system for businesses can consist of:

- income tax – 18%;

- VAT (value added tax) – 20%.

Also, depending on the business activity you choose, such fees and taxes may be added: excise tax, environmental taxes, customs duties, land tax, fee for vehicle registration in Ukraine.

A separate group of taxes are taxes for hired workers:

- personal income tax - 18%;

- military tax – 1.5%

- single social security tax – 22% of the minimum wage.

When you register a company, it becomes a general taxpayer by default. Upon your application, and if you meet the established criteria, you can transfer the company to the simplified system of taxation - payment of a single tax. Who can work on such a system and who benefits from it, we have already written here.

A legal entity can choose the 3rd and 4th groups of the Single Tax. Since Group 4 is only available for very specific types of business, let's talk about Group 3, which has the following rates:

- 3% + 20% for a personal income tax;

- 5% without VAT payer registration.

Please note! It is not always possible to choose the system of taxation that you want. The laws of Ukraine may set restrictions for specific types of business activities that shall be conducted only on the general system of taxation. For example, if the company’s activities are related to gambling, some types of financial services, trade in antiques, etc.

It is also important to remember that when working on the simplified system, each group has its own limits on annual income, beyond which the company will be forced to move to another system of taxation, and sometimes - will even have to pay penalties.

In order to avoid this, you need to understand in advance the planned amounts of income, estimate the beneficial for you scheme of business activity and taxation.

You may also like: Online Sales Tax in Ukraine

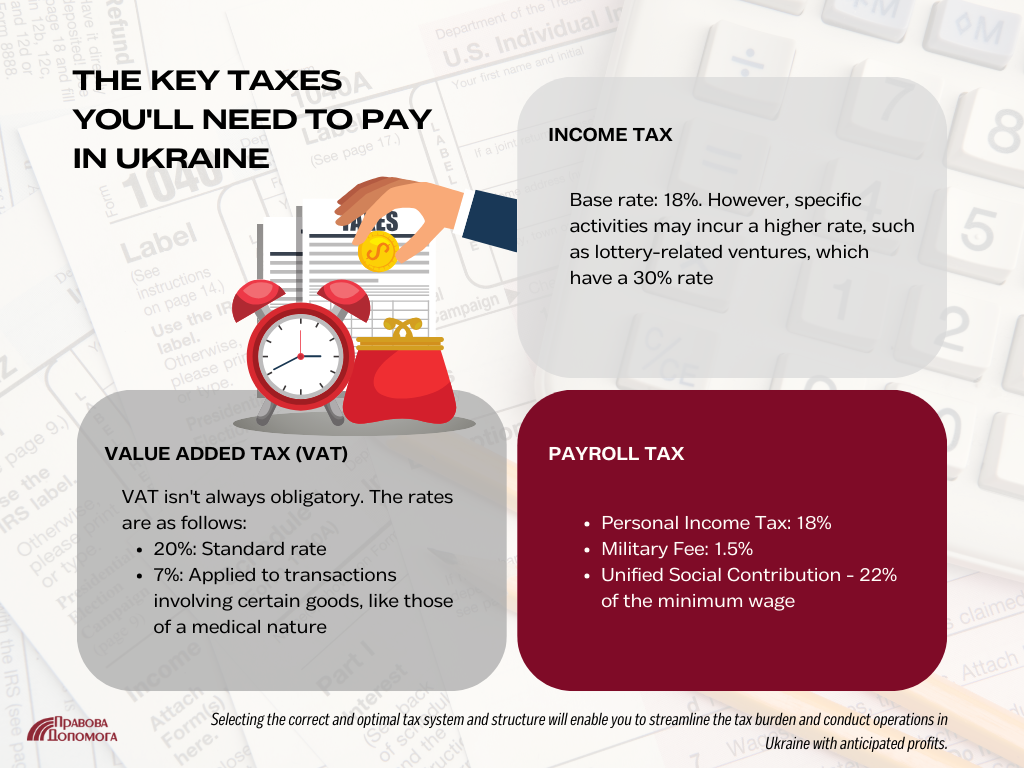

The main taxes you have to pay in Ukraine

When registering a business in Ukraine, you must be prepared to pay certain blocks or groups of taxes:

Income tax.

The basic rate is 18%. However, for certain types of business activities the rate will be higher. For example, activities related to lotteries have a rate of 30%.

The tax is accrued not on the entire amount of income, but on the so-called “net income”, that is, minus the company’s expenses. The total amount of income, which is subject to taxation, is determined on the basis of the financial statements, according to the accounting.

Employment taxes

We have already talked about them above:

- personal income tax - 18%;

- military tax – 1.5%

- single social security tax – 22% of the minimum wage.

However, there are tax exemptions for personal income tax (PIT) of certain categories of people, which is also necessary and can be taken into account when hiring personnel and paying employment taxes.

Please note! The amount of minimum and maximum single social security taxes depends on the established minimum wage for the period of charging single social security taxes. How to calculate the correct single social security taxes? Here is an example with the set amounts of the minimum wage for the fall of 2021.

- Minimum amount of single social security taxes - minimum wage x 22%

(For example: UAH 6,000 х 22% = UAH 1,320)

- Maximum amount of single social security taxes - maximum salary x 15 times x 22%

(For example: UAH 6,000 х 15 х 22% = UAH 19,800)

That is, the maximum amount of single social security taxes will always be calculated from the minimum wage multiplied by 15 times. Even if the salary of an employee is UAH 150,000, the single social security taxes will be UAH 19,800.

But you should constantly monitor the changes of the minimum wages in Ukraine.

VAT.

VAT is not always a compulsory tax. The standard VAT payers are the companies, which counterparties are also the VAT payers.

Also, you will need to register as a VAT payer when your annual income limit is exceeded (more than 1 million UAH for 12 months).

Switching to VAT is also possible on one’s own will. The rate of VAT may be:

- 20% - basic rate;

- 7% - for operations with certain types of goods, e.g., medical supplies.

Tax rates are not the only issue you should clarify before entering the Ukrainian market. Here are the most frequent questions that foreign businesses face when operating in Ukraine:

Double taxation when working with foreign contractors

Issue of necessity of transfer to VAT and compulsory transfer to VAT

Repatriation of income from a Ukrainian company to a foreign company

You can use the information we offer in our lawyers’ publications, or you can contact them directly for professional assistance. Our services include:

- Legal consultation on optimization of business taxation in Ukraine;

- Development of schemes to optimize taxation in Ukraine;

- Assistance with business registration of any complexity;

- Business maintenance, including accounting and legal support services in Ukraine.

The cost of legal services will depend on the scope of services that you will need. We will develop for you the most convenient package of services of a lawyer.

And finally, the most important issue: Is it possible not to pay taxes in Ukraine? It is possible, of course. But not for long. Active businesses, especially with foreign investments, will always be under close supervision of regulatory bodies. Failure to pay taxes is a huge and unjustifiable risk.

In this case, the choice of the correct, optimal system and scheme of taxation, will allow you to optimize the tax burden and do business in Ukraine with the expected profits.

Do not risk your business - contact us for tax optimization and assistance in registration of your business activity in Ukraine.

Didn’t find an answer to your question?

Everything about Business Registration in Ukraine for non-residents here.