Why is control over the activities of Ukrainian Non-Profit Organizations?

Cost of services:

Reviews of our Clients

Today, a vast number of charitable and non-governmental organizations (hereafter referred to as non-profit organizations) receive funds for charitable or community projects. The outcomes of such fund utilization can be varied: while some organizations conscientiously fulfill their commitments, others do so only partially, and some do not adhere to agreements at all, misappropriating some or all of the funds.

In the context of how to avoid funding fraudulent entities while aiding non-profit organizations, our article will be beneficial to donors, grantmakers, patrons, or any individuals providing resources or property for charitable purposes who wish to see the tangible results of their contributions. To reduce the risk of such problems, we will share legal and practical tips for you.

Therefore, the article will answer important questions for benefactors:

- Why is it necessary to control the activities of Ukrainian non-profit organizations?

- How can you vet volunteers and charitable organizations to ensure you don't inadvertently give money to fraudsters?

- What should you pay attention to when selecting a charitable fund or non-governmental organization?

We will also discuss the support we provide to those wishing to safely make charitable contributions and achieve the specific results they expect from their donations. Our team has already become reliable advisors and partners not only for dozens of non-profit organizations but also for many foreign donors, patrons, and grantmakers.

You may also like: Recording Humanitarian and Charitable Assistance in the Accounts of a Charitable Foundation

How to Avoid Risks When Donating to Non-Profit Organizations?

If you are willing and able to provide financial or material support to non-profit organizations, it's crucial to consider several key aspects. This precaution is essential to foresee potential fraud and ensure the effectiveness of your charitable contribution. There's a risk of transferring funds or property to unscrupulous organizations, as noted earlier.

Based on our extensive experience, we advise you to consider the following:

1. Risk of Fund Loss: Donating to disreputable organizations can compromise the intended benefits or outcomes of your project. Essentially, you might end up channeling resources for unclear purposes to ambiguous recipients. Careful consideration is advised.

2. Corruption Scandals and Legal Risks: Occasionally, individuals misusing non-profit funds become entangled in scandals, including corruption or legal offenses. Should investigations trace any part of your donation, you might also face scrutiny.

3. Flaws in Ukrainian Legislation and Practice: Although the activities of non-profits in Ukraine have increased since 2022, the legal framework hasn't fully adapted to this change, leading to certain challenges. Additionally, some non-profits might be run by less-than-honest individuals.

4. Challenges in Fund Recovery: Without establishing adequate financial controls, retrieving funds becomes a difficult task.

5. Misappropriation for Internal Projects: There's a possibility that the organization might allocate funds to its own projects unless your agreement specifies otherwise.

Given these points, it's crucial to exercise control over the utilization of funds by charitable or public organizations, even if the non-profit is managed by people you know, such as friends, acquaintances, or business partners.

You may also like: Choosing Between Accreditation of a Representative Office or Registering a Fund in Ukraine

Contractual Control Mechanisms for Grant and Charitable Funds Usage

When you desire to financially or materially support non-profit organizations, implementing contractual control mechanisms is a straightforward and effective method. Individuals or entities providing funds for non-profit projects can draft an agreement that outlines:

- Terms of fund provision;

- Liability for breach of obligations;

- Monitoring and fund recovery methods.

From our own experience, we assisted a client in drafting such an agreement. Our main steps included:

- Counterparty Due Diligence: We conducted a thorough check to identify any risks associated with the organization, including searching for court decisions that might provide insights into whom you're dealing with.

- Validation of Existing Projects: We requested evidence of currently implemented projects, guarantee letters, partner reviews, etc., to ensure the recipient's credibility.

- Targeted Assistance Stipulation: The agreement should specify if the funds are for specific purchases or activities.

- Liability and Penalties: Defined responsibilities and penalties, especially the return of funds in case of misappropriation, are crucial. This allows for claims and lawsuits against non-profit organizations if the provided funds are not used as intended.

- Tranche-Based Assistance: This approach is effective in establishing trust between parties. Large projects are broken down into stages, with each phase followed by reporting and decision-making about further steps.

Additionally, we have another regular client, an IT company, which periodically receives requests for charitable assistance from organizations. We carefully study the purpose of the assistance, request corresponding letters from the end recipients, and provide targeted charitable assistance in the agreement.

If you're uncertain about how to securely and correctly incorporate these elements into your agreement, but wish to ensure your funds reach the right beneficiaries, we are prepared to help. We can develop a contract for charitable assistance, a cooperation memorandum, or other types of agreements concerning the safe transfer of assets and funds, tailored to your interests.

Non-Contractual Control Mechanisms for Monitoring Ukrainian Non-Profit Organizations

Beyond contractual methods, there are various other ways to monitor and control the use of funds in non-profit organizations. One effective strategy is the integration of a representative for direct oversight of fund utilization. For example, if a non-profit has a supervisory board, a condition for grant allocation could be the appointment of a donor's representative to this board, ensuring control and access to all organizational processes.

Regular Reporting: Requesting regular reports on the use of funds is crucial. Large organizations often readily provide these reports, sometimes even making them publicly available. These reports are essential for understanding how funds are utilized and can be formatted to suit both parties' needs. The key is ensuring these reports are provided, thoroughly analyzed, and acknowledged by the donor.

Planning and Budgeting: Understanding how funds will be used in the future is vital. Non-profits should prepare detailed plans and budgets, which can then be reviewed by potential donors to ensure funds are allocated appropriately.

How to Recover Funds Transferred to Charitable or Non-Governmental Organizations?

An unpleasant but sometimes necessary aspect is the recovery of provided funds. If it comes to ending the relationship and recovering funds, there are two options: out-of-court settlement or litigation. However, it's important to remember that fund recovery is an extreme measure and not always successful. If the funds have already been spent, legally or otherwise, recovery might not be possible through legal means as there may be no funds left in the account.

To avoid legal disputes or claims, we recommend using the aforementioned advice. Better still, engage legal professionals. Our specialists have extensive experience with non-profit projects and can assist you with legal aspects:

- Counterparty due diligence;

- Consulting on your specific concerns;

- Preparing agreements and related documents;

- Analyzing reports, assisting with legal and accounting audits;

- Assisting with claims, negotiations, and legal proceedings.

With our support, your backing of non-profit organizations will not only be significant but also legally safeguarded.

Learn more about our services here.

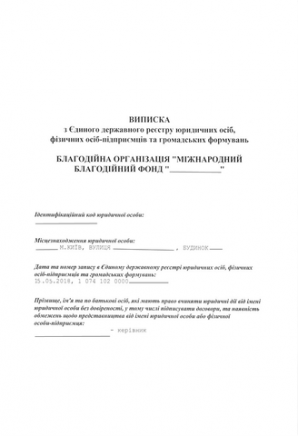

Get detailed information about the process of registering a charitable fund in Ukraine here.

Find out about the cost of consulting and servicing charitable funds in Ukraine here.

Get information on the accreditation of foreign non-profit organizations.

We provide our clients with a wide range of legal and accounting support services for non-profit activities in Ukraine.