Accounting and other reporting of charitable foundations in Ukraine

Cost of services:

Reviews of our Clients

The importance of charitable organizations has been on the rise, as their activities are aimed at providing assistance to individuals and legal entities in need.

Such assistance must comply with the objectives stated in the organization's charter and be within the scope of the current legislation.

Charitable funds are among the most popular forms of charitable organizations.

According to current legislation, a charitable fund is a legal entity that must keep records and submit reports in the manner established by law.

The key difference between charitable organizations and commercial businesses is that the former cannot have the goal of making a profit.

While it may seem that this exempts them from taxes and regulatory oversight, that is not the case. Non-profit organizations are granted certain privileges by the state in the form of the status of a non-profit organization, but to prevent any abuse of this status, banks and tax authorities closely monitor the activities of non-profit organizations.

Compliance control is carried out by banking institutions and tax authorities. Today we will talk in more detail about control from the tax side.

In order to understand what the reporting of a charitable fund consists of and what significance it has for the real functioning of your organization, let's talk about the fund's expenses, taxation, and types of reporting.

We will provide some tips on the fund's operations, such as how to import a car into Ukraine and the associated reporting requirements.

This is just one of the issues that we help solve for charitable organizations in Ukraine. We:

- Will help you find the best solution for starting charitable activities in Ukraine: registration, purchase of a fund, accreditation of a representative office, etc.;

- Will provide all services in one place: legal consulting, account opening, accounting and personnel records, payroll and much more;

- Will solve problems specific to foundations: inclusion in registers, work with volunteers, reporting to the parent organization, etc.;

- Will take care of the legal security of the fund.

You may also like: How to Open a Bank Account for Your Charitable Fund in Ukraine?

Expenses of a charitable fund in Ukraine

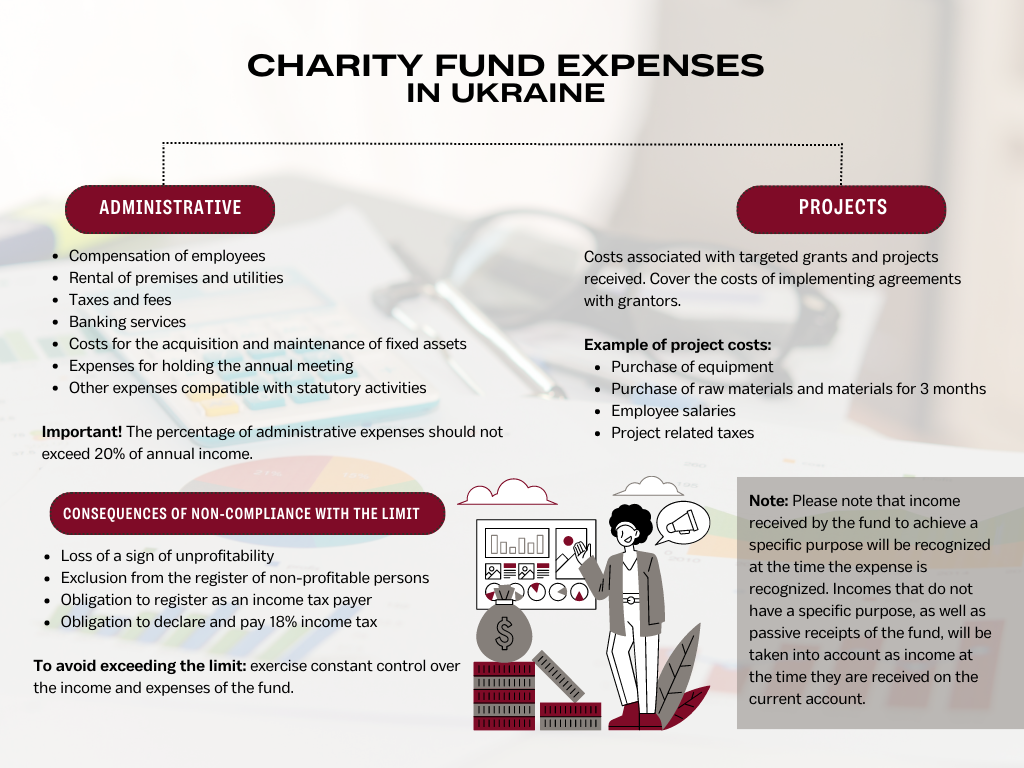

Administrative expenses for the fund’s day-to-day operations may include:

- employee salaries;

- rent and utilities;

- taxes and fees;

- banking services;

- acquisition and maintenance of fixed assets;

- expenses for holding the annual meeting;

- other expenses that do not contradict the fund's charter activities.

