How to register a public non-profit organization in Ukraine during the war?

Cost of services:

Reviews of our Clients

The war in Ukraine stopped the work of a large number of government agencies and important processes for the country. This included the work of state registrars, and thus the ability to create and register any kind of companies, institutions, organizations.

Despite the fact that in many regions state registrars and notaries resume their work, in our country there are still a lot of territories in hazardous areas, where the full work of registrars is impossible.

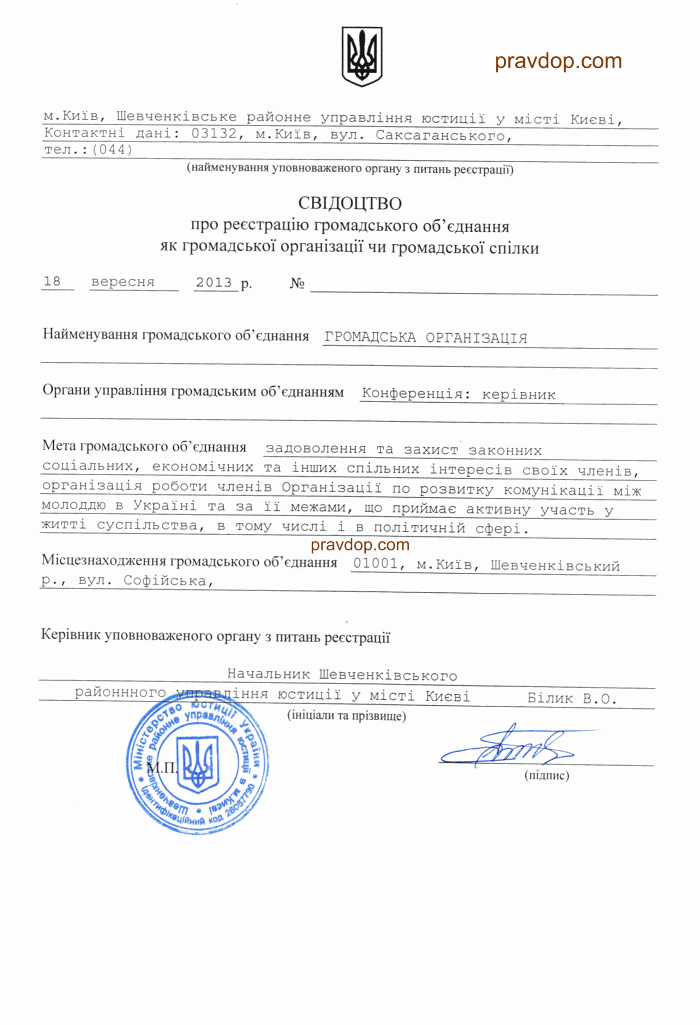

However, there has never been a greater need for opportunities to create charitable and non-governmental organizations to protect the interests and rights of diverse groups of people. For example, it is much easier and more reliable to talk to foreign partners about humanitarian or other assistance if you do it on behalf of an officially registered organization. When you can show the documents of registration, provide an official account, demonstrate the goals and mission of the organization, provide some guarantees, etc.

What to do in such a situation? How, having important goals for Ukraine and understanding how to help now, to be able to register the necessary public non-profit organization? All the more, the official registration and nonprofit status is important as well.

You may also like: The Management Bodies of a Non-Governmental Organization or Union

Can I register a non-governmental organization during the war?

Of course you can, but it will involve certain difficulties.

First, only a limited number of registrars can register organizations. This list is formed by the state and is constantly updated. Today, practically all departments work, except for the regions with active military activities.

Charitable and non-governmental organizations are almost the first types of enterprises that got the “green light” for registration or making changes. Everyone understands how important it is now for solving the issues with assistance in the regions, and on a nationwide scale as well.

There is another List - it includes those territorial and administrative units, which will not be able to carry out registration activities, that is, users will lose access to registries.

