The difference between financial licenses: how to choose a license for your business?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

We often have deal with the situation when a person wants to open a financial institution. He chooses a type of financial license. Then he contacts us for its issuance but owing to the detailed analysis of the situation by us it turns out that he needs a different type of license.

Of course, we can get any type of financial license, but we decided to write this material to distinguish between their types and make your choice easier.

It is important to remember that obtaining a license is only a small part of what you will need to do to start your business. The whole process of registering a financial institution has a large number of pitfalls, which, as a rule, are known only to a qualified lawyer. But we will try to make at least this part of the entire process more understandable for you.

We will consider each type of license and explain in which case you need to get each one of them.

Where to begin?

The first thing to do to create any financial institution is to register a legal entity.

Each type of financial institution has its own requirements to its legal form, authorized capital, personnel, hardware and software, etc.

Important! You must bring the legal entity in compliance with these requirements immediately after the registration stage. This is exactly the stage when a reliable legal partner will ensure you have no problems and have to go through re-registration in the future.

Next, you need to get your company listed in the register of financial institutions, however, there are two possible ways:

1. Inclusion in the general register of financial institutions.

This option will be of interest to those who plan to obtain several financial licenses sometime in the future or immediately. For the procedure, it is necessary to prepare a whole list of correctly executed documents.

You can put together a package of documents yourself, if you want, using our check list.

Related article: Entering the register of financial institutions in Ukraine: our practical experience

2. Inclusion in the register of lessors.

This registry may be interesting only to those who plan to deal exclusively with leasing and want to save their time and money. Indeed, for inclusion in the register of lessors, it is necessary to prepare significantly fewer documents. For example, at the stage of inclusion in the Register, there is no need to prepare an audit report, copies of employment books of an accountant and manager, etc.

You want to engage not only in leasing but in several types of financial activity or in one other type of activity. What to do in this case?

If you still decide in favor of the first register, you will need to choose one or more of the following licenses.Most often, financial institutions receive licenses for:

- Providing funds through loans, including on the terms of a financial loan;

- Providing guarantees and sureties;

- Providing factoring services;

- Providing financial leasing services.

Let's talk more about each of them.

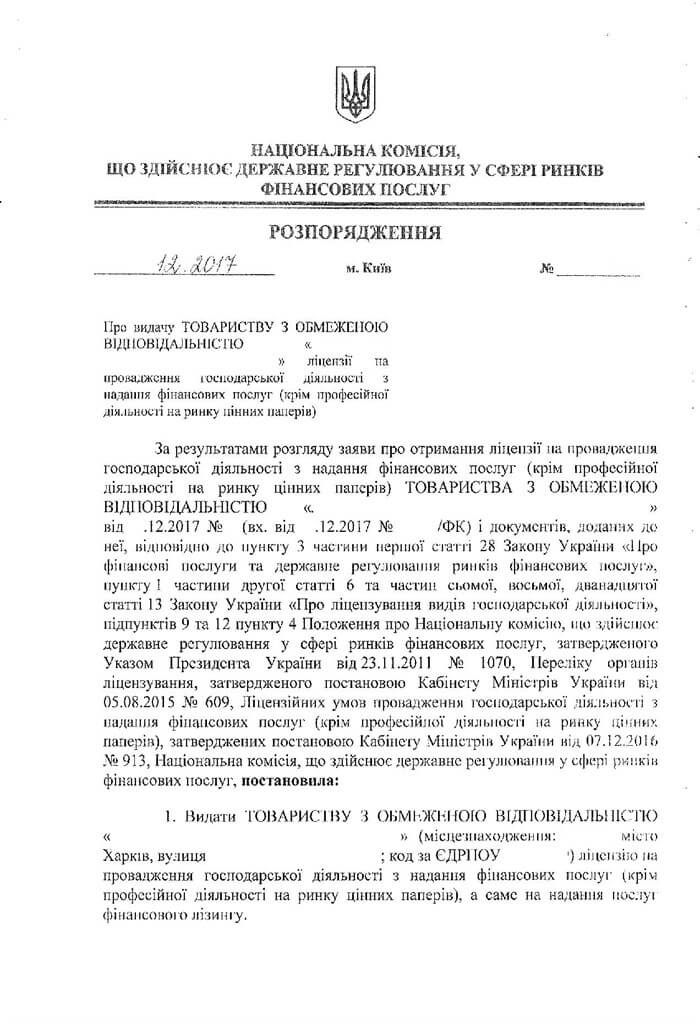

License to provide funds through loans, including on the terms of a financial loan

For an ordinary citizen, an interest-free loan and a commercial loan are almost the same things. However, in reality, there is significant difference between these concepts.

A commercial loan is always the provision of funds through a loan with the condition of their return with interest, while an interest-free loan can occur without accruing such interest. Accordingly, such a license will be of interest to those who plan to provide commercial loans to legal entities or sole traders, regardless of whether it is money or property (for example, tangible assets, such as gold, silver or precious stones).

Related article: How to open a network of pawnshops of one owner in Ukraine?

Providing guarantees and sureties

The peculiarity of this license lies in the fact that it implies the provision by a legal entity of a so-called confirmation of solvency of another company or person. That is, it makes a “promise” that the one for whom it is charged will return the funds taken on a commercial loan (interest-free loan).

Provision of factoring services

This type of license is designed so that businesses, in particular suppliers of services and goods, can actively conduct their activities under installments (a commercial loan, an interest-free loan). In such cases, the factoring company may become an intermediary between the Customer and the Supplier and require the first payment of the obligation assumed.

Related article: Particularities of registration of a factoring company and entering it in the register of financial institutions

Leasing activity

The peculiarity of this license is that, under a leasing agreement, a legal entity provides certain property for use to another person, which, in turn, agrees to redeem it later.

In practice, such activities are common among entrepreneurs selling various types of vehicles and other bulky and expensive property.

Related article: Essence of leasing and the most popular types of it

Obtaining any of the above licenses is, of course, a complex and multi-step process. Moreover, this is just one of the steps to starting the operation of your business. The whole process from start to finish involves a significant investment of time spent in lines at the state institutions and constant delays in starting your business.

In this case, a qualified lawyer can relieve you of the burden and do everything quickly, simply and safely, thanks to the practical experience and specialized knowledge.

Our experts can also provide you with legal advice on any of the stages of registration of a financial institution, help to choose and receive all permits.

Our clients