The most important issues to be resolved with the seller before buying an apartment in Ukraine

Cost of services:

Reviews of our Clients

To ensure that the purchase of the apartment you've set your heart on goes through smoothly and without any hitches, it's essential to take a responsible approach to the process and prepare in advance. This involves gathering all the necessary documents for the transaction and selecting a competent notary.

We recommend commencing the process with a thorough inspection. For more details, please refer to our previous articles:

Apartment Inspection in the Secondary Market

Apartment Inspection in the Primary Market

Today, let's elaborate on the phase that follows the inspection, where negotiations between the parties begin and the property purchase and sale agreement is established. During these negotiations, it's imperative to obtain clear answers to the following questions:

- Will there be a preliminary purchase and sale agreement, and when will the main property transfer agreement be executed?

- Which party shall obtain the missing documents to complete the property transaction, the timeframe for doing so, and how these agreements will be documented?

- When will the apartment be cleared of the seller's personal belongings and handed over to the buyer?

- Which notary will validate the property transaction?

- Which party, and to what extent, will be responsible for taxes and notary fees?

- What will be the selling price of the property?

- Outlining the payment arrangements for the apartment.

We’ll explain the importance of each of these questions in your apartment purchase process below.

You may also like: Is it Safe to Buy an Apartment through a Real Estate Agent in Ukraine?

Will there be a preliminary purchase and sale agreement, and when will the main property transfer agreement be executed?

A preliminary property purchase and sale agreement is established when the parties have agreed on buying and selling an apartment, but they require additional time before the actual transaction occurs. For example:

- The parties may need to obtain additional documents or certificates.

- The buyer might need extra time to gather the necessary funds.

- The seller may require time to vacate the apartment of personal belongings, and so forth.

In essence, the preliminary agreement is a statement of intent that safeguards both parties from withdrawing from the deal. It outlines all the essential conditions of the main property purchase and sale agreement, which can only be altered by the mutual consent of both parties.

Please note! After signing the preliminary agreement, the price of the apartment and the sale timeline cannot be altered.

To maintain discipline between both parties until the main sales agreement is executed, the buyer, according to the terms of the preliminary agreement, provides the seller with a specific amount of money. This amount serves as confirmation of their commitment to signing the main sales contract within a predetermined period and purchasing the apartment under the previously agreed-upon conditions.

In response, the seller accepts these funds, thereby affirming their commitment to selling the apartment. This is commonly known as a "deposit," which can be either returned to the buyer or credited as part of the payment for the apartment when the main contract is signed.

If the deal does not go through within the agreed-upon timeframe due to the fault of the buyer, the guarantee (or deposit) amount remains with the seller as compensation for the buyer's unmet obligations. However, if the deal falls apart due to the fault of the seller, they are obliged to refund the buyer double the deposit as compensation for breaching their commitments.

The preliminary real estate sales agreement must be executed in the same form as the main contract, typically notarially certified. Attempting to use a different form for the contract may significantly complicate or even make it impossible to protect your rights in case a dispute arises.

While such an agreement is not mandatory for property purchases, it is recommended in many cases. For example, if you and the seller agree on buying a property but require additional time to complete the transaction.

Which party shall obtain the missing documents to complete the property transaction?

