Should the director be paid a salary in Ukraine if he is the owner?

Cost of services:

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

Every employee has the right to be compensated for all work performed. Wages are all payments made to an employee for all work performed. The amount of salary is negotiated with the candidate for the vacancy and is stipulated in the employment agreement.

The terms of the employment agreement must comply with current legislation, state guarantees and agreements between the company and the employee. All employees who are in an employment relationship with the employer (employment agreement) are entitled to salary.

For the use of full-time employees, the employer is obliged to pay at least the state-approved minimum wage.

In 2022, this amount is as follows: as of 01.01.2022 - UAH 6,500.00 (39.26 UAH/hr), and as of 01.10.2022 - UAH 6,700.00 (40.46 UAH/hr).

Exceptions: It is allowed to pay an employee below the minimum wage if he/she (the employee) is employed for part-time work.

For ignoring the rule of accruing wages not less than the minimum wage, the company will have to pay a fine of 2 minimum wages, which is UAH 13,000 (as of 01.01.2022) and UAH 13,400 (as of 01.10.2022).

This is one of the many issues that we, as a team of lawyers, resolve in the process of registering a business for foreign clients. We also:

- Will help you determine in what form to open a business in Ukraine;

- Will not abandon you at the start - we will not only register a company for you, but also offer further legal and accounting services;

- Will save you time and money. We are a ready-made team of project managers, lawyers and accountants who will take on the organization of personnel and accounting issues, password management, and also provide answers to any legal questions.

Is it mandatory to pay wages?

Yes, if an employer has employees who work under the employment agreement, it (the employer) is obligated to pay wages.

The amount of the payment depends on the following:

- conditions of remuneration (monthly salary / hourly wage; full-time / part-time - specified in the employment agreement);

- the number of working days/hours per month (indicated in the timesheet);

- other conditions described in the employment agreement (bonuses, allowances and additional payments).

Frequency of salary payment - according to the current legislation, wages must be paid at least 2 times a month, with an interval not exceeding 15 calendar days.

If you still want to “circumvent” the labor laws (in terms of wages), do not forget about the penalties, namely:

- For allowing an employee to work without executing an employment agreement - 10 minimum wages per employee (as of 01.01.2022 - UAH 65,0000.00; as of 01.10.2022 - UAH 67,000.00). In case of repeated violation within 2 years - UAH 195,000.00 per employee (as of 01.01.2022) and UAH 201,000.00 per employee accordingly (as of 01.10.2022).

- Breach of time limits for salary payment for more than 1 month - 3 minimum wages, as of 01.01.2022 - UAH 19,500.00, as of 01.10.2022 - UAH 20,100.00.

- Payment of wages not in full - 3 minimum wages, as of 01.01.2022 - UAH 19,500.00, as of 01.10.2022 - UAH 20,100.00.

You may also like: Business Planning for Foreign Business in Ukraine

Owner Director. How to employ and pay wages?

A large % of companies, at the beginning of the business, make a director of one of the owners/single owners of the business. This situation is also common when a foreigner registers a business in Ukraine.

Some members are guided by internal (intuitive) arguments, “I am a founder, why should I pay my own salary if it is my business? I'm just at the startup and I myself invest in the development of the business”. The second part of directors wants to see a monthly return (in terms of money on a personal account) from their business. The third part delves deeper and asks the question:

“How to properly formalize the employment relationship with the owner director to get the maximum benefit? “.

This question is very specific and depends on your goals. The founder of the business performs the management of the business directly himself/herself or through his/her authorized board members.

Option 1: The direction of the business you plan to engage in is popular, and according to your financial model in the first months of work / six months your business becomes profitable. Your business model quickly pays for itself, and you plan to receive a monthly income from your activities.

In this case, everything is simple - you formalize the employment relationship with the owner director. What you need to do:

- You create the executive body, headed by the director at the general meeting of members and stipulate this decision in the minutes.

- The Charter of the company prescribes the duties and rights of the executive body.

- You draw up an employment agreement with the director.

- You accrue and pay the salary to the director on a monthly basis.

Option 2: The concept of your business is new to the market / you have a new product / the circle of your customers is quite narrow at the time of company registration.

The planned financial indicators show that your business can pay off not earlier than in a year or two, and at the stage of “Infancy” of the company the inflow of money is mostly at the expense of investments. You are interested in full reinvestment of profits.

If you are close to this option, we recommend formalizing a corporate relationship with the owner, namely transferring the management of the business to him. If the director is elected from among the founders, he/she does not receive remuneration for the performance of his/her duties. The founder acting as a director does not fall under employment relationships, which is confirmed by a number of court practices, such as, for example:

- Decision No. 74638759 of 07.06.2018, Kharkiv District Administrative Court in case No. 820/3159/18;

- Decision No. 81915618 of 23.05.2019, Chernivtsi District Administrative Court in case No. 824/189/19-a.

However, this option requires well-founded documentary evidence, in order to avoid questions and penalties from the controlling authorities.

