Simplified taxation system LLC: how to understand?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

To facilitate accounting and taxation of small and medium-sized enterprises, the concept of simplified taxation system was introduced by the Presidential Decree in 1999. After that, it was amended, improved and changed, and at present the simplified taxation system is divided into 4 groups of single tax.

Today, we will talk about how the simplified taxation system works for legal entities, what advantages it offers and who should think about choosing such a system.

You may also like: Financial Assistance To Your Business During Quarantine

How does the simplified taxation system work and who is it suitable for?

Groups 1 and 2 are created for individual entrepreneurs, respectively, the company can’t choose this model of the simplified taxation.

Group 3 of the simplified taxation system can be used by enterprises of any form of incorporation, it can either include VAT or exclude payment of this tax.

Group 4 of single tax is created for agricultural enterprises and entrepreneurs.

Let’s elaborate in more detail on the Group 3, because it is the most optimal taxation scheme for most LLCs, which are not engaged in agriculture.

The main purpose of the simplified taxation system is to facilitate accounting, tax calculation and reporting in general. The tax is calculated by cash method - all the money credited to the current account or to the cash desk of the enterprise.

Most often, the simplified tax scheme is used by enterprises providing services. Enterprises engaged in trade may find it to be not profitable - the surcharge may not allow to use it, and the expenses are not taken into account when using the single tax.

Let’s talk further about the working nuances that are worth thinking about when choosing the simplified taxation system.

Read also: Accounting News For Sole Proprietors In 2020

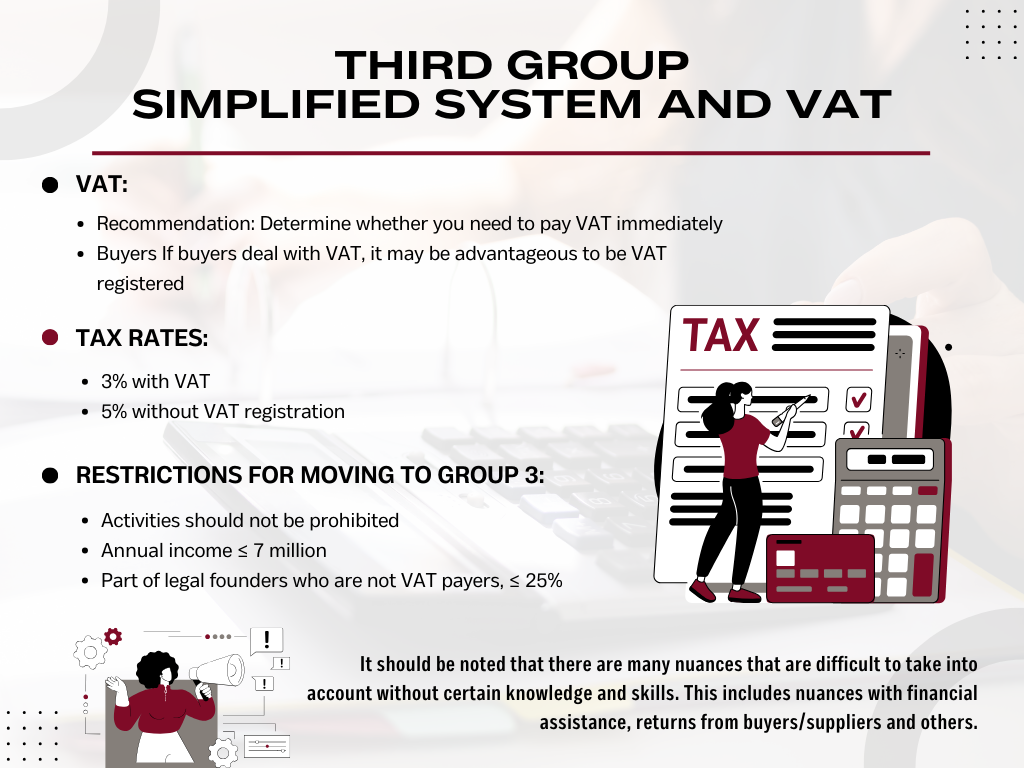

Group 3 of the Simplified Taxation System and VAT

It’s worth deciding immediately whether you need to pay VAT - Group 3 may pay it. If the main buyers of the company work with VAT, they will not be interested in working with a supplier who is not a VAT payer. You can become a VAT payer or refuse the VAT even in the course of work. You will need to submit an application to that effect.

Tax rates for Group 3:

- 3% with VAT;

- 5% without VAT.

Example: You chose the single tax without paying VAT. The company has an income of less than 1 million per year and major buyers, individuals without VAT. You were paid UAH 300,000 for the quarter. For tax calculation, it is enough to multiply 300,000*5% and get 15K tax.

Are there any restrictions for using Group 3?

There are not many restrictions for using Group 3 of the single tax:

- Your activity should not belong to prohibited types of economic activity (according to paragraph 5 of Article 291 of the Tax Code of Ukraine);

- Your annual income should not exceed 7 million per year;

Please note! The simplified taxation system does not allow for barter transactions.

Organization of the Group 3 accounting

Let’s highlight a few basic accounting rules for the Group 3 of the single tax:

- When choosing the tax rate of 5% of income, a business entity is obliged to keep a ledger of income and expenditure. The ledger shall be first registered with the tax office and filled in daily by hand.

- If you are registered as an income tax payer, then the ledger shall also include tax records - maintenance and issuance of tax invoices.

- Extraction of tax invoices is no longer conducted by cash method, but on the first event. And in this case, you can’t do without the assistance of specialists.

You may also like: Financial Monitoring News

We only touched upon some of the issues related to the simplified taxation system for an LLC. It’s worth remembering that the staff organization and the calculation of salaries at the enterprises using the single tax does not have any “simplifications” and shall be conducted according to general requirements. Besides, there are many other nuances that are difficult to take into account without certain knowledge and skills. They include peculiarities of financial assistance, customer/supplier refunds and other aspects.

If you want to make accounting of your activities on time and without errors, don’t hesitate to call us. We will advise you on all matters of interest or take over the accounting of your business.

Our clients