Please note! Ukrainian legislation sets a limit on the percentage of administrative expenses that a charitable fund can incur. Specifically, these expenses should not exceed 20% of the fund's annual income.

To illustrate, let's consider an example.

Suppose a charitable fund received a grant of 2 million hryvnias in 2022. Over the course of the year, the fund incurred expenses of 1.5 million hryvnias and received passive income of 20 thousand hryvnias in the form of interest on a deposit account.

Note. Targeted receipts of the fund are recognized as income at the time of recognizing expenses, while non-targeted and passive fund receipts are recognized as income at the time they are credited to the settlement account.

Based on the above example, the fund's income in 2022 amounted to UAH 1,520,000 (1.5 million + 20 thousand hryvnias).

Therefore, the limit of administrative expenses is UAH 304,000 (1,520,000 x 20%).

Consequences of exceeding the limit of administrative expenses:

- loss of non-profit status;

- removal from the register of non-profit organizations;

- the obligation to register as a taxpayer for corporate income tax (from the first day of the following month after exceeding the limit);

- the obligation to declare the exceeding amount and pay 18% corporate income tax (on the excess amount).

To avoid exceeding the limit, it is necessary to exercise constant control over the fund's income and expenses throughout the year.

Strategies to prevent exceeding the limit of administrative expenses:

- reclassifying personnel expenses (e.g., categorizing the salaries of the fund's director as administrative expenses while categorizing the salaries of other employees as project expenses);

- allocating legal and auditing expenses between projects;

- categorizing travel expenses as project-related;

- and others.

Documents used to designate expenses as administrative or project-related include:

- accounting policies;

- budget estimates;

- other internal policies.

Project expenses of a charitable foundation.

Project expenses are those that are incurred by the organization to fulfill transactions for which targeted funding has been received.

For example, the foundation received a grant to set up a bakery that will provide job opportunities for people with disabilities and limited abilities.

In accordance with the grant agreement and the project estimate, funds are provided to cover project expenses, which include:

- purchase of equipment;

- acquisition of raw materials and supplies to ensure three months of operation;

- employee salary expenses;

- taxes related to the project.

You may also like: Confirming Charitable Assistance: Using Contracts and Acts in Foundation Documents

Taxation of Charitable Foundations in Ukraine

For accounting purposes, a foundation recognizes income based on the funds received according to the following principles:

1. Targeted income is recognized as income in the period when the expenses are actually incurred. For example, in September 2022, the foundation received a grant of UAH 1.5 million. The grant agreement is valid for one year, expiring in September 2023. From September to December 2022, the foundation spent UAH 780,000 (goods and services were received). Therefore, the financial indicators of the foundation as of December 31, 2022, are as follows:

- Bank account balance – UAH 720,000

- Target financing – UAH 720,000

- Targeted income – UAH 780,000

- Targeted expenses – UAH 780,000

2. Non-targeted (aimed at achieving the statutory goal as a whole, rather than for a specific project) and passive income is recognized as income in the period when it is actually received into the settlement account. For example, in 2022, the foundation received UAH 500,000 in charitable contributions, including UAH 4,000 in income from exchange rate differences when converting foreign currency contributions. In 2022, the foundation spent UAH 420,000. Therefore, the financial indicators of the foundation as of December 31, 2022, are as follows:

- Bank account balance – UAH 80,000

- Non-targeted income – UAH 496,000

- Passive income – UAH 4,000

- Expenses – UAH 420,000

Please note! The receipt of funds is not subject to profit tax provided that they are properly documented. You can learn more about this in our article.

Having the non-profit status does not exempt a charitable organization from paying other taxes, such as:

- Personal Income Tax, Military Tax, and Pension Fund Tax - in cases where there are labor relations between the foundation and its employees;

- Value Added Tax - if the organization supplies goods and services on the territory of Ukraine that are subject to taxation according to current legislation.

Note: mandatory registration of the foundation as a VAT payer occurs when the foundation carries out taxable transactions worth more than UAH 1 million in a calendar year. For example, if a foundation sells goods or equipment (and uses the proceeds to achieve its statutory goals) and the volume of such sales reaches UAH 1 million, the foundation is subject to VAT registration. If the foundation does not sell anything and only receives benefits for further transfer to beneficiaries, mandatory registration does not arise.

If necessary, the foundation can be voluntarily registered as a VAT payer.