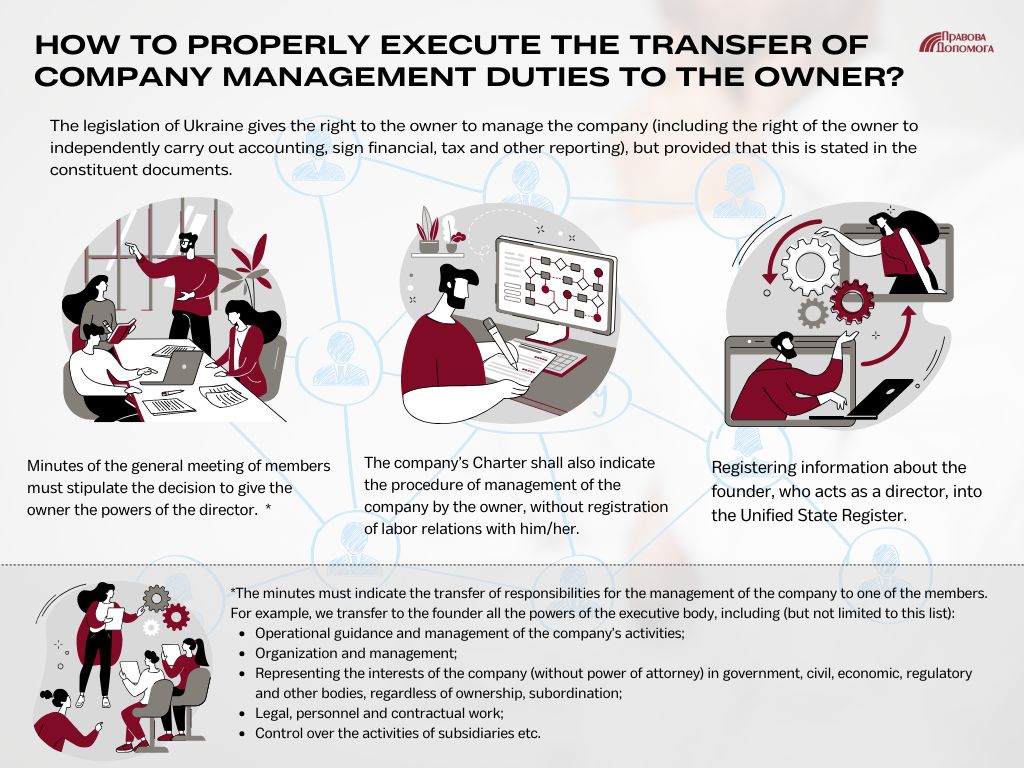

The legislation of Ukraine gives the right to the owner to manage the company (including the right of the owner to independently carry out accounting, sign financial, tax and other reporting), but provided that this is stated in the constituent documents.

Any of the two options may be simply executed and translated into reality with our specialists.

You may also like: What Is the Difference Between Reporting of a Foreign Company and a Resident Company?

How to properly execute the transfer of company management duties to the owner?

1. Minutes of the general meeting of members must stipulate the decision to give the owner the powers of the director. The minutes must indicate the transfer of responsibilities for the management of the company to one of the members. For example, we transfer to the founder all the powers of the executive body, including (but not limited to this list):- Operational guidance and management of the company’s activities;

- Organization and management of: economic activity, material and technical support, financial and economic work, accounting and reporting, maintenance of monetary and settlement operations;

- Representing the interests of the company (without power of attorney) in government, civil, economic, regulatory and other bodies, regardless of ownership, subordination;

- Legal, personnel and contractual work;

- Control over the activities of subsidiaries and joint ventures (if any);

- Signing authority.

2. The company’s Charter shall also indicate the procedure of management of the company by the owner, without registration of labor relations with him/her. We specify the powers granted to the owner.

3. Registering information about the founder, who acts as a director, into the Unified State Register (Unified State Register of Legal Entities and and Private Entrepreneurs).

You may also like: What to Do If the Company Has a Huge Income Tax to Pay?

Peculiarities of employment and payments to non-resident owner director

Non-residents (foreigners) have equal rights and obligations in labor relations (unless otherwise provided by Ukrainian legislation or other normative international acts).

Foreigners have the right to perform labor activity only if the employer has permission to use labor of foreigners or stateless persons. Exception - persons who permanently reside on the territory of Ukraine (with a residence permit).

At the moment of registration of the newly established company the director can be only a citizen of Ukraine or a person with a residence permit. What should the non-resident owner director do? As an option, at the start of the business activity, a nominee director may be appointed to the position of director, and during this period the owner obtains a work permit. Our company provides such services, including proxy director.

Owners, members or beneficiaries belong to a special category of foreigners who have privileges, namely:

- As a founder, member, or beneficiary of a legal entity, a foreigner can be employed in any position in his/her company;

- A work permit is issued for 3 years;

- No limits on the amount of wages (the main thing is not below the minimum wage).

For the employment of the founder/member of the company, the territorial body of the central executive authority, which implements the state policy in the sphere of employment and labor migration, independently obtains information on the completion of formation of the authorized share capital at the time of application for the permit.

Exactly the possibility of optimization of expenses for the director’s salary is one of the main reasons for appointing the founder as the director of the company. Also, the reasons may be the desire to control all the aspects of the business as much as possible, or other.

You may also like: Nominal Director when Registering LLC in Ukraine by a Foreigner

Ways to optimize the director’s labor costs

At the time of registration of the employment relationship with the director, namely determining the amount of salary, you must remember that the salary of the director cannot be less than the salaries of other employees of the company.

For example, if the accountant or commercial director of your company has a salary of UAH 40,000.00, then the salary of the director must be at least UAH 42,000.00.

Are you satisfied with this situation and does the financial situation of your company allow you to pay salaries in this amount? Excellent, you will not see any comments or objections from the tax authorities on this scheme.

If, however, you are willing to pay your employees market wages, but you want to see your wages lower than theirs, since after withdrawing money from the company there may be a cash gap and you need to re-invest, we suggest the following option.

For example, when executing an employment agreement with a director, you specify that the director works part-time and his/her salary is 0.5 (or other) of the salary.

Whatever your motivation - we will help you to understand whether it really is the best option for you and your business, offer the best solution to the problem and help to implement your plan.

If you want to register a business in Ukraine and solve the problem with the director, don’t hesitate to contact us.

The cost and terms of business registration for foreigners here.