Accounting and taxation of grants by residents of Ukraine

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Today, many operating companies and startups have the opportunity to take advantage of financial support from investment funds, credit institutions, and other financial donors (including foreign ones) that can provide financial assistance. One type of such financial assistance is a grant.

A grant is a fund given to business entities and individuals for the implementation of certain projects, conditioned by grant programs. Money in the form of a grant is provided on a non-repayable basis.

Most companies, having received a grant, present it as a “gift” in the form of money in a current account, which can be spent on any expenses, but this is not true.

A grant is a type of earmarked funding and can only be used as part of a targeted grant program.

Today, we will tell you how to receive a grant in Ukraine, and most importantly, we will clarify the peculiarities of taxation of the grants received and the impact on the financial result, depending on the taxation system of the legal entity.

Important! It is not uncommon for a grant received in Ukraine to be used both in Ukraine and withdrawn beyond its borders - to foreign companies and funds. It all depends on the conditions of the grant and the goals of the project. In such situations, we also provide accounting and legal support for the procedure for preparing for a grant, participation in grants and further development of grant funds. The selection of a foreign jurisdiction, the opening of a company or funds abroad, if required by the conditions for obtaining a grant, is also possible with us. Taxes with us are not theory, but optimization in practice. We have a network of practicing accountants and lawyers not only in Ukraine, but also abroad, in the jurisdiction you need.

All decisions with us are legal. We calculate the situation not only for this moment, but also take care of the future security of the client.

How to participate in the grant program in Ukraine?

Essential conditions for grant programs are as follows:

- determination of the recipient of the grant based on the results of the competition;

- intended use.

In order to receive a grant, the company’ and its owners’ desire is not enough.

To become a participant of the grant program it is necessary:

1. To develop a clear project or idea of business direction to the society (and first of all to the grantor);

2. Create a business plan of the project/idea, which will include:

- the goals and objectives of the project/idea;

- target audience;

- advantages and disadvantages of the project/idea;

- a financial model a cost-benefit analysis that will show the payback of the grant, plan of income and expenses involved in this project).

Our experts can help you with the financial model for the program.

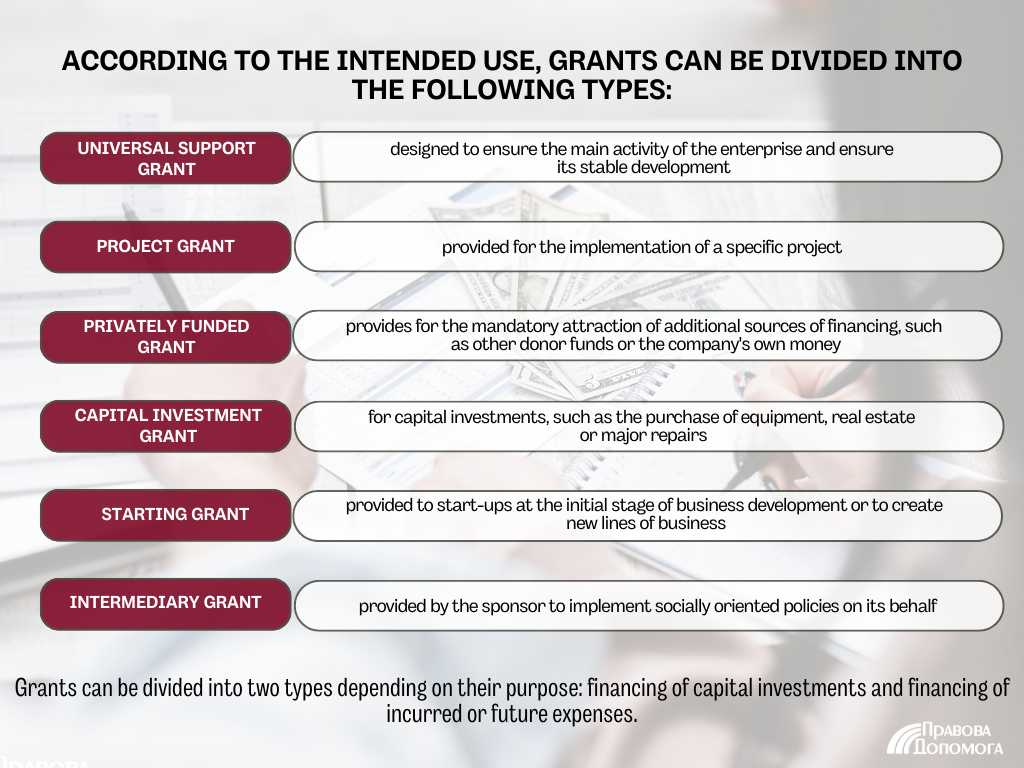

According to the intended use, grants are divided into the following types:

- A general support grant is provided to support the main activities of the company and ensure its stable development.

