Registration of an individual entrepreneur for a foreigner in Ukraine in 2023

In February 2020, we were contacted by a British citizen who studied in Ukraine and wanted to work here as a sole proprietor.

This is not the only case of registration of a sole proprietorship for a foreign citizen, so we decided to provide general information on the issue, including the answers that we gave to our Client during the consultation.

You may also like: Cash Registers For Sole Proprietors. A New Law On Cash Registers

What does a foreigner need to register as a sole proprietor?

According to Part 1 of Article 18 of the Law of Ukraine “On State Registration of Legal Entities, Individual Entrepreneurs and Public Organizations”, if the person has reached the age of majority, it is enough just to submit a completed application of the established sample to register a sole proprietorship.

This application shall contain the following information:

- Passport data and identification number of a sole proprietor;

- His/her place of residence;

- Types of economic activity according to the classifier.

Since a foreign national does not have a Ukrainian identification (tax) code, it must be obtained before the registration procedure.

Interesting: ETA for entrepreneurs who trade in services: Are there special rules?

An important point will be to correctly specify the types of economic activity according to the classifier and choose exactly those types of activities that you will need for your business. It’s worth remembering that penalties may be charged for conducting activities that do not comply with the sole proprietor’s registration data.

Submission of documents and the identity document during the registration of a sole proprietorship for a foreigner

You can personally apply for the sole proprietor registration. And although it is not provided for in the aforementioned law, you must have an interpreter.

If a person does not want to visit the state registrar in person, he/she shall also submit a notarized power of attorney with the application. For its issuance, the notary will ask you to provide a document confirming your identity and legal stay in Ukraine. Such document is a residence permit.

Interesting: Accounting services for business in Ukraine: outsource or hire an accountant?

When obtaining the permit, you should be careful, because often after getting the plastic card foreigners do not even guess that it should be submitted together with a residence registration certificate. If there is only a plastic card without a certificate, the notary may refuse to issue a power of attorney.

The fact is that a sole proprietor must be registered with the tax authorities at the place of registration. You can’t register without a specific address. The legislation spells it out quite indirectly, where one follows from another. That is why it is important to know and take into account all the above points.

You may also like: Source Documents Of Sole Proprietors In Ukraine

Can a foreign sole proprietor become a single taxpayer?

Yes. If its activities do not include such, which are incompatible with the use of the simplified taxation system. These are, in particular, lotteries, currency exchange, trade in excisable goods. The single tax shall be paid at 5% of income (if excluding VAT), which is almost the lowest business tax in Europe.

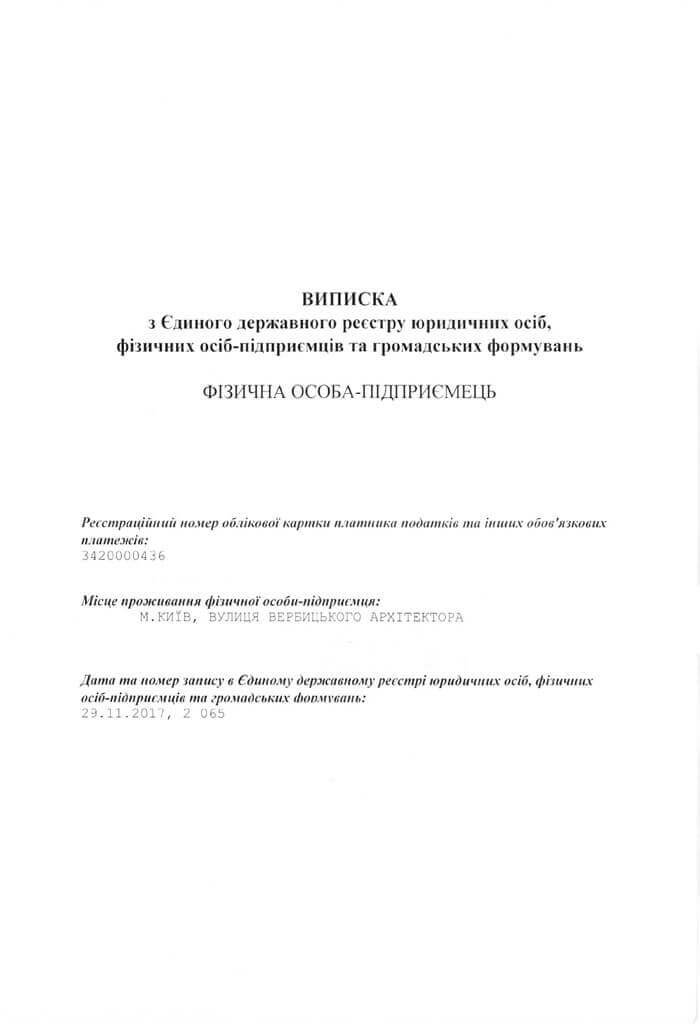

After the consultation, the Client finally decided to register as a sole proprietor in Ukraine, and our experts have undertaken all the procedural aspects.

Legal services for registering a sole proprietorship for a foreign citizen in Ukraine

If you intend to start a business in Ukraine, or just want to live in the country for some time, you have many options on how to do it. You can register your company, get a Work Permit, register a sole proprietorship or even legalize your stay through marriage or studies.

The main thing to remember is that each of the options has its pros and cons, which means the decision must be individual — the one that is suitable for your case.

Thus, the registration of a sole proprietorship is convenient for many types of activities, but it implies that you have other grounds for obtaining a Temporary Residence Permit in Ukraine.

Our specialists offer you:

-

Consultation of a migration lawyer on your goals and the possibility of implementing them legally;

-

Analysis of your situation and selection of the best way to solve the problem;

-

Registration of a sole proprietorship or other form of business in Ukraine on a turnkey basis;

-

Assistance in obtaining TIN, the opening of bank accounts in Ukraine;

-

Assistance with the translations of documents, its certification by a notary, etc.

We will also provide assistance in obtaining a Temporary Residence Permit in Ukraine for the period that you want to stay in Ukraine, even if you have no grounds for a Temporary Residence Permit.

If you want to carry out economic activities in Ukraine as a sole proprietor, don’t hesitate to call us. We can help you with the entire procedure and provide advice on accounting of the sole proprietorship.

Didn’t find an answer to your question?

Information on the registration of a Sole Proprietorship here.