How to switch from Sole proprietorship to LLC and when is it needed?

This material will be useful for those who want to expand their business or reach a new level and turnover. We will talk about the possible reasons for moving from a sole proprietor to an LLC and how to arrange this process properly.

The key reason for such a transition is the situation when the business area requires to conduct commercial activities in another legal form or when it becomes more materially profitable.

For example, in the sphere of medical business, such form of business organization as a sole proprietorship prevent you from conducting many different operations, including certain types of surgical procedures, or the issuance of certain types of certificates. While the LLC enables you to carry out such operations, and, accordingly, significantly expand the range of potential services.

You may also like: Example Of Transition Of A Privately Practicing Doctor From A Sole Proprietorship To An LLC

What are the advantages of moving from a sole proprietorship to an LLC?

Legal liability. In a situation where you are fined as a sole proprietor, this is considered to be your personal fine, which you shall pay, in some cases, with all your assets. When a fine is imposed on a legal entity, then it becomes a company’s fine only and the LLC members will pay it within the limits of their contributions.

For example, in terms of the new Law on Cash Registers, a LLC is a more advantageous form of business organization, because you will only be responsible for the failure to issue a cash voucher with the property that the legal entity has on its balance.

Taxation. As for the taxation of LLCs, this legal form also has the right to operate under the simplified system of taxation.

Read also: Corporate Income Tax

How To Properly Arrange The Transition From A Sole Proprietorship To An LLC

Since there is no direct procedure for converting a sole proprietorship to an LLC, there are a number of actions that need to be taken to achieve the desired result. Our lawyers advise to act according to the following algorithm:

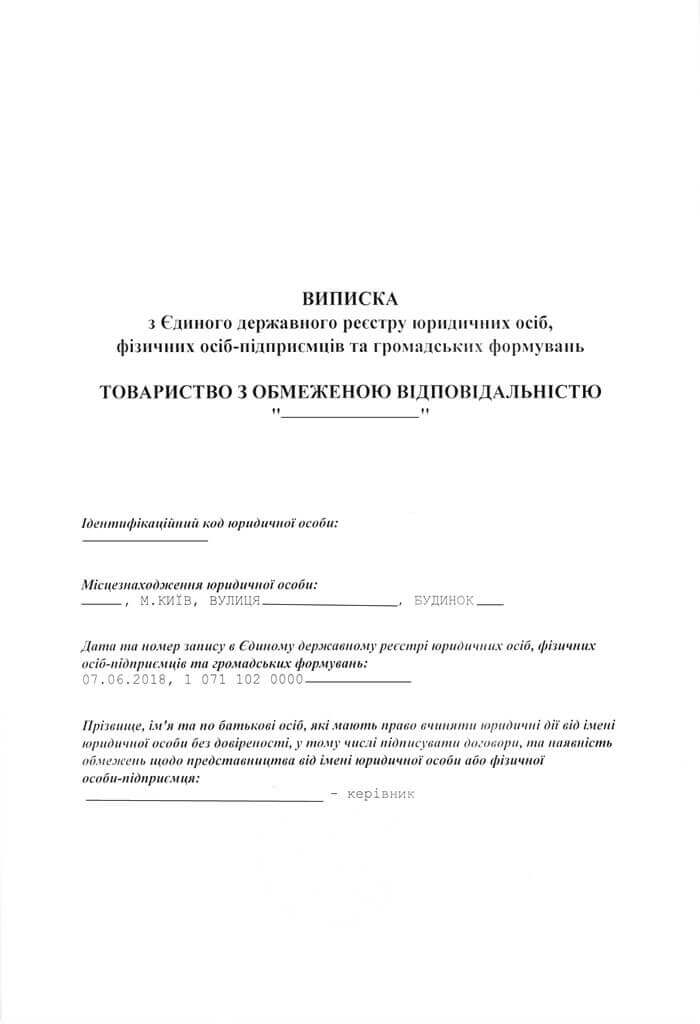

- Register a legal entity.

- Transfer its property to the new LLC by drawing up the Transfer and Acceptance Certificate.

- Terminate your sole proprietorship business.

If your business requires a license or other permits, you will need to obtain them for the new LLC.

If you want to expand your business quickly and easily, don’t hesitate to contact us. We will solve all your issues in a safe and efficient manner.