How to keep track of expenses of non-profit organizations?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

A non-profit organization (NPO) is a specific tax status granted to organizations that do not aim to generate profits from their activities or distribute them among their members. Consequently, these organizations are exempt from paying taxes on their profits. However, it's important to note that being an NPO doesn't automatically exempt them from other taxes.

Managing the finances of an NPO involves unique considerations. The guiding documents of the organization, such as its articles of incorporation, play a crucial role in conducting financial operations. Every monetary transaction, whether it involves incoming funds or outgoing expenses, must align with the organization's intended purposes.

Today, we will delve into the intricacies of handling funds in a non-profit organization. We'll explore the associated risks and discuss how to structure things in order to maintain non-profit status.

We'll pay special attention to NPO expenses, as they can vary significantly, including expenses like rent, employee salaries, equipment procurement, and more. We'll also discuss the purpose behind such expenditures and how they should be managed.

Our company is not only happy to share its experience through useful materials, but also provides services to non-profit organizations in Ukraine regarding registration and further activities. We offer:

- Services of a team of experts with experience in creating and supporting non-profit organizations (NGOs) in Ukraine, including complex cases: foreign organizations, accreditation, etc.

- The ability to completely cover the needs of the organization of work in Ukraine: accounting, legal and personnel support, all types of reporting, hiring, the procedure for working with volunteers and migration services - all services in one place, you do not need other contractors.

- Comfort service. A personal manager is assigned to each client, you clearly understand what you will receive, when and how.

You may also like: Is it possible to receive charitable assistance in cryptocurrency?

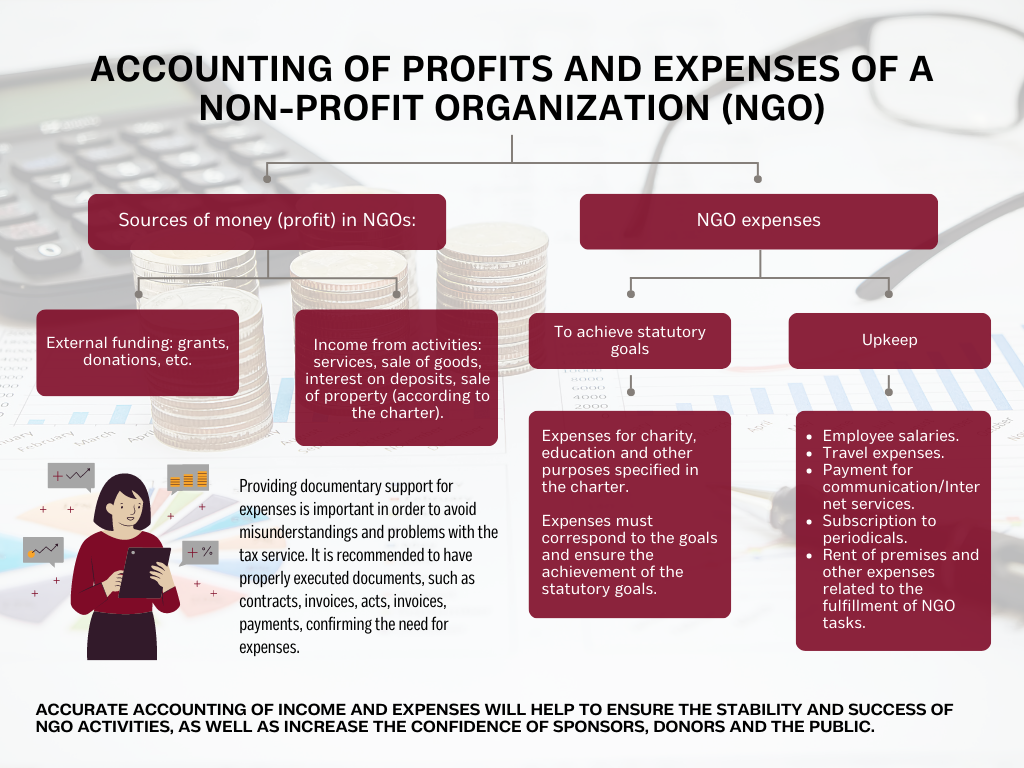

Income and expenses in the accounting of a Non-Profit Organization

When it comes to accounting, the income and expenses are recorded using the accrual method, regardless of the actual dates of money received or spent.

The sources of income for an NPO can include:

- External funding

- Revenue generated from providing services, selling goods, earning interest on deposits, or selling assets.

An NPO may engage in business activities, such as offering services or selling certain products, if it is specified in its bylaws. However, all income derived from such activities must be allocated towards covering expenses that align with the organization's mission.

It's important to note that if an NPO receives income from operations permitted by its bylaws but is found to be in violation of those provisions by regulatory bodies, it will lose its non-profit status starting from the first day of the following month.

The same principle applies to expenses incurred by an NPO. All expenses must be strictly related to the organization's defined goals and activities outlined in its bylaws.

Expenses can be further categorized as follows:

- Overhead expenses, which encompass wages for employees, travel expenses, communication/internet services, subscription fees for publications, facility rent, and other costs associated with running the NPO.

- Expenses related to achieving the organization's mission, such as charitable activities, education initiatives, and more.

