What Is Authorized Share Capital And How To Properly Form It?

Cost of services:

Reviews of our Clients

Authorized share capital (registered capital) formation is the initial stage of starting any business. It amounts to the minimum amount of the company assets contributed by the founders in favor of the firm at the stage of its establishment.

The authorized share capital can be formed both at the stage of registration and in the future using three options:

- Money (cash and non-cash);

- Property (buildings, equipment, securities);

- Mixed (cash combined with property).

Minimum amount of the authorized share capital in Ukraine

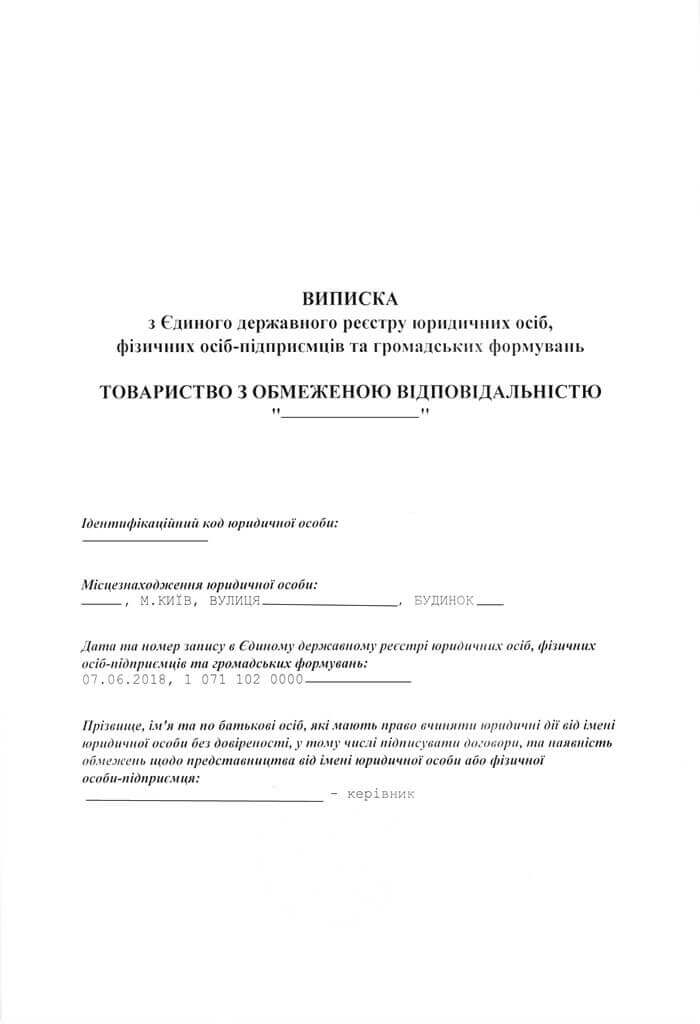

Of course, each type of business entity has its own requirements to the amount of the authorized share capital. For example, there are no requirements to the minimum amount of the authorized share capital of an LLC. Although, of course, it shall have the authorized share capital. So, if you wish, you can register a LLC with the authorized share capital in the amount of 20 kopecks.

On the other hand, the minimum authorized share capital for a JSC is set at 1,250 minimum wages as of the time of registration.

Also, a certain minimum amount of the authorized share capital is usually set for companies engaged in financial activities. For example:

- For companies that provide loans - the amount of resources owned must be at least UAH 3 million;

- For pawnshops - at least UAH 500,000.

These are just a few examples of the minimum amount of the authorized share capital. Most types of organizations have clear requirements not only for the amount, but also for the way in which the authorized share capital shall be formed.

Read also: How To Increase The Authorized Share Capital Using A Real Estate Object? Our Experience

Term of the authorized share capital contribution

The standard term for payment of the authorized share capital for LLCs and ALCs is six months from the date of state registration, unless otherwise provided by the internal charter of the company. But many other legal forms of enterprises can be subject to additional restrictions and rules. For example, a joint-stock company is not allowed to conduct any procedures or operations until 50% of its authorized share capital is formed. However, this rule does not directly concern the process of establishing a JSC.

Formation of the company’s authorized share capital may have several purposes at once:

- Firstly, many businesses are directly required by law to have the authorized share capital;

- The size of the shareholders’ share in the authorized share capital directly affects the amount of income that the shareholder can receive from the company’s profit at the end of the year;

- The amount and availability of the authorized share capital can become an indicator of status, authority and reliability for partners and clients;

- It’s important to understand that if the authorized share capital is formed, for example, 50/50, and after a while, the other shareholder will be simply “lost” - it will be critically difficult to make any decisions regarding the company’s activities.

We will help you hunt down the issue of the authorized share capital formation, as well as will assess all potential risks in advance.

Read also:

Our clients