Ways to pay and refund VAT in the EU in 2023

Cost of services:

Reviews of our Clients

One of the four fundamental principles underlying relations within the EU is "freedom of goods circulation". This means that a single market is established in the EU by eliminating regulatory restrictions that usually impede the smooth flow of goods.

Ideally, this principle would imply the abolition of all duties within the EU and the abolition of customs borders as well as the abolition of VAT.

But in practice, each EU country has introduced its specific features of VAT regulation, and hence the system of VAT collection in the EU has become completely ambiguous.

Today the question of VAT payment in Europe also faces Ukrainian businessmen, as the opportunities for the export of goods to the EU become more and more numerous. Many of them start their companies in Europe. This means you need to understand the rules of the "game" and in advance to calculate the tax system for your profitable activity. We will take on this task, and we are better at it because:

- Taxes with us are not theory, but optimization in practice. We have a network of practicing accountants and lawyers not only in Ukraine, but also abroad, in the jurisdiction you need.

- Fresh current tax practice with us: over the last year, more than 20 cases of business relocation to Malta, UAE, Poland, Andorra, etc. Experience in working with the issue of royalties, double taxation, shares abroad, substance.

- All decisions are legal, the client does not violate anything. We calculate the situation not only for this moment, but also take care of the future security of the client.

- If your business is located both in Ukraine and abroad, we offer you the Ukrainian level of service anywhere. We speed up slow foreign counterparties, and we take on communication with foreign partners.

You may also like: Company Registration in Poland: Legal Services

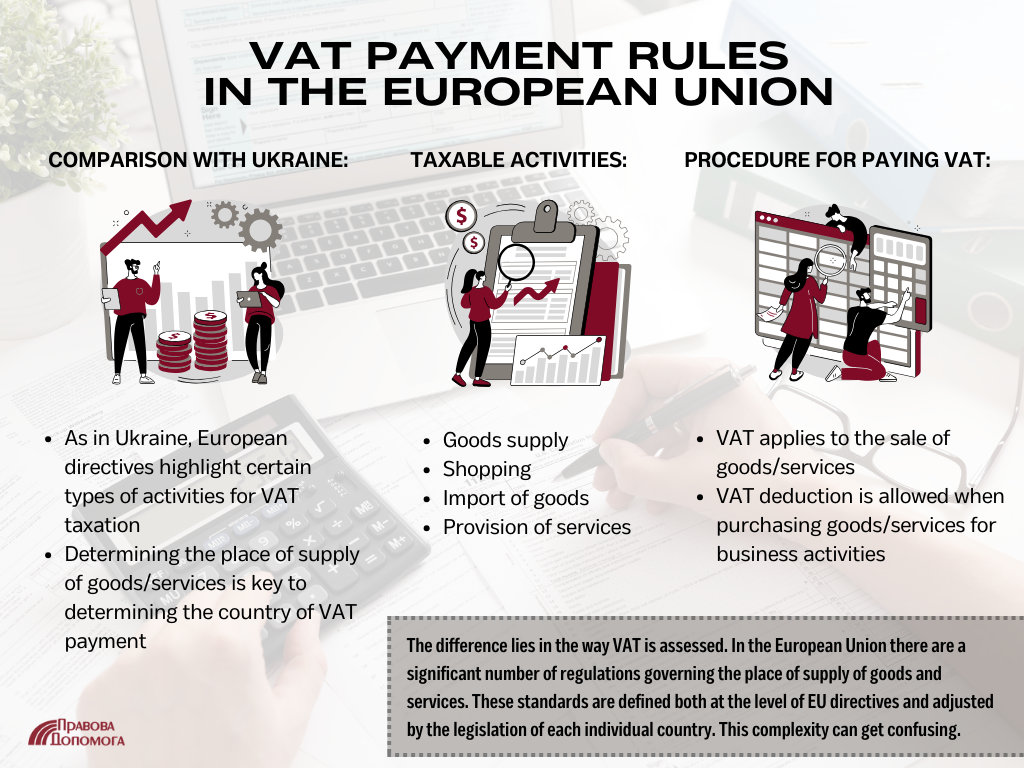

VAT rules in the European Union

As in Ukraine, the European directives:

- distinguish certain types of activities that are subject to VAT;

- establish the obligation to determine the place of supply of goods/services in order to understand in which country VAT must be paid.

Thus, the taxable activities in the EU are as follows:

- supply of goods;

- purchase of goods;

- import of goods;

- rendering of services.

According to the general rules, VAT applies to sales of goods/services, while it can be deducted in case of purchase of goods/services that are related to business activities (similar to Ukraine).

