Registration of sole proprietorship in Kiev

Cost of services

Reviews of our Clients

... our work on joint projects assured us of your high level of professionalism

What we offer

- consult on matters about types of activity according to the List of types of economic activities

- help to choose a system of taxation;

- appoint a meeting for signing documents at a notary office;

- prepare a list of documents for submitting to the state bodies;

- put on record to the Register of payers of the unified tax in the State Fiscal Service of Ukraine;

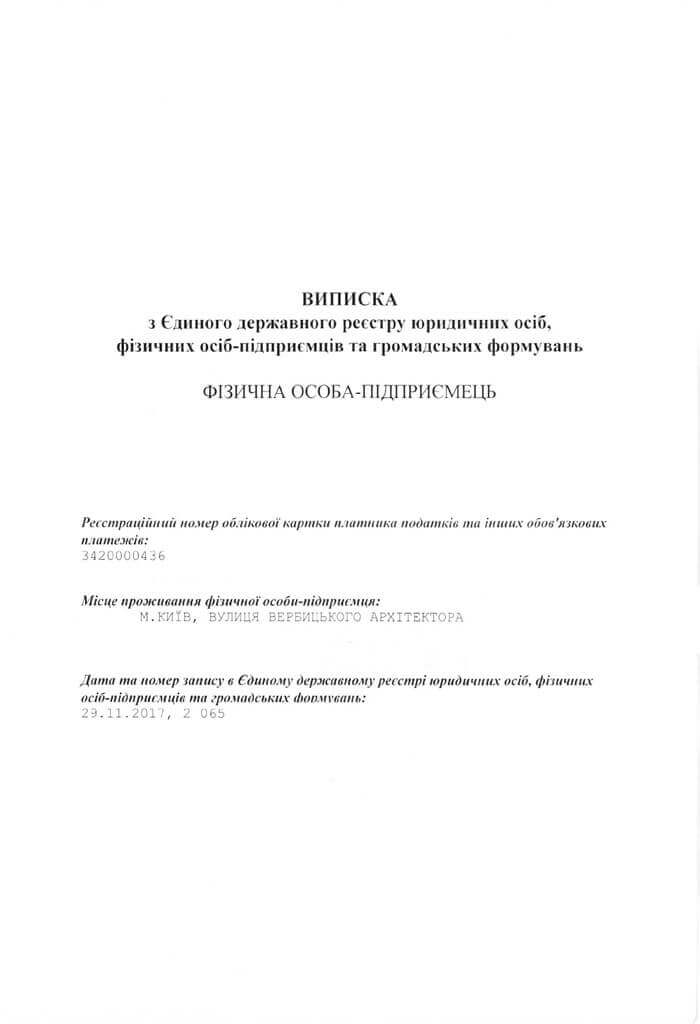

- get an extract from the Unified State Register and excerpt from the Register of payers of the unified tax;

- accompany procedure of issuance a digital signature;

- help to product a seal.

Required documents for registration of a sole trader

If you are internally displaced person then you have to provide also a certificate about it. Despite person has a place of residence at the occupied territories, our lawyers will register a sole trader in Kyiv without any problems.

Cost of services includes the full legal support of the registration procedure of a sole trader.

Except it, you have to pay for services of issuance a digital signature and production a seal if you want to get it. Drafting a power of attorney is also paid additionally. If a Client wants then we can appoint a meeting at a notary office.

The procedure of registration a sole trader is free of official fees. Only if there are changes into information, which is contained in the Unified State Register, then you must pay for this to the state budget.

Why us

Our successful projects

Cost of registration of a sole trader is 250 USD.

This price doesn’t include notary’s office services, services of office on issuance a digital signature and services on production of a seal.

Project launches when all price is paid.

Term of registration of a sole trader (including putting on record to the Register of payers of the unified tax in the State Fiscal Service of Ukraine) is 1-4 working days.

A sole trader is register according to a place of residence. However, our company can deal with a registration of a sole trader in other regions of Ukraine.

A place of conducting a business activity is an address of a sole trader’s residence. It is not obligation to have your own or leased premises for it.

A sole trader can conduct activity with or without a seal. Also issuance of a digital signature is provided if a Client wishes.

Answers to frequently asked questions

Do I have to pay an official fee for registration of a sole trader?

No, you don’t have to. Only if there are changes into information, which is contained in the Unified State Register, then you must pay for this to the state budget.

Has a sole trader register only according to his place of residence?

Yes, a sole trader registers only according to his place of residence. However, our company can help with sole trader’s registration in other regions of Ukraine.

Is there limited number for types of a sole trader’s activity?

There is no limited number for types of a sole trader’s activity. It means that person can choose types by himself or herself.

Is it obligation to have leased or own equipped premises for starting a business?

No, there is no such obligation. The laws don't demand to have own premises or offices for sole traders.

The procedure of registration of a sole trader

Upon notification about willingness to order registration of a sole trader and, a legal expert of law firm “Pravova Dopomoga” together with a Client arranges a meeting time at a notary office to receive a power of attorney.During notarized letter of attorney issuance a Client signs an agreement of legal services provision, informs our firm about types of activities that a sole proprietorship is planning to conduct, location of activities conduction. Also payment is made. If a Client want to get a digital signature and a seal, we clarify details and a Client gives additional money for this.

If a Client want to sign a power of attorney by himself or herself then he can do it and pay via Internet.

Within the agreed term our firm provides all the documents at once or step by step if such provision was agreed. Upon last document provision an Act of Acceptance is signed and final settlements are made.

The described typical procedure may be changed to a more suitable for a Client variant.