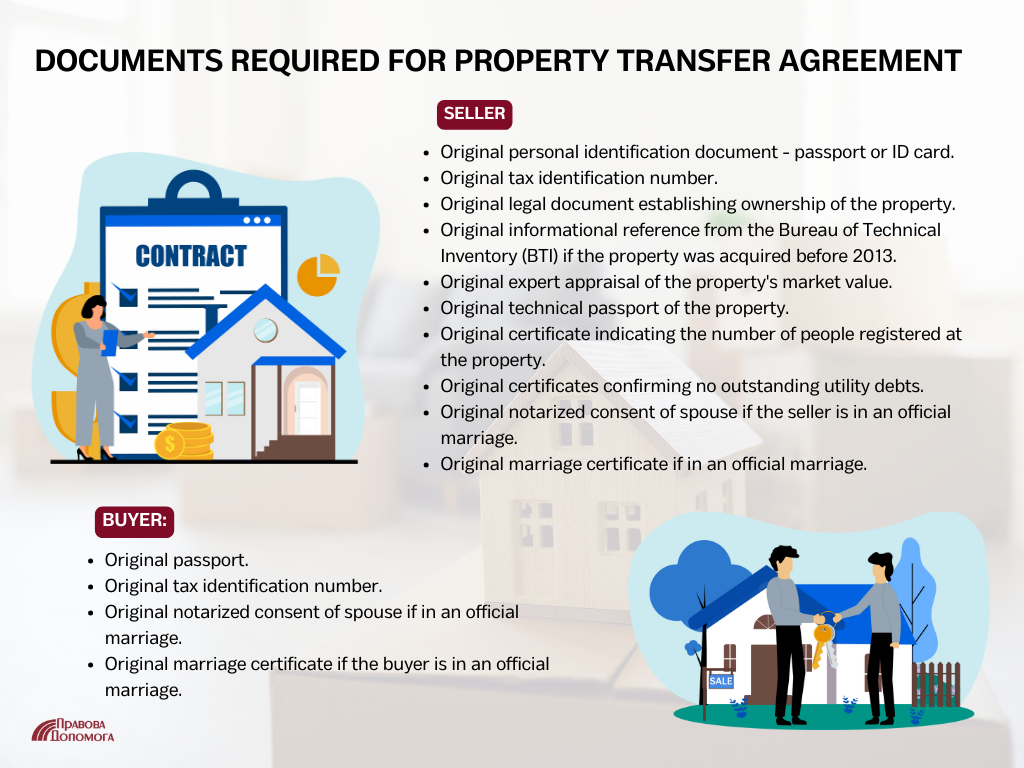

Let's outline the specific documents that each party must provide for a real estate transfer.

Seller:

- Original proof of identity document - passport or ID card.

- Original tax identification number.

- Original property deed for the apartment.

- Original certificate from the BTI (if the apartment was acquired before 2013).

- Original expert appraisal report of the apartment's market value.

- Original technical passport for the apartment.

- Original certificate indicating the number of registered individuals in the apartment.

- Original certificates confirming no outstanding utility payments.

- Original notarized spousal consent, if the seller is legally married.

- Original marriage certificate, if the seller is in an official marriage.

Buyer:

- Original passport.

- Original tax identification number.

- Original notarized spousal consent, if the buyer is legally married.

- Original marriage certificate, if the buyer is in an official marriage.

As a general rule, both parties are obligated to provide their respective documents for the transaction. However, while the list of documents for the buyer is relatively straightforward and doesn't involve gathering additional paperwork, the seller needs to provide a significant volume of documentation.

In practice, sellers frequently encounter difficulties in obtaining certain documents, either due to uncertainty about where to acquire them or simply because of time constraints.

We often take on the responsibility of assembling the necessary document package for the transaction on behalf of the seller. This not only saves time for both parties but also ensures the accuracy of the collected documents, thus guaranteeing a successful completion of the transaction.

When will the apartment be cleared of the seller's personal belongings and handed over to the buyer?

This issue should be settled before the purchase agreement is signed. Based on mutual agreement, the apartment can be vacated before the transfer and be handed over at the time of signing the main contract. If additional time is needed for this, and to solidify the parties' agreements, it is recommended to enter into a notarized preliminary sales agreement.

Alternatively, the premises can be cleared of the seller's personal items after the main sales contract is signed. In this case, it is crucial to specify in the contract a deadline by which the seller must vacate the apartment and transfer it to the new owner.

To prevent misunderstandings and potential conflicts on this matter, it is wise to have lawyers oversee the process of formalizing all agreements between the parties in the contract.

You may also like: How to Sell an Apartment When You've Lost the Documents?

Which notary will validate the property transaction?

Each notary, whether private or state, operates exclusively within their designated notarial district and is not authorized to validate transactions outside of their jurisdiction. For property transactions, there is a legal provision that grants a notary the right to validate such a transaction under one of the following conditions:

- The seller's place of residence is registered within the notarial district.

- The buyer's place of residence is registered within the notarial district.

- The property in question is located within the notarial district.

Furthermore, according to established business practices, the right to select the notary (considering their jurisdiction) belongs to the buyer. This is because the buyer is the party assuming the risk of not acquiring property ownership despite investing their money.

Since notaries are human and errors can occur, during the process of facilitating the property transaction, a lawyer assesses the checks performed by the notary to evaluate the feasibility of the transaction. This assessment includes verifying the registration of individuals in the apartment, confirming the expert appraisal, checking for any encumbrances on the property/seller and buyer, and reviewing notarial documents, among other aspects.

Notaries perform checks only for matters that could potentially block the transaction, like the presence of a property lien, but they do not investigate various other factors that may not hinder the seller from selling the property but could have adverse consequences for the new owner in the future, such as unpaid utility bills.

It's also important to check the notary before finalizing the transaction and prepare for the meeting in advance! At the very least, you should be aware of what to expect during the visit and what questions you may be asked. Foreigners may need a translator present at the notary's office.