The difference represents taxable VAT.

It would seem that everything is simple and clear. However, the EU has so many rules relating to the place of delivery of goods/services and established both at the level of directives and “adjusted” by the legislation of different countries, that one can easily get confused in them.

Let’s look at a few examples to make sure of this.

You may also like: New Rules for Application of Double Taxation Treaties

Import and resale of goods within the EU

Import of goods is traditionally understood as the import of goods into the territory of the EU. More precisely - to the territory of a certain EU country, through which the goods can be further sold in the domestic market, distributed in the market of other EU countries, or exported outside the EU.

In case of import of goods from outside of EU, according to general rules the same principles should be applied as in Ukraine:

- When importing goods, the importing company must pay VAT on behalf of a non-resident supplier at the VAT rate, which is valid in the country of registration of the importer for this type of goods.

- Subsequently, the importer has the right to credit the VAT paid (i.e., has the right to deduct the tax paid). The importer must be registered as a VAT payer in its country of registration, of course.

For example, if a Polish company imports some food products into the EU, instead of the standard VAT rate of 23%, it can pay a reduced rate of 5% or 8% for the non-resident supplier from whom it buys the goods (for example, a Ukrainian company). In this case, the VAT paid further falls on the VAT costs for the Polish company.

Such rules apply in most EU countries (including Poland, Slovenia, etc.).

But if the goods enter the first country of the EU “temporarily” (for example, entered in the regime of transit or bonded warehouse), but are further subject to customs clearance in another country, where the free trade, the place of import (delivery) and the place where import VAT will be considered this other country.

For example, this applies to food products that will be sold in Germany but are processed according to transit procedures in Poland (given importation by road from Ukraine). It will be subject to VAT in Germany because it is the final market and the final customs clearance will be there.

If the importer plans to sell its goods to other EU countries for the benefit of individuals, the limits for such sales (whether they exceed the threshold of 10,000 euros) must be taken into account. They will play a role in determining the options of where to pay tax.

You should also consider that, as a general rule, the place of delivery of goods will be the place where the goods are at the time of completion of shipment or transportation to the buyer, i.e. the location of the final consumer. This means that VAT must also be paid at the location of the consumer.

- If sales do not exceed 10,000 euros/year, the company will be able to pay VAT on sales either at the domestic rate of its country of registration or voluntarily register as a VAT payer in each country where consumers will be located.

For example, if a Polish company sells goods imported from Ukraine to other EU countries (Germany, France), with sales not exceeding 10,000 euros per year, then the Polish company must pay VAT either in Poland at its domestic rate, or to register as a VAT payer in Germany, France, and pay VAT there.

- If the value of sales exceeds the limit of 10,000 euros/year, the seller loses the ability to pay VAT in its country of registration but must register as a VAT payer in each EU country where it sells its goods, and submit declarations there. This is not very convenient in practice.

However, there is an alternative: the seller can register in the so-called "single window" VAT system - One Stop Shop (OSS), and apply the VAT rates of the country where the consumer is located. But at the same time, it can file declarations in the country of its registration, which greatly simplifies the flow of documents.

Thus, if the sales of a Polish company exceed €10,000 per year and the consumers are located in different EU countries (Spain, Italy), then the Polish company must register as a VAT payer, and submit VAT declarations in each country where it sells (Spain, Italy).

Alternatively, it can register in the OSS system, pay VAT at the rates of the countries where it sells (at the Spanish/Italian rate) but submit declarations and pay the tax at its place of registration.

You may also like: Strengthening Substance Requirements in the European Union in 2022

Export from the EU

The export of goods and services outside the EU is generally exempt from VAT. However, if we are talking about goods, the producer is entitled to a further deduction of VAT paid on the production of goods (or their purchase), if it proves that the goods are intended and actually “traveled” outside the EU. For this purpose, it is necessary to have the relevant supporting documentation.

The provision of services by an EU resident to a non-EU resident is also exempt from European VAT. For example, if a Cypriot company provided legal services to a Ukrainian company, the invoice must be issued without VAT.

If you are planning to conduct your activities in the EU, and want to make sure that the tax system in your business is optimized as much as possible, don’t hesitate to contact us.

Our services include:

- Analysis of the business transaction on whether it is taxable VAT in the EU;

- Determination of the place of supply of goods/services;

- Determination of the VAT rate applicable to the specific goods/services;

- Advice on the best way to keep and report VAT in the EU, depending on the type of activity and the client's target audience.

We will also help with the registration or relocation of your business in the EU countries and arrange the process of import/export of goods.

Please click here for legal advice and tax optimization scheme development costs.

Everything about the import and export of goods and services here.