So, the first question you need to decide is where you can conduct registration actions in your case.

Registration can now be carried out both at the registrar and online - to do this, you must be guided by a list of working registries, draw up and submit electronic copies of documents, filing in an electronic form. Of course, it is necessary to have an electronic certified signature of the person authorized to sign registration documents (the applicant).

If not all of the documents were submitted - or they were improperly executed - the applicant will receive a refusal. If the application was submitted online - the answer will also be made online - by mail or through other means of communication available to the registrar.

Please note! Today, there are categories of charitable and non-governmental organizations that will not be charged for registration - these are organizations whose creation is aimed at helping the Armed Forces of Ukraine and other formations or persons who defend our country from the aggressor. Also, if you create an organization to protect the interests of persons who suffered from military aggression, and this goal is stipulated in your statutory documents, the registration fee will not be charged as well. In fact, all non-governmental organizations now fall under the notion of protection.

To summarize, the algorithm of actions, which you should focus on, is as follows:

- Make preparations for registration - Hold the meetings of members, prepare all statutory documents;

- Decide on the method of filing the documents - offline or online, and prepare for that;

- Find the closest registrar who can accept your documents;

- Carry out registration activities.

For what purposes can a public organization be registered in 2023?

Most public organizations are created with the status of a non-profit organization. Non-profit status is obtained from the state tax service at the place of registration. In order for a public organization to receive such a status, it is necessary that the relevant points be fixed in the charter of the public organization. For example, a ban on the distribution of income received by a public organization among members, management bodies of the organization, except in cases of salary calculation and payment of taxes.

It should also be noted that in case of liquidation, the assets will be transferred to other non-profit organizations or credited to the budget.

What gives non-profit status:

-

allows not to pay income tax;

-

does not provide for the mandatory transition to VAT payment, etc.

However, the employees of the public organization will still have to pay the taxes that are calculated on the wages. Also, this does not cancel the mandatory reporting.

You can submit documents for obtaining a non-profit during registration (we always do this) and after registration, but already directly to the tax office at the place of registration.

In our practice, there were situations when, for technical reasons, the tax office did not receive the application for non-profitability, which was submitted during registration. Undoubtedly, it would be possible to appeal the actions and demand entry into the register based on the registration application, however, it was much faster and better for the client to submit documents to the tax office and receive an extract from the register.

An extract from the non-profit register can be obtained in paper form at the tax office or through an electronic office.

Important! Periodically monitor profitability, as any violation of the rules of non-profitability may result in its loss, which will result in taxation of all income at an income tax rate of 18%.

Interesting: Virtual banking and financial management of public organizations

Use of public organization in business in Ukraine

The public organization is a non-profit organization and is not aimed at making a profit. However, a public organization has the right to receive income from various sources and use them for its statutory activities.

Tax advantages allow you to use public organizations to unite citizens and to realize some common goal, for example, popularization of some dance or art form.

In our practice, there was a client who planned to popularize one of the types of art in Ukraine. He already had a registered trademark and worked independently in this field. Our lawyers worked through his questions and helped to register the Public Organization precisely taking into account the client's personal needs. The public organization allows him to carry out various activities that are necessary for his activities and not to pay taxes.

Also, our lawyers helped in the creation of public organizations for the purpose of attracting volunteers, carrying out charitable activities, etc. This is a separate area that requires a detailed study of the constituent documents for such purposes.

Our team offers you to do all this work for you, as well as:

- Development of the structure of the organization or union that will suit you;

- Development of the documents of the organization, including the Charter, which would clearly regulate the future life of the NGO;

- All work taking into account additional wishes, for example, a foreign member or special rules of participation in the NGO.

Please check our service fees here.

Do you want to start a non-governmental organization or a union? Don’t hesitate to contact us! We register companies even in wartime, and we can help you do it simply and safely.

Didn’t find an answer to your question?

Everything about registration of non-governmental organizations in Ukraine here.

Our clients