- Transport tax – if the foundation owns a vehicle;

- Land tax – if the foundation is the owner of a land plot;

- Property tax – if the foundation is the owner of real estate.

You may also like: Getting Registered as a Volunteer Organization in Ukraine

Charitable organizations reporting requirements in Ukraine

According to the current legislation, every non-profit organization is required to report on its activities to the following entities:

- regulatory authorities (tax and statistics);

- donors and benefactors;

- founders.

The timeliness and accuracy of reporting are essential elements that demonstrate the transparency and legality of the organization's operations.

There are several types of reports that a charitable organization should prepare:

1. Management reporting.

The basis of management reporting is the budget. It is formed through the plan of income and expenses, enabling the organization to set goals that need to be achieved.

The budget is created for the organization as a whole (at the beginning of the calendar year) and/or for each project (per donor, before the start of the project).

Please note! The budget should be approved by the organization's members' meeting. Approval of the budget indicates that the members of the organization have agreed on the target directions of income and expenses. The budget form is arbitrary and is approved by the organization's internal policies.

Our specialists can assist you in developing a budget.

2. Donor reporting.

This type of reporting is presented to donors, philanthropists, and grant providers. The format, deadlines, and components of the report are described in contracts and agreements.

The financial information in the donor report guarantees that the donor funds are being used within the terms of the agreement.

3. Tax and financial reporting.

Tax and financial reporting are the result of the entire organization's activities. Financial reporting is an integral part of tax reporting.

The main tax reports include:

- Report on the use of non-profit organization revenues, submitted to the State Tax Service once a year.

- Financial reporting (abbreviated balance sheet and statement of financial performance).

Please note! The absence of activity does not mean that reporting should not be provided. If there are no operations, the report is submitted with empty fields.

Additional reports that the foundation submits to tax authorities (if there are operations) include:

- Calculation of income tax for individuals and amounts of withheld personal income tax, military duty tax, and single social contribution

- VAT declaration

- Declaration for transport tax

- Declaration for land tax

- Declaration for real estate tax

Charitable organizations, especially large international organizations that come to Ukraine, need the help of a professional accountant and lawyer. Not only because they are afraid of losing their non-profit status or having problems with the tax authorities, although this is an important reason. But also because they are usually bound by regulations and obligations to their parent organization.

Their actions are regulated, and the parent organization and foreign donors usually pay close attention to the reporting and documentation of the foundations in Ukraine.

For such organizations, we offer a separate package of services - support for charitable organizations, which includes accounting under the control of a lawyer.

You can find out the cost here.

You may also like: Registering Relationships between Charity Foundations, Employees, and Volunteers

Public reporting of charity foundations in Ukraine

Information regarding the revenue and expenditure structure of a non-profit organization is not considered to be confidential or proprietary information.

One of the ways to demonstrate transparency in the activities of a foundation is through public disclosure. However, clear guidelines and forms for public disclosure of charity foundations have not yet been defined by the legislative authorities.

The foundation determines the format of the report independently, which is approved through internal policies without the assistance of any external parties.

Legal Advice: How to buy a vehicle for subsequent transfer to the Ukrainian Armed Forces/military unit?

A foundation may purchase vehicles for further transfer to the Armed Forces of Ukraine in the name of:

- a legal entity (Ukrainian);

- a legal entity (foreign);

- an individual (Ukrainian);

- an individual (foreign).

Note. The procedure for purchasing a vehicle and transferring it to the Armed Forces is almost identical, although the taxation of the purchase may vary depending on the seller of the vehicle.

Documentation for purchasing a vehicle with the purpose of further transferring it to the beneficiaries of charitable aid (not limited to):

- Obtaining a request from the military unit about the need for a vehicle (in any form of written communication).

- Order, which confirms that the fund has decided to formalize the vehicle purchase procedure to satisfy the needs of the military unit.

- Purchase and sale or transfer agreement (or any other type of agreement) between the fund and a legal/physical person.

- Agreement and/or transfer act for the vehicle upon receipt by the fund and its transfer to the beneficiary.

Our team provides a complete range of services for charitable organizations in Ukraine, including:

- Registration or purchase of a ready-made charitable foundation in Ukraine.

- Accreditation of a representative office of a non-profit charitable organization in Ukraine.

- Accounting and personnel reporting for charitable foundations.

- Opening accounts for charitable foundations in Ukraine.

- Development of documents for the foundation's work, including contract templates.

- Support of foundation activities by qualified lawyers, etc.

If you want to get professional help for your charitable organization in Ukraine, please contact our specialists.

Our clients