- A project grant is provided for the implementation of a specific project.

- A partial grant provides for the mandatory involvement of additional sources of funding (other donor funds or the company’s own money).

- A capital investment grant is provided for capital investments (purchase of equipment / real estate or their capital repair).

- A startup grant is provided to startups at the beginning of business development or to create new areas of operation for an existing business.

- An intermediary grant is provided by a sponsor to carry out socially-oriented policies on its behalf.

Based on the purpose of the grant, globally they can be divided into 2 types:

- Financing of capital investments (funds for acquisition of current and noncurrent assets or their capital repairs);

- Financing of incurred or future expenses.

You may also like: How to Safely Invest in Ready Ukrainian Business?

How shall accounting records reflect operations related to the receipt of the grant?

If your business plan is approved in the grant program competition, you receive money in the form of a grant into a special current account.

According to accounting standards (both national and international), a grant is earmarked funding. Earmarked funding is not recognized as income until:

- there is no confirmation that it has been received by the company (in the case of receiving funding after the fact);

- there is no confirmation of compliance with the terms of the funding program (grant program);

- there is no confirmation of the intended use of funds.

Accounting for capital grants.

According to the rules of the National Accounting Standards, earmarked financing received for capital investments is recognized as income during the depreciation period of the investment object. This income shall be reflected as “Proceeds from free assets received” (accounting account 745).

If you do accounting according to International standards, there are 2 ways of reflecting proceeds from free assets received:

- Income is charged to future periods, which are recognized as income on a systematic basis over the depreciation period of the asset.

- Decrease in the book value of the asset by the amount of the grant (in this case, the book value of assets acquired with grant funds will be lower than in the first option).

The company shall record proceeds in the accounting policy.

Accounting of grants for expenses.

A grant can be received to compensate for expenses already incurred, to pay current or future expenses.

When already incurred expenses are compensated with grant funds, income is recognized simultaneously with the repayment of receivables.

A grant received for payment of current and future expenses (of a non-capital nature) is recognized as proceeds in the periods in which the expenses were incurred.

These revenues are recorded as “Proceeds from free current assets received” (accounting account 718).

You may also like: Equity Crowdfunding in Ukraine

Tax accounting for grants in Ukraine

According to the current legislation of Ukraine, monetary funds received in the form of target financing are not subject to income tax, unified tax, personal income tax and military tax.

But depending on the legal form of ownership there are nuances of target financing income (grants) recognition. Let’s elaborate more on these peculiarities.

If the grant recipient is a legal entity, individual entrepreneur or self-employed person under the general system of taxation:

- the financial result is reduced by the amount of income from the received grant;

- the financial result is increased by the amount of incurred expenses paid at the expense of grant funds.

Please note! Regardless of whether you are a high-profit or low-profit business, you are required to adjust your financial result by the amount of grant money received/spent (even if you are allowed to not apply tax differences).

If the grant recipient is a legal entity, individual entrepreneur or self-employed person on a single tax:

- the amount of the grant received is not subject to a single tax in case of its intended use.

You may also like: Accounting for the Costs of New Product Development in Ukraine

Grant in Ukraine and payment of VAT

According to the Tax Code, funds received in the form of a grant are not subject to VAT. Accordingly, no additional accrual of VAT obligations on the amount of credited funds is required.

However, there are no restrictions on the tax credit received when purchasing equipment, services and other needs at the expense of the grant funds.

VAT is recognized as a tax credit if the tax invoice is issued and registered in the Unified Tax Invoices Register (the UTIR) within the terms specified in the Tax Code.

Risks of the grant misuse

Misuse of funds is a violation of the grant program and may result in additional tax liabilities:

- Business entities on the general system of taxation shall recognize income in the period of untargeted expenses and accrue 18% of income tax.

- Business entities on a single taxation system increase income by the amount of costs in the period of untargeted use of funds and make additional accrual of the single tax.

When receiving a grant, you must carefully study the conditions and rules, as there are programs, according to which unintended use of grant funds provides for return of the full amount of funding allocated to the grantor.

This is basic information that concerns the accounting part of working with grants in Ukraine. If you have questions. related to the accounting of grant or investment funds - we are ready to provide you with information or take over all bookkeeping.

Among our services:

- Drawing up a financial model of the project;

- Consultation on the preparation of the financial part of the business plan;

- Accounting and tax advice on the correct reflection of grant funds in accounting and reporting;

- Accounting support and much more.

- Consultations and preparation for receiving grants in Ukraine;

- Registration of companies and funds in Ukraine, sale of ready-made companies and funds under a grant;

- Registration of companies and funds abroad;

- Tax optimization and more.

Didn’t find an answer to your question?

Our clients