Which party, and to what extent, will be responsible for taxes and notary fees?

As per the Ukrainian Tax Code, the seller is required to personally pay the individual income tax and contribute on their own behalf until the property transfer is completed. The buyer is mandated to make payments to the Ukrainian Pension Fund. Additionally, there are other obligatory fees associated with property transfer, including a duty and notary service fees.

While personal income tax and Pension Fund contributions are individual and cannot be shifted to another party, the payment structure for the duty and notary fees is a matter to be agreed upon by the parties involved. Conventional business practice suggests that notary service fees are usually split equally between the parties, and unless otherwise specified, the seller covers the duty payment.

It is strongly recommended to discuss the payment arrangements for these fees with the other party well in advance to avoid any potential disputes following the signing of the purchase and sale agreement.

You may also like: Taxes When Buying Real Estate

What will be the selling price of the property?

The price of the apartment, and consequently the contract amount, is determined at the discretion of the parties and should be agreeable to both.

For fair taxation, a transaction can only proceed with a valid expert appraisal of the property's market value (valid for up to 6 months).

The question of "what price to stipulate in the agreement" usually doesn't arise when the parties are subject to low tax rates for the sale or purchase. However, it becomes a consideration when the tax rate is high, such as when selling to a foreign citizen.

In such cases, the parties may choose to specify the purchase price of the property in the contract – an expert-appraised value – to "lower" the tax amount payable.

It's essential to note that if the contract indicates a value lower than the actual payment, any funds not covered by the contract will not be returned to the buyer in the event of contract termination or invalidation.

When working with our clients, we proactively assess all the risks associated with conducting a transaction at a "reduced" value, and prepare contract clauses and additional documents to protect the client and their finances.

Payment method for the property

In accordance with the current legislation in Ukraine, real estate purchase agreements only permit non-cash payments using bank accounts. This means that buyers are not allowed to make cash payments under the contract.

Furthermore, payments must be made exclusively in Ukraine's national currency, the hryvnia. In practice, many sellers prefer and may even offer cash transactions in foreign currencies.

Please note! When foreign citizens purchase real estate within Ukraine, it is considered an investment operation, and they are classified as non-resident investors. As a result, payment for the property must be conducted through a Ukrainian bank, with funds subsequently transferred to the seller's account.

Failing to do so can make it extremely challenging to repatriate profits from property sales made by foreign citizens through cash transactions outside of Ukraine. You can find more details on why this is the case here.

The payment method should be discussed in advance, and careful consideration is required before agreeing to a cash payment.

Verification of the notarial agreement

A close examination and corrections are essential for the notarial agreement. Once again, the contract's text is prepared by a human, and no one is immune to errors in the text. We frequently come across spelling errors in the names of the parties and their tax identification numbers as mentioned in the contract. If these errors aren't rectified before signing, they can lead to legal complications that might need resolution through litigation.

Moreover, the contract text is often standardized. If you have agreed to specific conditions, they must be formulated accurately and included in the contract text. There are instances where a notary, to simplify the process, may decline to include additional clauses.

Refusing someone without legal expertise in real estate matters is simpler than challenging a professional attorney because the attorney will defend your position and a specific clause in the contract.

While the notary makes amendments to the contract text, our lawyer reviews the contract itself and assesses certificates confirming the absence of debts for utility services.

Frequently, it happens that a seller has guaranteed the presence of such certificates for the transaction, but, in reality, only provides bills for payment and receipts. In these cases, a lawyer examines the bills and their payments, offering solutions for situations related to debts or overpayments and preparing the necessary documents to resolve the issue, such as statements from the seller for the termination of contracts for utility services.

Once the text is mutually agreed upon and approved by the parties, the contract is transcribed onto a special notarial form. It is then signed by the parties, settlements are processed, and property rights are registered. The registration is once again conducted by a notary, and it is crucial to verify the accuracy and completeness of the information entered in the registry.

We propose simplifying the real estate purchase procedure to the fullest extent and entrusting the responsibility to our legal team. We will:

- Pre-negotiate all purchase conditions with the involved parties.

- Arrange the transaction with a trusted, reliable, and reputable notary.

- Supervise the actions of all participants in the property purchase process.

- Examine the checks performed by the notary before certifying the transaction.

- Review the property purchase agreement and, if necessary, make the required adjustments to ensure your satisfaction as the new property owner.

Didn’t find an answer to your question?

Everything about legal support for purchasing an apartment here.

Check out the cost and services related to property verification here.