Regarding expenses for maintaining an NPO, it is crucial to have properly documented records to avoid any misinterpretation of these expenditures. For instance, when it comes to rental expenses for the organization's premises, it is important to have a well-executed lease agreement with a reasonable rental price. Furthermore, when making payments, it is essential to specify the payment's purpose by including the lease agreement details and payment period.

In the case of business trips, it is advisable to have a clear travel order and assignment in place. It is also preferable to possess a travel certificate with "arrived-departed" annotations, a comprehensive report detailing the work conducted during the trip, as well as an expense report including transportation tickets, hotel invoices, and other relevant documents.

It is not uncommon for NPOs to find themselves with limited documentation to prove completed business trips. In such cases, they may only possess documents such as the travel order, tickets, and hotel invoices.

To illustrate, consider a few years ago when a disability advocacy organization sent an employee to the Czech Republic for negotiations regarding potential collaboration in cerebral palsy rehabilitation. Upon the employee's return, they provided documents substantiating hotel payments in Prague, flight tickets, and boarding passes.

However, during a tax audit, these documents were deemed insufficient to establish a clear connection between the employee's trip and the organization's mission. Since no additional documents, such as a travel assignment, an execution report, or a signed cooperation agreement, were provided, the trip was categorized as personal.

As a result, the tax authorities retroactively revoked the NPO's non-profit status, effective from the first day of the month following the violation. Consequently, the NPO was subject to additional taxation on the expenses related to the business trip, as well as all subsequent income, along with penalties and fines.

IMPORTANT! It is important to note that depending on the type of organization, there may be additional legally defined limitations. For example, charitable organizations may have a cap on administrative expenses, restricting them to no more than 20% of their annual income. Failure to comply with these guidelines may lead to the classification of expenses as non-programmatic, resulting in the loss of non-profit status.

Regarding expenses related to fulfilling the organization's mission, which is the primary purpose of the NPO, it is equally crucial to maintain proper documentation. This includes having contracts, invoices, reports, delivery notes, and payment receipts that support and justify the expenditure

You may also like: Establishing Relationships with Foundation Staff and Volunteers

Accounting for expenses in non-profit organizations during times of war in Ukraine

In light of the ongoing war, the tax legislation in Ukraine has introduced changes regarding expenses related to charitable assistance. According to Section XX "Transitional Provisions" of the Ukrainian Tax Code, NPOs will not be penalized for using their income to provide financial contributions, transfer assets, or offer services in support of entities such as the Armed Forces, National Guard, Security Service, Ministry of Internal Affairs, Territorial Defense, and others during the period of martial law.

This means that if an NPO, as stated in its founding documents, has objectives unrelated to supporting the government but is currently engaged in activities to address the country's needs in areas like defense, housing, utilities, healthcare, and more, there will be no tax implications for deviating from its stated purposes.

However, it is crucial to pay close attention to the documentation in this context. Although there is no specific list of legally required documents, it is advisable to ensure the availability of at least the following:

- A formal letter from the organization requesting assistance, stating the type and amount of aid sought, or a letter of acceptance from the organization acknowledging the receipt of assistance.

- An internal order or decision within the NPO outlining the allocation of charitable aid.

- Supporting primary documents, such as bank statements (in the case of money transfers) or a transfer agreement specifying the date and the responsible individuals.

You may also like: Registering Humanitarian Aid for Charitable Organizations

Risks to non-profit status

The activities of non-profit organizations (NPOs) may seem devoid of profit-making intentions. However, it's possible that while conducting their operations and generating income, they may find themselves in a situation where their annual income surpasses their expenses, resulting in a surplus. Such a scenario doesn't necessarily put their non-profit status at risk, as long as the surplus is utilized to further their stated objectives.

However, in all other cases, to maintain their non-profit status, operating NPOs must adhere to the requirements outlined in relevant laws and their founding documents. These requirements include:

- Not distributing the received income among their members or employees (salaries are not considered income distribution) or any other individuals.

- Allocating the income according to the objectives specified in their organizational documents.

If, by chance, an oversight occurs, and a "risky" transaction slips through, most situations can still be rectified.

For instance, let's consider a charitable organization dedicated to supporting families with hearing-impaired children. During their annual financial reporting, they discover that their administrative expenses have exceeded 20% of their annual income, potentially jeopardizing their non-profit status.

However, upon closer examination of the organization's expenses related to their overall operations and charitable initiatives, it becomes evident that the administrative expenses include costs associated with renting premises from a local deaf society for children's activities, as well as expenses incurred for sending an employee on a business trip to a medical center in the capital to negotiate a contract for free services for children with hearing problems.

These expenses should be categorized as expenditures aimed at achieving their stated objectives since they directly contribute to the organization's mission. By making a slight adjustment in their accounting practices, the administrative expenses are reduced to 17%, successfully resolving the issue for the charitable organization.

Every case is unique, and we offer services to optimize the accounting processes within your organization. Our comprehensive range of services includes professional consulting, providing clear recommendations from legal and accounting experts, as well as full accounting management for your organization.

See the costs and specifics of accounting for non-profit organizations here.

See the costs associated with business services in Ukraine here.

Our clients